Digital identity verification company Onfido partnered with India’s largest shared ride company Zoomcar last week. This marks Onfido’s sixth ridesharing partnership. The London-based company has also teamed up with Drivy, BlaBlaCar, EasyCar, Turo, and most recently, SnappCar.

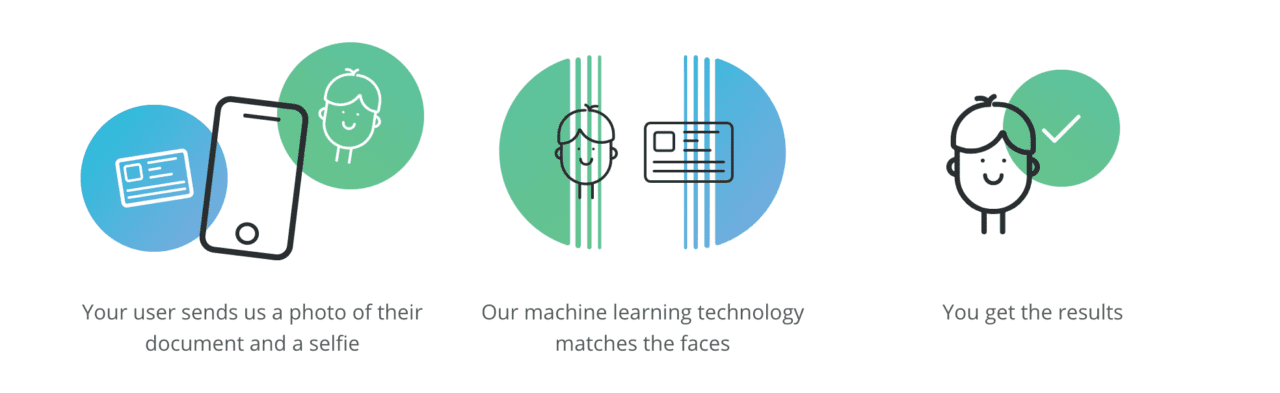

Zoomcar’s mobile app allows users to rent cars and cycles by the hour, day, week, or month. Onfido will help Zoomcar quickly and securely verify a user’s identity. To rent a car, users take a selfie and a photograph of their ID document using their smartphone.

“Onfido is a fantastic partner to work with,” said Rajesh Bysani, CPO at Zoomcar. “Their mobile-first document and facial verification is helping us to achieve our core mission of convenient car rental, while improving the safety of our platform. It benefits everyone.”

Founded in 2012, Onfido leverages machine learning to offer biometrics-based fraud detection. The company’s Facial Check compares a photo on the user’s ID to their live selfie to ensure the customer is who they claim to be. Additional features include a document check, which ensures the user’s document has not been forged, digitally tampered with, lost, or stolen; as well as an identification record check, which cross-references a user’s details against global databases and credit reference agencies.

Onfido provides identity checks in 195 countries for 1,500 customers across the globe. At FinovateEurope, the company’s CEO and Co-Founder Husayn Kassai demoed how Onfido conducts a facial verification check with video. The company has received more than $30 million in funding from investors including Salesforce Ventures and Idinvest Partners.

The partnership will enable Boomtown’s U.S.-based merchant acquirer and independent sales organization clients to offer CardFlight’s SwipeSimple payment acceptance solution to merchants. An EMV capable POS system, SwipeSimple is available as both a mobile or countertop register version and comes with back office reporting software to help businesses manage their inventory and operations. The SwipeSimple Register version (pictured right) was

The partnership will enable Boomtown’s U.S.-based merchant acquirer and independent sales organization clients to offer CardFlight’s SwipeSimple payment acceptance solution to merchants. An EMV capable POS system, SwipeSimple is available as both a mobile or countertop register version and comes with back office reporting software to help businesses manage their inventory and operations. The SwipeSimple Register version (pictured right) was

The idea of democratizing financial information is core to both companies. Quovo co-founder and CEO Lowell Putnam said that Onist’s efforts to offer consumers a clear view of their finances aligns perfectly with Quovo’s own mission, making Onist, as Putnam described, “an ideal early partner.”

The idea of democratizing financial information is core to both companies. Quovo co-founder and CEO Lowell Putnam said that Onist’s efforts to offer consumers a clear view of their finances aligns perfectly with Quovo’s own mission, making Onist, as Putnam described, “an ideal early partner.”