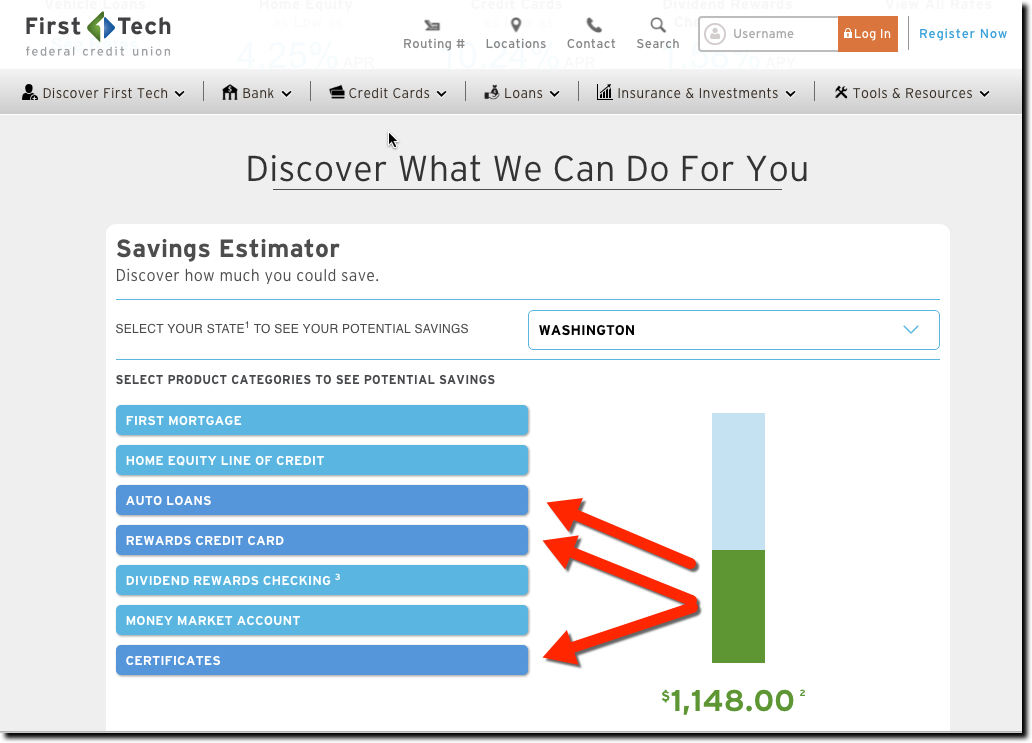

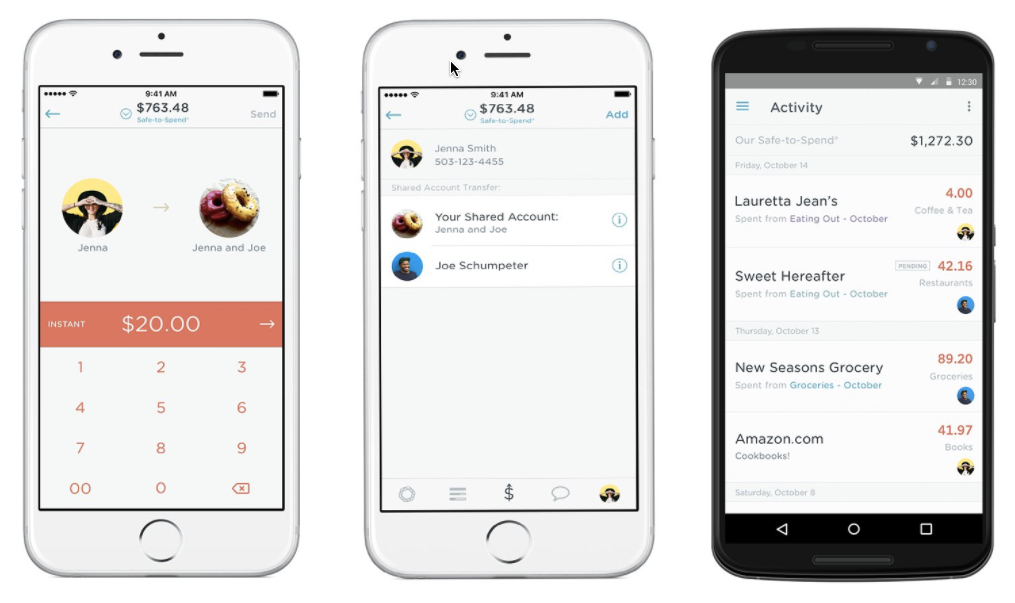

One thing we are looking forward to this year is the launch of Simple’s (part of BBVA) Simple Shared checking account. When the beta was announced last September (2016) and the company said it would be launching “some time in 2017.” See screenshots above.

The account promises to help users track their individual purchases, while also maintaining a shared transaction area and goal(s) that includes an Our Safe-to-Spend number across both users. Users would be able to simply transfer money to each other as well. And interestingly, it appears that any two people (and maybe more?) will be able to sync their Simple accounts together, it won’t have to be an actual legal joint account. That’s exactly how it should be.

Innovating in the Deposit Business

The deposit business is relatively straightforward. There are checking accounts, debit cards, and savings accounts (most paying a negligible amount of interest). So how does a bank differentiate itself in this absurdly low interest-rate environment? Branding, trust and location have been the traditional drivers and are still vital. And every decade or so a new technology comes along and there is some jostling along the way until everyone offers it (ATMs, VRUs, debit cards, online banking, mobile banking, etc.).

But even in a world where every FI offers the same basic product lineup, there are still ways to add value and increase market share and/or margins. Synced joint accounts, like Simple’s Shared Account. Married couples are the biggest opportunity, but there are other segments as well: Parents that need to sync with their kids. adults that need to sync with their aging parents, employers with employees, advisors with their clients, and so on.

There has been progress on this front. Many (most?) business accounts offer ways to enable third-party accountant/advisor access. Person-to-person transfers make it easy to send money to kids at college. And PFM solutions such as Mint, allow money-tracker couples to keep an eye on their spending across multiple accounts.

Bottom line: Existing solutions are often difficult to use, missing key features, and not fully integrated within big-name financial brands. Simple, which already offers a state-of-the-art checking account with Safe to Spend balance forecasting, natural-language search, and overall great UI, is expected to raise the bar considerably when Shared Accounts launches. I look forward to using it.

