The Finovate crew has landed. And a whole van full of padfolios, multi-colored lanyards, tabletop-sized signage, and Best of Show trophies have been unloaded at the City National Civic facility that will host this year’s FinovateSpring 2014.

And here’s some more good news: if you haven’t secured your ticket to FinovateSpring yet, there’s still time left. Click here to buy your tickets and save your spot before the show is sold out.

With that in mind, here are a few reminders, tips, and need-to-knows before the show gets started bright and early Tuesday morning.

Schedule

Registration for FinovateSpring 2014 begins at 8am Tuesday morning, April 29. The first demo will began at 9am sharp, and the live demos continue all day long until 4pm. We begin again Wednesday morning at 9am, with another day full of live demos, again ending at 4pm.

And be sure to stick around during the networking session afterward. We will be announcing winners of our Best of Show competition Wednesday evening at approximately 5pm.

Venue

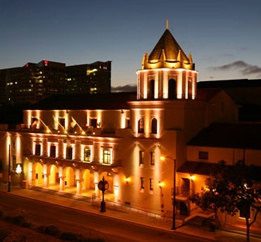

Our venue in San Jose is the City National Civic building, just down the road from the San Jose State University campus, and across from the convention center.

It’s a great facility with a lot of style and character. It also has an impressive history of hosting stars from the Rolling Stones and Jefferson Airplane to Los Lobos and Elvis Costello.

You can find the City National Civic building at:

135 West San Carlos Street

San Jose, California 95113

Presenters

We’ve got 68 companies scheduled to demo over the two days of FinovateSpring 2014, with a healthy mix of newcomers and Finovate veterans. You can learn more about our presenters on our

Presenters Page.

The App!

And last but not least, don’t forget the app! We are again doing everything we can to make it easier for you to get to know and connect with our presenting companies. So this year we are partnering with Bizzabo to help you take your networking to the next level.

All you have to do is download the free Bizzabo app from the

Apple App store or from

Google Play store (search for “Bizzabo”). Once you’ve downloaded Bizzabo, type “Finovate” into the search bar, sign in, and click the green “Join the Community” to get started. More info on how to make the most of Bizzabo is

here.

We couldn’t be more excited about this year’s show and can’t wait to get started. If you have any questions, check out our

FinovateSpring 2014 FAQ. Or send us an email at

[email protected]. In the meanwhile, we’re looking forward to seeing you in San Jose!

Yodlee deepens ties to developer community,

Yodlee deepens ties to developer community,