Personal finance startup Linxo is launching its first payment card. The new, Visa-branded card will be available starting next year.

Linxo is positioning the card as a “real-time” payment card. This means that consumers will see instant notifications after they make a payment. Users will be able to manage their budget in real-time, since the expense will be immediately visible in the app.

“We are seeing users’ practices evolving quickly in two strong directions: firstly, the requirement for a very good user experience, and, secondly, the introduction of real-time as a new payment standard,” said Bruno Van Haetsdaele, Linxo cofounder. “So, we thought to ourselves: how can we offer the best money management experience and the best payment experience?”

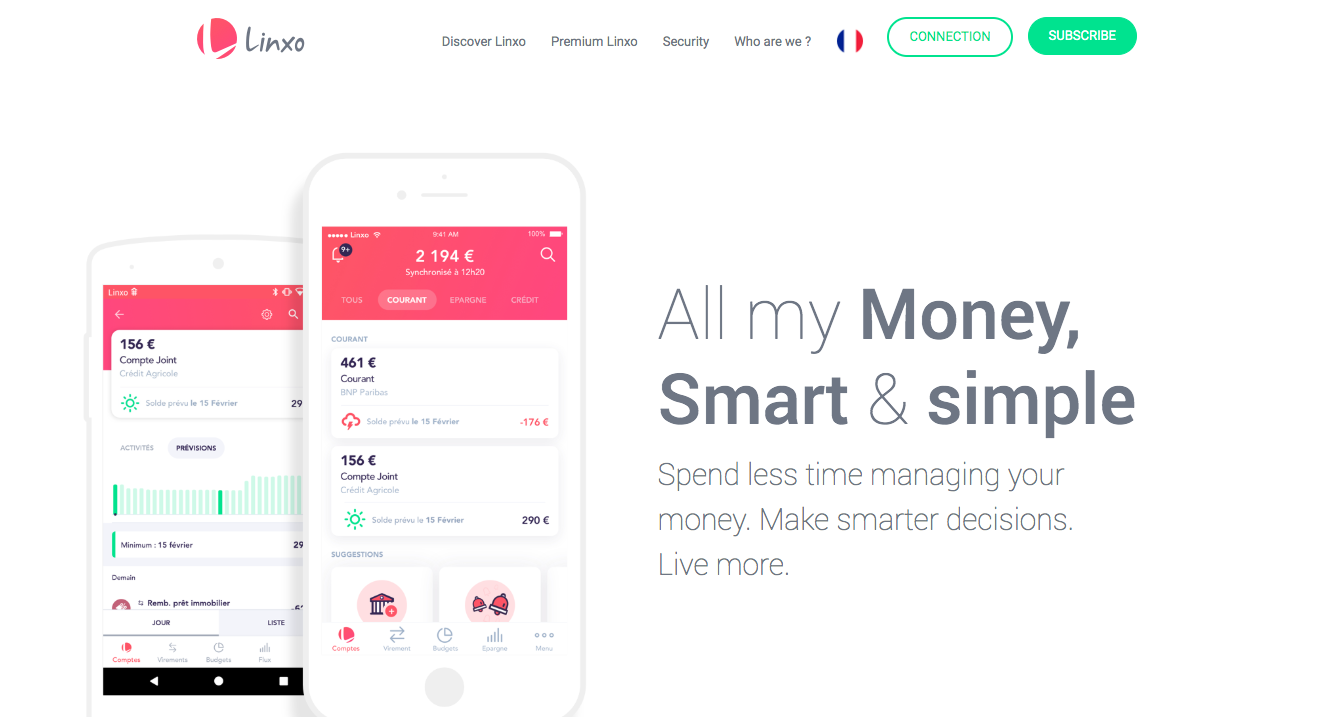

