Digital identity verification company Mitek announced a new partner today. The California-based company has teamed up with compliance, credit risk, and lending solutions company Abrigo to help the firm’s bank clients access technology to help protect themselves against financial crime.

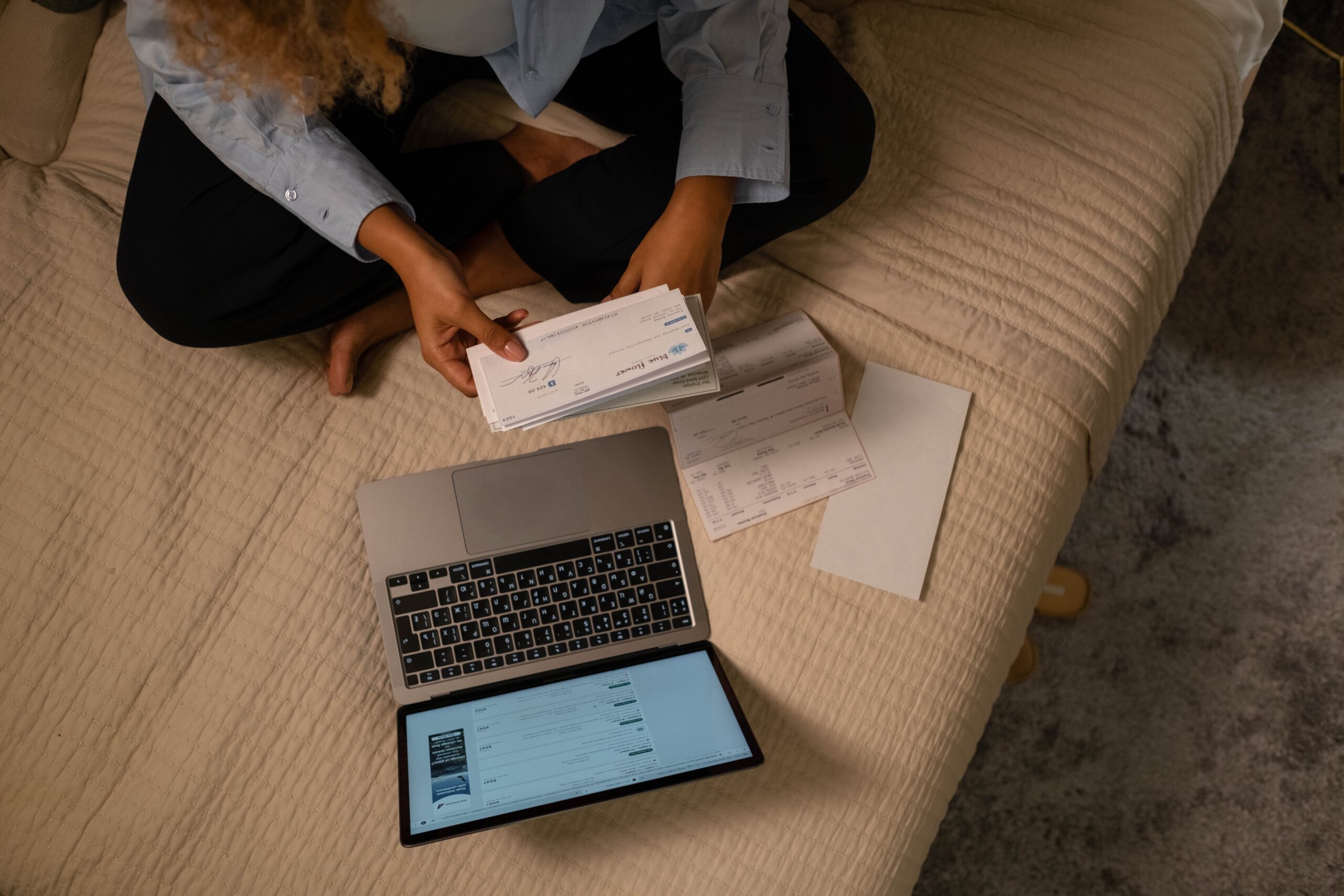

Specifically, Abrigo is seeking to mitigate check fraud, which is not only prevalent among banks, but is also costly. While the technology behind paper checks seems antiquated, fraud techniques for the payment method are not. According to FinCEN, check fraud suspicious activity report (SAR) filings increased 94% over the course of 2021. Last year, the number of SAR filings exceeded 680,000. “The sophistication of fraud and synthetic checks has never been more concerning,” explained Mitek SVP and GM Michael Diamond.

Abrigo will offer its bank customers access to Mitek’s Check Fraud Defender to help them stop fraudulent activities around checks. Mitek’s Check Fraud Defender uses imaging science, machine learning, and artificial intelligence to analyze the images of the checks and verify authenticity to reduce fraud losses.

“By combining Mitek’s cutting-edge technology with Abrigo’s industry-leading platform, we can provide our 2,400 customers with a powerful solution to help protect their institutions and customers from financial crimes,” said Abrigo CEO Jay Blandford.

Mitek was founded in 1986 and offers technology for mobile check deposit, new account opening, identity verification, and more. The company’s solutions are used by more than 7,900 organizations and its mobile check deposit and account opening tools reach more than 80 million consumers. Mitek is publicly listed on the NASDAQ under the ticker MITK and has a current market capitalization of $517 million.

Earlier this fall, Mitek partnered with Equifax to advance the company’s biometric authentication and liveness detection capabilities.