Author: Jim Bruene is Founder & Senior Advisor to Finovate as well as

Principal of BUX Advisors, a financial services UX consultancy.Â

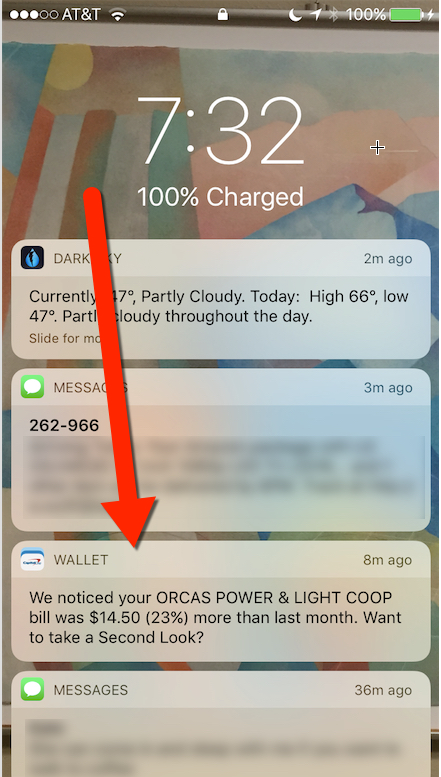

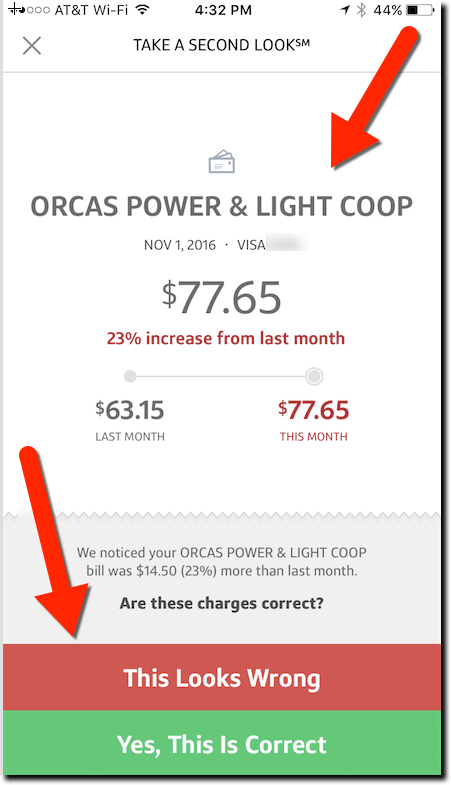

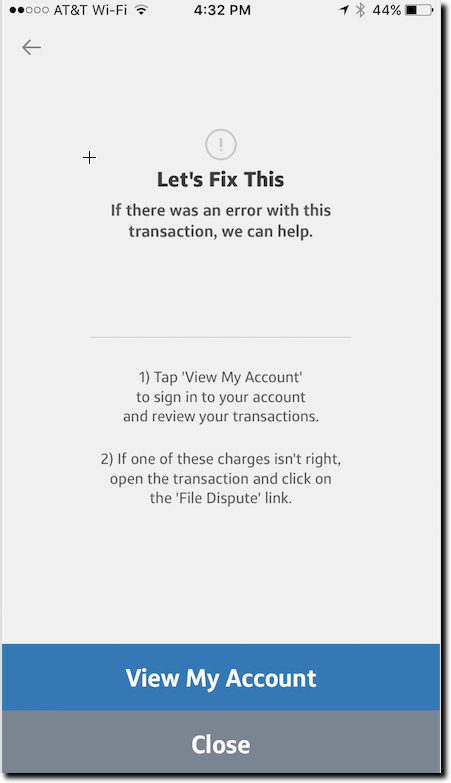

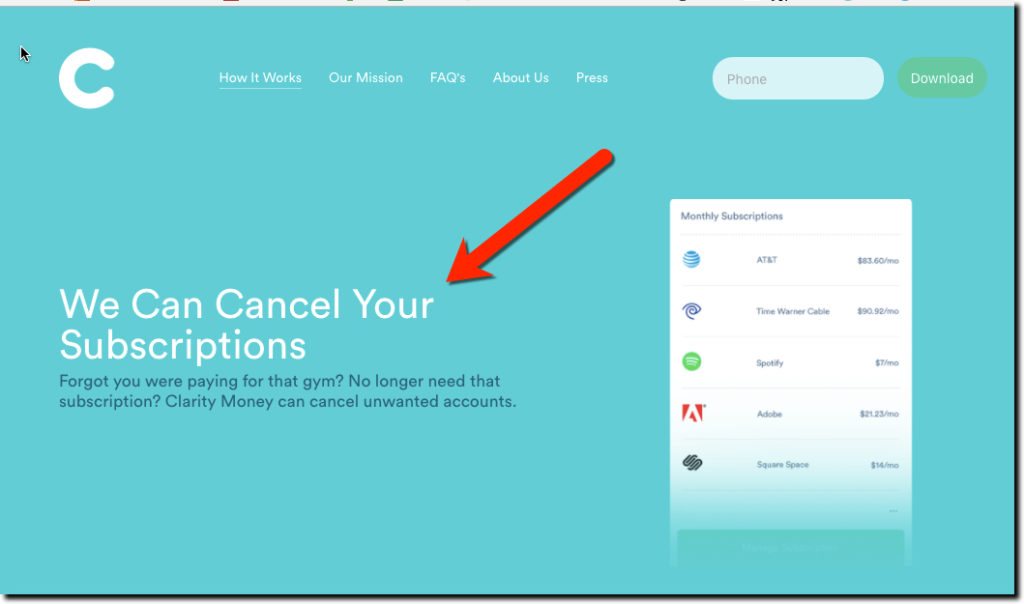

While the term PFM is dead, the concept, employing software to watch over your finances, is more widespread than ever. It’s just called AI, spending management, or nothing at all since it’s now baked into many digital banking offerings.