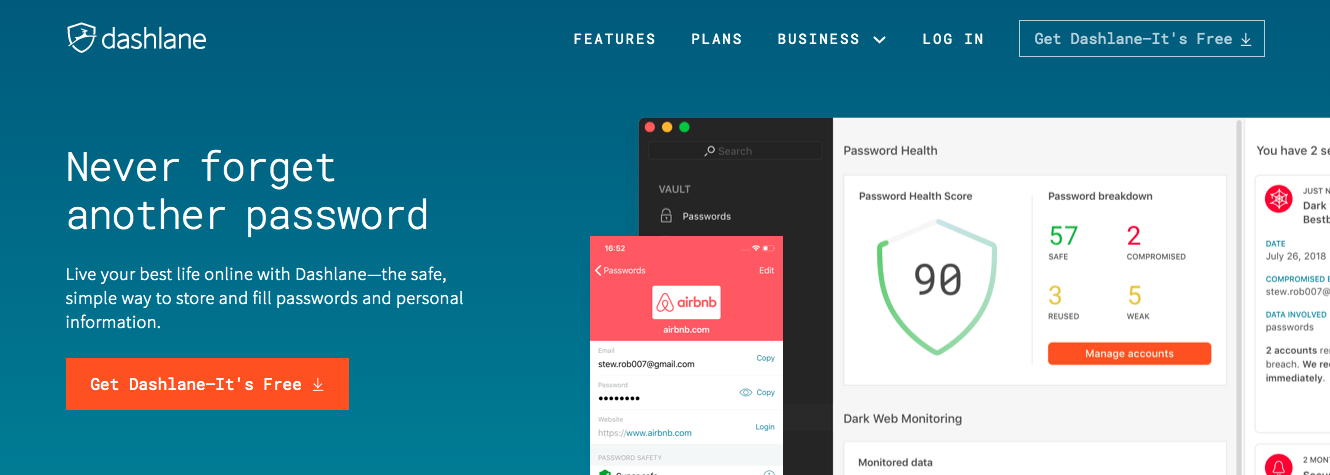

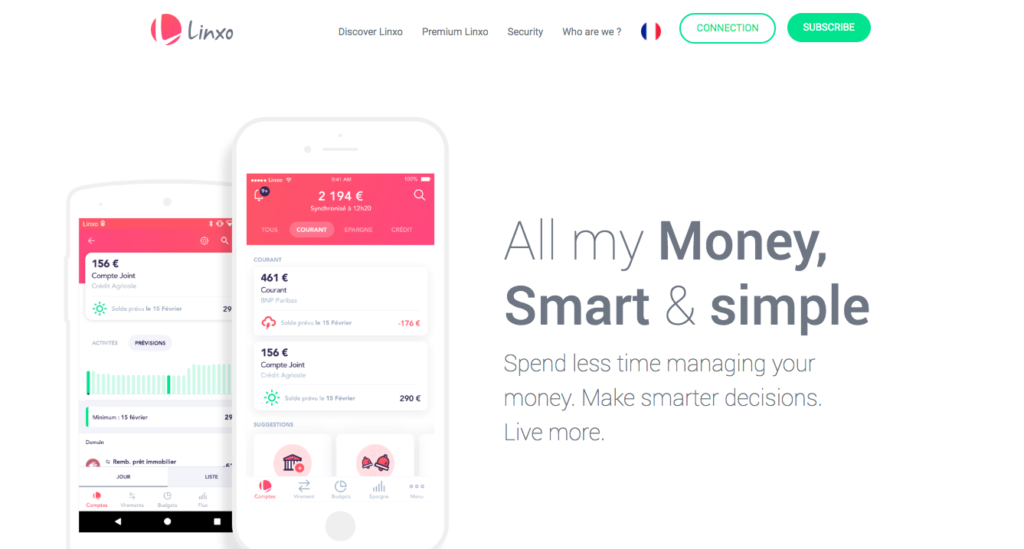

Founded in 2010 and headquartered in France, Linxo offers its 2.8 million users a personal financial management app that aggregates all of their spending information across accounts. The app not only allows users to view and analyze their spending, it also helps them manage their finances by enabling them to transfer funds without logging into their bank account.

Linxo’s app will work in tandem with the new payment card by categorizing and monitoring expenses, offering a view of all the user’s accounts, and providing a budget forecast that predicts the user’s future balance based on their current spending. Some features, such as the budget forecast, are only available with Linxo Premium, a service available for $34 (€29.99) or $5 (€4.49) per month.

