If you read much tech news, you’ve probably heard about Kickstarter, or at least their most famous project that helped a budding entrepreneur make watches from iPod Nanos (above).

If you read much tech news, you’ve probably heard about Kickstarter, or at least their most famous project that helped a budding entrepreneur make watches from iPod Nanos (above).

Kickstarter is the best known (note 1) of the so-called crowdfunding sites where the Internet is invited to help fund new projects in return for recognition and/or a tangible good related to the project. Kickstarter focuses on the arts world, helping connect artists, designers, publishers, and performers with patrons around the world, who kick in as little as a $1 to help get a project off the ground. There are dozens of others focusing on other areas as well.

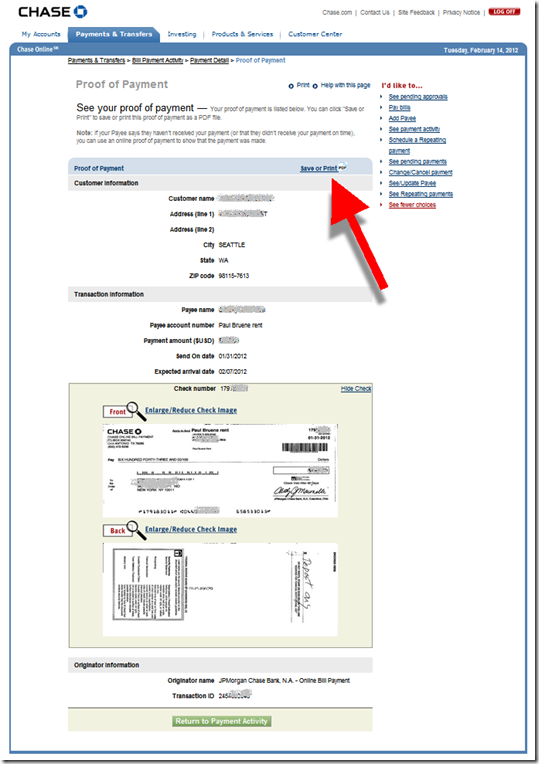

I used Kickstarter this weekend to fund publication of a new comic book called Steamfunk (screenshot below). I came across it when searching for local Seattle-area projects.

I used Kickstarter this weekend to fund publication of a new comic book called Steamfunk (screenshot below). I came across it when searching for local Seattle-area projects.

My niece is a steampunk fan, so I thought it would be a nice surprise for her. I dropped $15 into its pledge drive, and assuming the artist Zilla Doty receives at least the $3,000 he was seeking (note 2), in April I’ll have a signed copy of his inaugural edition to send to my niece (note 3).

Not only do I get a cool one-of-a-kind gift, I gain the satisfaction of helping a local artist get a project off the ground. Very gratifying.

_______________________________________________________________________

Bank Opportunity

_______________________________________________________________________

I bring this up, not because it’s a slow news day, but because I think leveraging crowdfunding could be a good way for community banks or credit unions to distinguish themselves in the local market. It would not be an easy project, getting people to part with their money never is, but it has the potential to attract new small business clients while supporting your community.

Here’s how it would work (note 4):

1. Bank sends customers to a third-party crowdfunding site, which could be operated independently, or private-branded for the bank

2. Bank publicizes new community projects via its website, blog, Facebook page, and so on

3. OPTIONAL: Bank offers to match the crowd’s funding with a credit line/loan (if needed and assuming reasonable credit risks) or other banking services

For extra credit: Integrate crowdfunding with peer-to-peer lending.

————————

Kickstarter project page

Note: This is how it looks after you’ve made a pledge

———————————-

Notes:

1. According to Compete, Kickstarter had 750,000 unique U.S. visitors in Dec. 2011.

2. With 20 hours to go, the project has easily surpassed the $3,000 goal. 175 backers have pledged almost $5,000.

3. The pledge process is very smooth. Payment is made when you make the pledge and fulfilled through Amazon Payments. If the project fails to reach 100% funding by the end date, you get your money refunded. According to the company, 90% of the projects who make it past the 25%-funded mark end up with 100% funding. That’s an amazing stat.

4. No, I don’t have a clue what objections you might get from compliance, but I’ll bet it will be an interesting conversation.

5. We haven’t written specifically about crowdfunding at Online Banking Report, but we’ve covered P2P lending and small biz banking services.