While the term PFM is dead, the concept, employing software to watch over your finances, is more widespread than ever. It’s just called AI, spending management, or nothing at all since it’s now baked into many digital banking offerings. Consumer value prop

Consumer value prop

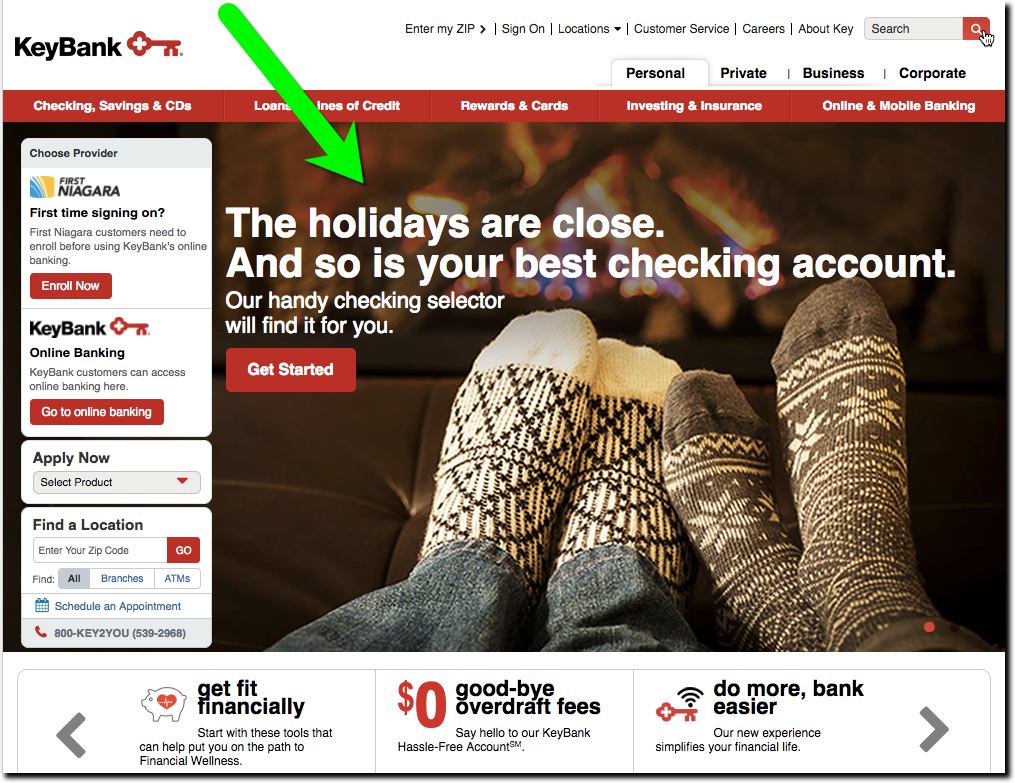

