![]() Five months after we first spotted the link (see previous post, note 1), U.S. Bank is telling online banking users that they’ll be able to use the new PC-based, remote-deposit function on March 14. Customers will use standard all-in-one scanner/printers to submit checks.

Five months after we first spotted the link (see previous post, note 1), U.S. Bank is telling online banking users that they’ll be able to use the new PC-based, remote-deposit function on March 14. Customers will use standard all-in-one scanner/printers to submit checks.

The bank has decided to launch with a $0.50 per-item fee for retail customers. While I’m all for fees for value-adds, my response is mixed on this one.

The fee makes sense in many ways:

- Value: The customer receives a very real time savings here, and many would burn that much in gas, driving over to a branch. So $0.50 sounds pretty reasonable.

- Changing perceptions: It’s good to start weaning customers off the belief that every new feature is provided free of charge.

- Fairness: Customers that use the service, pay for its costs. That’s fair pricing for everyone.

- Optional: No one has to use the service; there are acceptable free (branch, ATM) or lower-cost (mail) alternatives for most customers.

But here’s what’s bothering me about it:

- Sends the wrong message about self-service: If the bank starts charging a dollar or even fifty cents to deposit an item in the branch, then the online fee makes perfect sense. But if the same service is free in the branch, I think it sends the wrong message to online users.

- Discourages trial: For nearly all potential customers, this is new and unproven technology. They at least need a free trial to get a feel for it.

- Is it worth the trouble? If U.S. Bank gets 50,000 items remotely deposited per month, the bank nets $300,000 per year in fee income. Would a free service save more than that in labor, while introducing the timesaver to far more customers, perhaps even driving some new accounts?

Bottom line: While it will cut usage dramatically, a fee makes sense if you want to add a new feature without increasing bank costs. And evidently, U.S. Bank doesn’t believe the higher number of deposits garnered by a free service would save enough labor to overcome the lost fee revenue. So the pros must outweigh the cons.

Nevertheless, I’d prefer to see remote deposit bundled together with several other value-added features for a small monthly fee, e.g., $2.95 for a “power user” electronic account.

Kudos to U.S. Bank for making remote deposit available to retail customers. I look forward to trying it, but given how much trouble I’ve had with my all-in-one scanner over the years, I am much more likely to become an active user of a smartphone version.

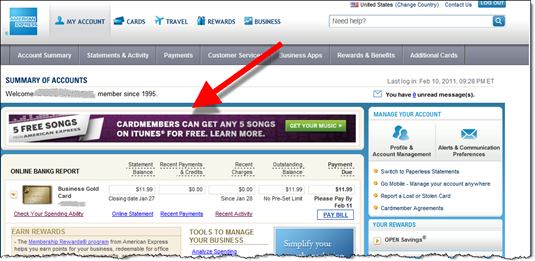

U.S. Bank’s Make a Deposit page inside the secure online banking area (20 Feb. 2011)

————————————-

Note:

1. The service has been piloted in several states, so I’m assuming that’s why it’s been on the menu.