This post is part of our live coverage of FinovateEurope 2014.

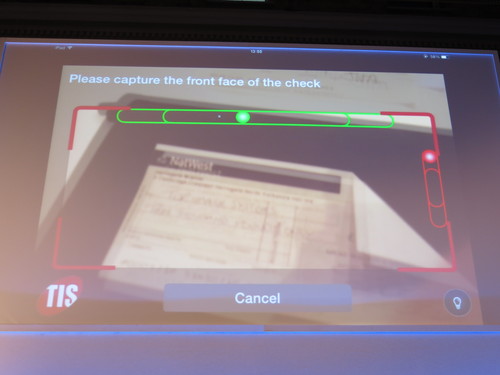

From Oslo, Norway, Encap Security is next, demoing their software-based, authentication solution.

“Smarter Authentication is the world’s only software-based, banking-grade, authentication technology that doesn’t compromise between security, user experience and utility.”

Presenting Thomas Bostrøm Jørgensen (CEO) and Adam Dolby (VP Bus. Dev.)

Product Launch: November 1, 2012

Metrics: People – Based in Oslo and Palo Alto, Encap Security’s management team has more than 60 years’ experience and an unrivaled pedigree in authentication, identity management, mobile app security and mobile financial services. Finance – Following a recent funding round, the total investment in Encap Security stands at €4.8 million. Market Traction – Encap Security’s solution is used by major financial institutions, enterprises and technology integrators including Santander Consumer Bank Norway, EnterCard and Sparebanken Vest. Encap Security’s technology is approved by the Norweigian Banks’ Standardisation Office and security experts Room66.

Product distribution strategy: Indirect through System Integrators and Service Providers, Direct to Business (B2B), and through financial institutions/tech companies and licensed platforms.

HQ: Oslo, Norway

Founded: 2007

Twitter: @encapsecurity