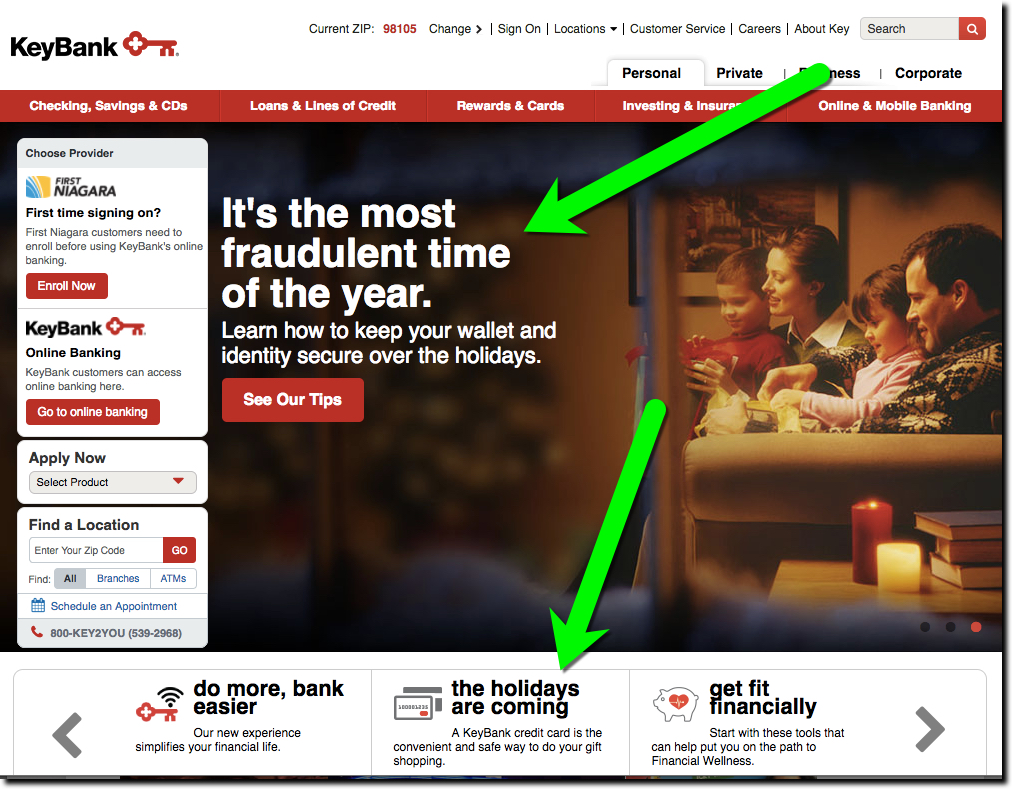

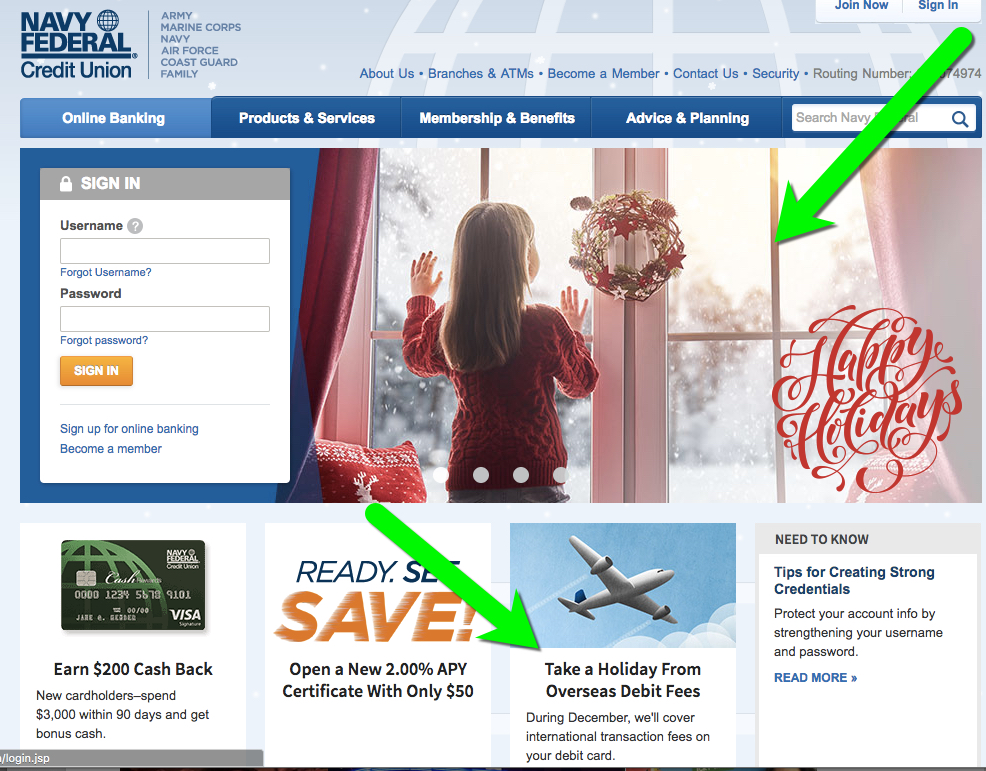

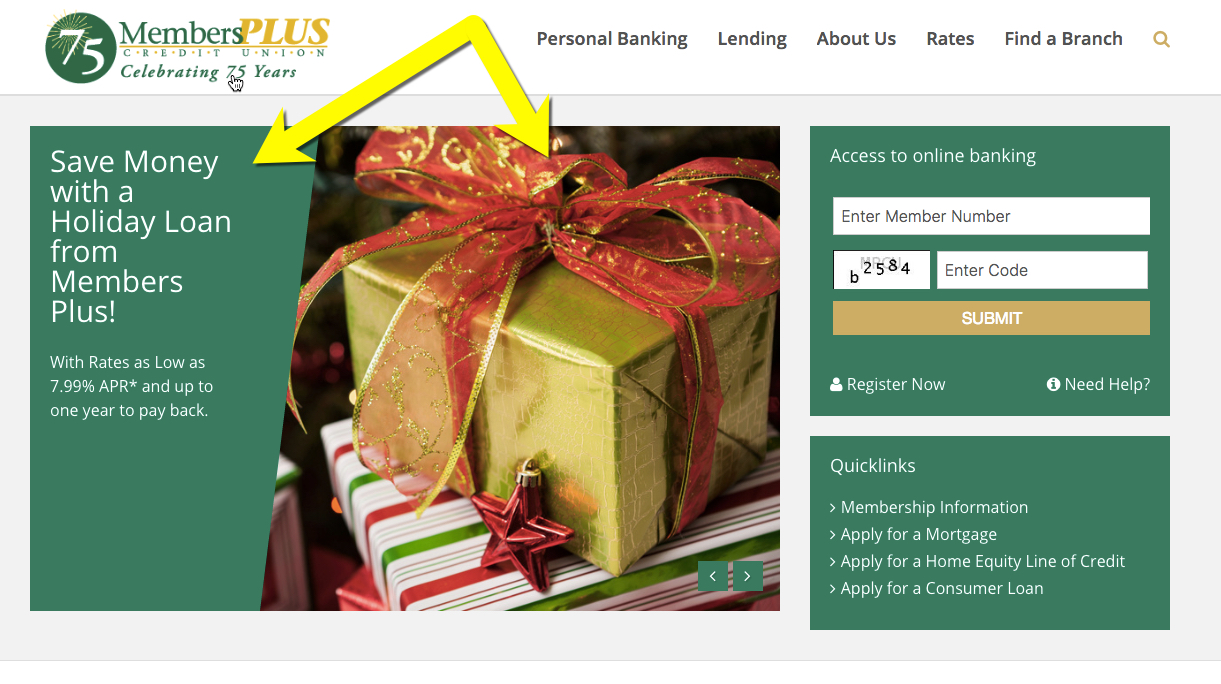

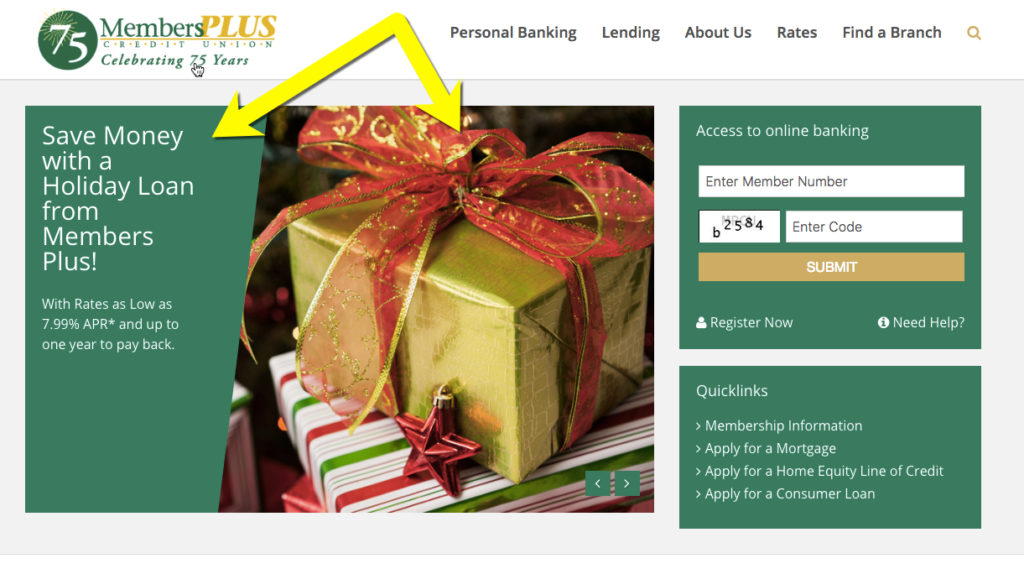

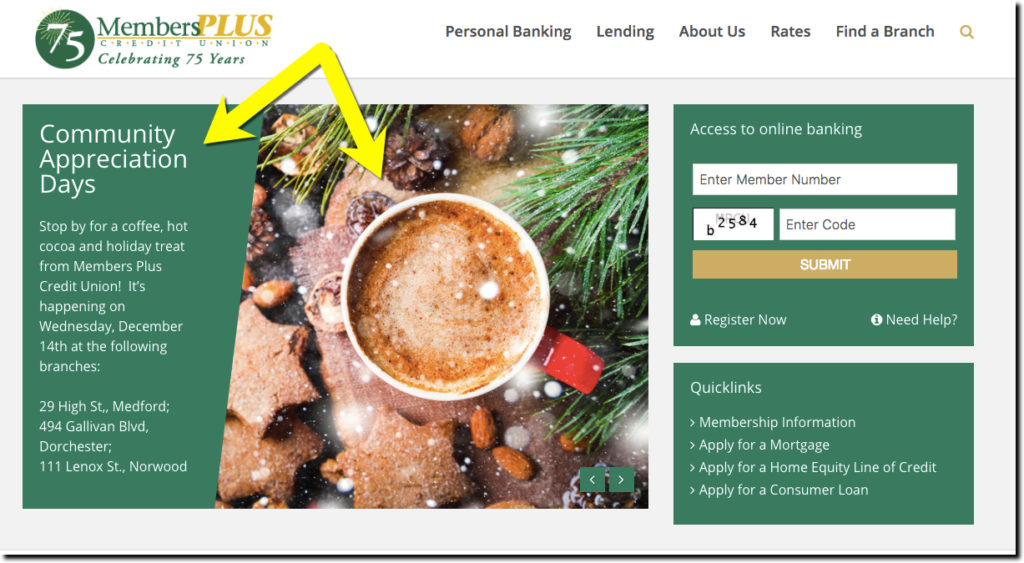

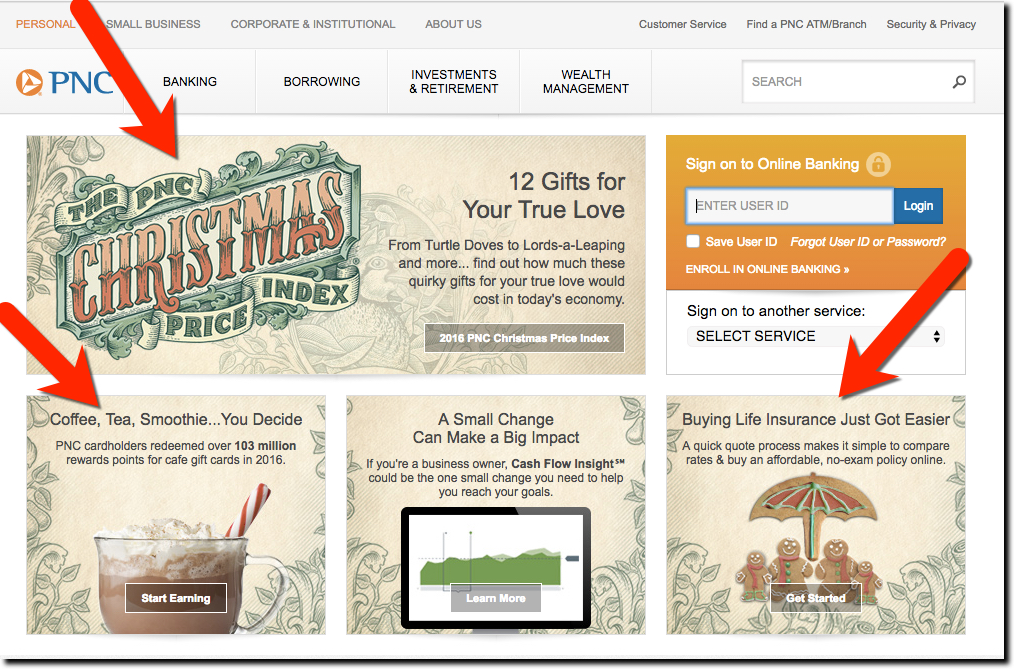

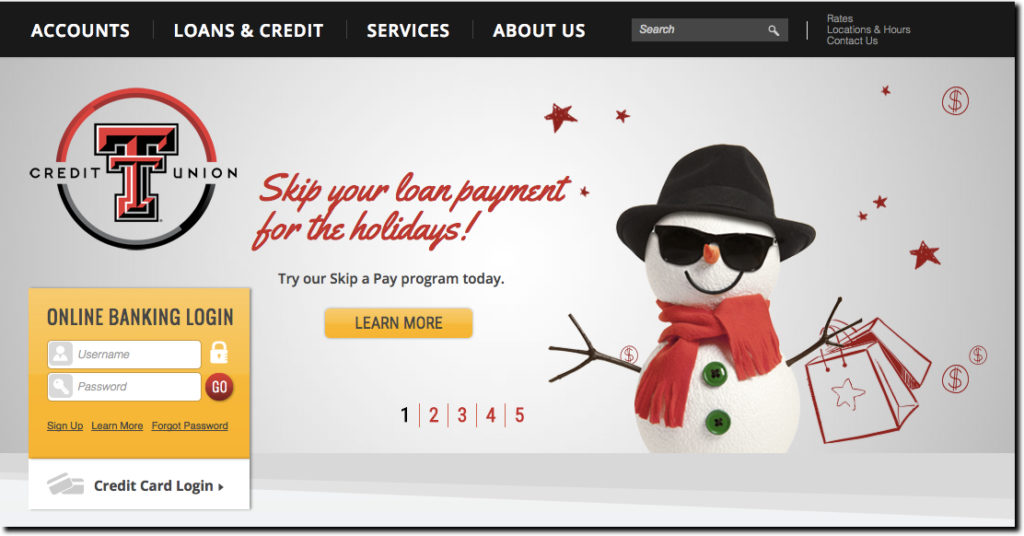

Happy holidays everyone! The holiday spirit is everywhere, except it seems, at the big U.S. banks. I get that budgets are busted, employees on vacation, and you don’t want to offend anyone by mentioning (or NOT mentioning) Christmas. Still, how hard would it be to throw a couple non-denominational snowflakes on top of your logo and wish everyone a happy holiday? Or better yet, how about a little bonus, like the holiday skip-payment offer similar to that featured on

Happy holidays everyone! The holiday spirit is everywhere, except it seems, at the big U.S. banks. I get that budgets are busted, employees on vacation, and you don’t want to offend anyone by mentioning (or NOT mentioning) Christmas. Still, how hard would it be to throw a couple non-denominational snowflakes on top of your logo and wish everyone a happy holiday? Or better yet, how about a little bonus, like the holiday skip-payment offer similar to that featured on