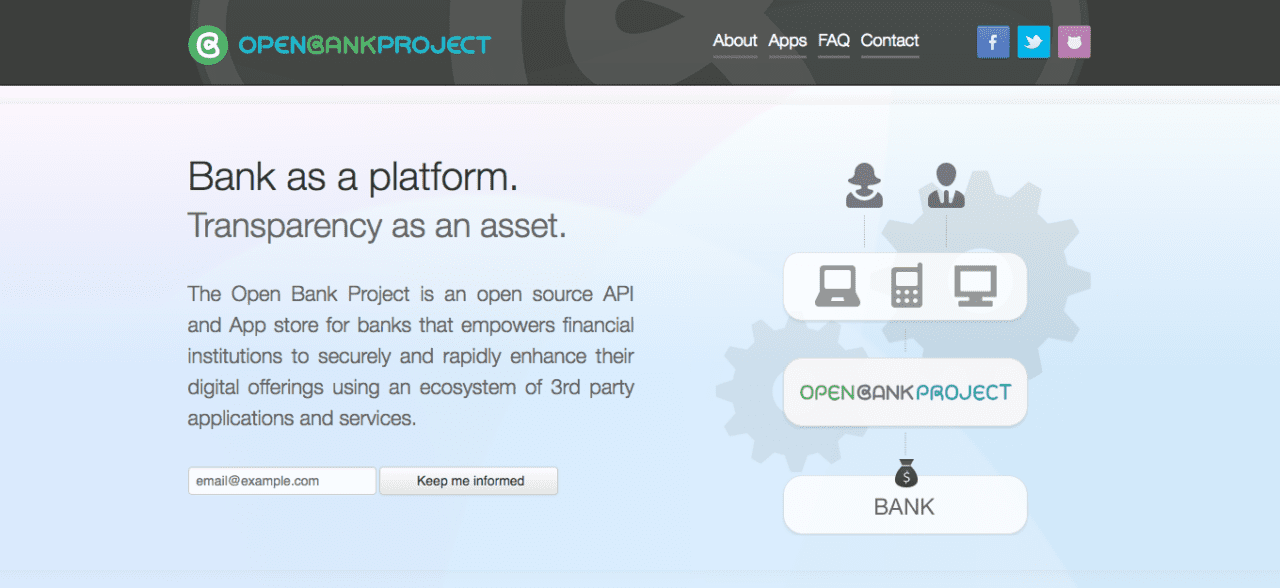

Courtesy of help from TESOBE’s Open Bank Project, Santander is hosting its first hackathon this spring. The bank¬†will leverage the Open Bank Project’s white-labeled sandbox technology and expertise to host the competition, themed¬†Building Banking Your Way.

Stephen Dury, Head of Customer and Innovation at Santander‚Äč, said, ‚Äú‚ÄčBy launching a hackathon, we hope to see the future of open banking come to life through participants fresh ideas, creative new use cases and industry-changing solutions.”

Using¬†a sandbox of emulated data, the hackathon aims to find innovative solutions to business challenges and¬†tackle issues ranging from customer interaction, security, homeownership, and money management. Prizes will be awarded to participants who create submissions that “surprise, delight, and engage with users in a way that has never been done before” and the winning team will receive $14,000 (¬£10,000).

Santander’s upcoming hackathon will take place from 16 through 18th March in Shoreditch.

Simon Redfern, CEO of TESOBE / Open Bank Project, ‚Äčsaid that this hackathon comes at a particularly exciting time given the EU’s new open banking regulations. “A hackathon is a great way of gathering and focusing fresh perspectives and we’re excited to meet and support the up-and-coming innovators who have the vision, passion, and capability to rapidly deliver compelling fintech apps and services using Open Banking APIs,” Redfern added.

The Open Bank Project has partnered with a number of global banks, including Societe Generale and The Royal Bank of Scotland, to help them organize and execute successful hackathons. With new PSD2 guidelines in place, banks may be more likely to open themselves to new opportunities and feel more pressure to create and adopt new, innovative services.

Headquartered in Germany, the Open Bank Project was founded in 2005. At FinovateSpring 2013, Redfern demonstrated a fun application of open banking– the world’s first singing bank. The point of the demo was not the singing bank itself, but rather was intended to showcase the ease of use of the Open Banking Project’s API. At FinovateEurope this March, TESOBE’s Open Bank Project will demo its newest technology from stage (register).

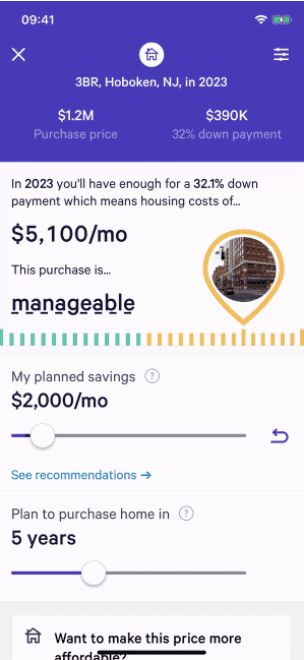

The Path home planning tool aims to help buyers understand what they can afford today and what it may take for them to be able to afford a larger home in the future. Also importantly, the tool shows users how this purchase may impact future goals, such as retiring early or paying for a child’s college tuition. Path extends beyond traditional affordability calculators to show a cost estimate that considers the user’s financial standing and other financial goals.

The Path home planning tool aims to help buyers understand what they can afford today and what it may take for them to be able to afford a larger home in the future. Also importantly, the tool shows users how this purchase may impact future goals, such as retiring early or paying for a child’s college tuition. Path extends beyond traditional affordability calculators to show a cost estimate that considers the user’s financial standing and other financial goals.