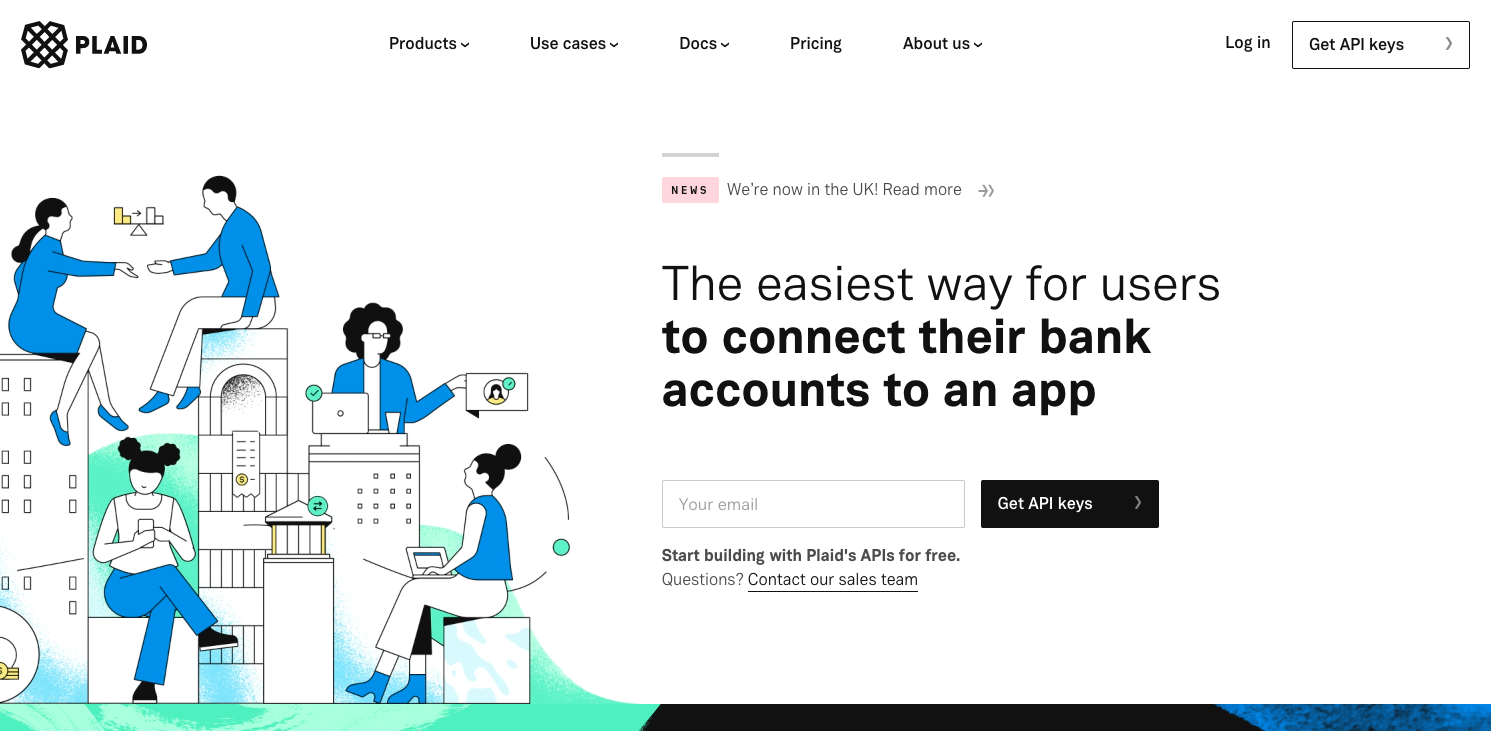

In addition to teaming up with Visa, Linxo is partnering with Natixis Payments, which will help the company build out the payment management system. Linxo selected Natixis Payments because it can help the company move the new payment card to market quickly. “We were attracted by the state-of-the-art offer and rapidity provided by the Xpollens solution which allows for the creation of a first card and payment account in just 100 days,” explained Van Haetsdaele. “On this basis, we can then co-build the best money and payment management mobile solution directly with our users. Our aim is to focus on our expertise: creating the best user experience.”

Van Haetsdaele demoed Linxo at the first FinovateEurope conference, which was held in 2011. The company has received a total of $26.2 million in funding, most recently in a 2017 venture round.