The second time’s the charm for digital banking platform Urban FT. The New York-based company has successfully agreed to a deal with Digiliti Money, a subsidiary of Digiliti Money Group (formerly Cachet Financial Solutions) under which Digiliti will merge into Urban FT’s affiliate, FinTech Imaging Solutions.

Prior to the closing of the deal, Digitili Money Group will transfer all of its core technology assets to Digital Money Technologies, a newly formed Minnesota corporation and subsidiary of Digitili Money Group that is not subject to the merger. Digital Money Technologies will license this software technology to Urban FT for two years for a license royalty fee of $360,000 per year. The deal also gives Urban FT the option to purchase Digital Money Technologies’ software for $3 million.

For its part of the deal, Digiliti Money Group will receive a payment of $250,000, a secured promissory note from Urban FT’s parent company for $2.4 million, and a percentage of revenues relating to Digiliti Money’s prepaid card business that Urban FT is acquiring.

This comes six months after Urban FT’s original attempt to acquire the company in a bid that valued Digiliti Money at $10.5 million on a net equity basis. Digiliti rejected the original bid and proposed alternate terms to the contract, which Urban FT and its lawyers considered “unreasonable and unacceptable under the circumstances.” Urban FT left the bid on the table until the end of the month.

In August of 2017 Digiliti’s CEO resigned. Later that month, interim CEO Bryan Meier disclosed financial difficulties, saying that the company is “reducing [its] cash burn to improve [its] bottom line performance, which [it is] demonstrating with the implementation of [its] recent cost-cutting initiatives intended to reduce [its] annual operating expenses by nearly $3 million.” In a statement on August 14, Digiliti made it clear that it was “actively reviewing strategic options to restructure the company, including the potential sale of the company or potentially filing for Chapter 11 bankruptcy.”

Urban FT president Kasey Kaplan, who was aware of the financial and leadership difficulty Digiliti Money was going through at the time, said, “Placing Digiliti into bankruptcy, if that’s what the Board is considering, would be a great loss to all of those stakeholders and would truly disrupt so many organizations that rely on Digiliti’s services every day.”

In order to avoid bankruptcy, over the course of the past six months Urban FT provided Digiliti with significant financial support “to ensure uninterrupted service to Digiliti clients and continued employment to Digiliti employees.”

Richard Steggall, CEO of Urban FT, said that the deal “is a fantastic outcome for both companies, their employees, and most importantly, for the clients we respectively serve.” Steggall added, “From the beginning of this process, we recognized that the Digiliti business was fundamentally a good one—with exceptional client and strategic relationships—and together we could create synergies, resulting in significantly reduced combined operating costs and additional services for our pooled client bases.”

The deal is expected to close February 24. Urban FT will continue to be headquartered in New York City with development and operations located in Digiliti Money’s headquarters location, Minneapolis.

At FinovateFall 2016, Urban FT debuted the Workshop, a real-time, mobile app management platform that enables banks to quickly configure, brand, and launch mobile banking apps without coding. The company was founded in 2013 and has raised $3 million. Urban FT has made two acquisitions in the past, including iParse in 2017 and Wipit in 2015.

Digiliti Money demoed its Select Mobile Money prepaid suite at FinovateFall 2014 in New York. The company was founded in 2010 and went public July 18, 2014.

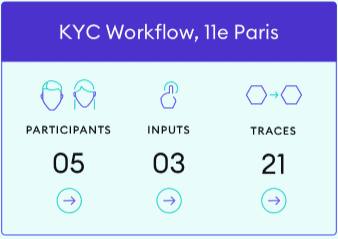

Dubbed IndigoTrace, it’s a user-friendly API that allows business administrators to create a workflow and invite participants, giving them each a role designated by a public/private key. Users can add inputs to the workflow and all changes can be monitored and traced in real time. This traceability offers visibility into who did what, when, where, and why, allowing for easy audits throughout the process. All information is secured by Stratumn’s Proof of Process (PoP) technology and public blockchains.

Dubbed IndigoTrace, it’s a user-friendly API that allows business administrators to create a workflow and invite participants, giving them each a role designated by a public/private key. Users can add inputs to the workflow and all changes can be monitored and traced in real time. This traceability offers visibility into who did what, when, where, and why, allowing for easy audits throughout the process. All information is secured by Stratumn’s Proof of Process (PoP) technology and public blockchains.