Narrative Science is bringing its natural-language-generation technology to Qlik Sense, adding intelligent narratives, intuitive analysis, and insights to Qlik’s data-visualization platform.

Calling the collaboration an example of Qlik’s “leadership in the data discovery industry,” Narrative Science CEO Stuart Frankel sees businesses and industries embracing NLG.

“The next generation of smart data discovery platforms will include natural language generation capabilities to explain findings to users,” Frankel said. “It is just a matter of time before this is a mandatory capability of visualization and business intelligence applications.”

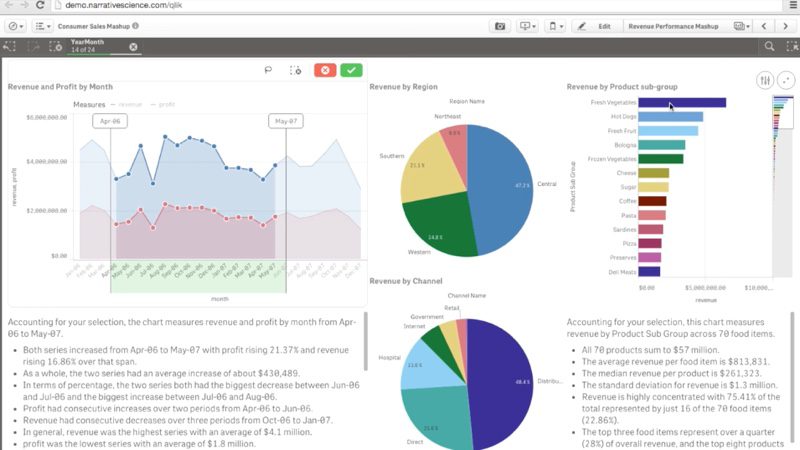

(Click image to play video)

Qlik specializes in visual analytics and business intelligence, ranging from reporting and self-service solutions to guided, embedded, and custom analysis. With the company’s technology, businesses can build drag-and-drop visualizations, create apps, and embed analytics into their websites and apps using both open and standard platform APIs. With offices worldwide and partners in more than 100 locations, Qlik is headquartered in Radnor, Pennsylvania, and trades on the NASDAQ under the ticker “QLIK.”

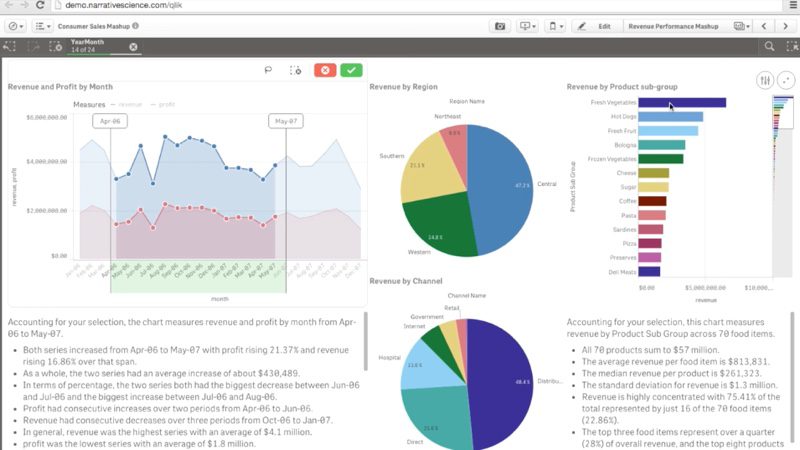

Narratives for Qlik automatically creates dynamic narratives that help illuminate key points in Qlik’s data visualizations. Moreover, Narratives for Qlik not only explains what the charts and graphs show, but also helps users discover non-obvious patterns and relationships in the data. Industry analyst Seth Grimes called the technology “a groundbreaking BI innovation,” adding that “the tight link to Qlik’s associative analysis and its personalization possibilities are pluses, but it’s the ability to provide a new means of communicating insights that is really compelling.”

Narratives for Qlik is available for download.

Founded in January 2010 and headquartered in Chicago, Narrative Science demonstrated Quill Financial at FinovateFall 2013. In November, Narrative Science unveiled its anti-money laundering solution, Quill for AML, and in September, the company launched a new version of its Quill Engage technology for Google Analytics. Last summer, Narrative Science released its Quill Portfolio Review solution, which helps money managers create better institutional portfolio commentary.

![]() A look at the companies demoing live to 1,500 fintech professionals. Register today.

A look at the companies demoing live to 1,500 fintech professionals. Register today. Michael Stemmle, Owner and CEO

Michael Stemmle, Owner and CEO Adriano B. Lucatelli, Entrepreneur, Founder of Descartes AG

Adriano B. Lucatelli, Entrepreneur, Founder of Descartes AG

Diederick van Thiel, CEO

Diederick van Thiel, CEO Rosali Steenkamer, CCO

Rosali Steenkamer, CCO

Alex Grinberg, Head of Business Development and Founder

Alex Grinberg, Head of Business Development and Founder Dean Young, Head of Product Management

Dean Young, Head of Product Management

Lukasz Olek, Chief Product Officer and Founder

Lukasz Olek, Chief Product Officer and Founder Michal Czekalski, CEO and Founder

Michal Czekalski, CEO and Founder Matthew Harris, International Business Developments and Partnerships

Matthew Harris, International Business Developments and Partnerships

Andrii Lebedynets, Co-Founder

Andrii Lebedynets, Co-Founder

Germany

Germany Ireland

Ireland The Netherlands

The Netherlands

United Kingdom

United Kingdom

Founded with a mission to eliminate the fees that often accompany both spending and transferring money, Revolut has been used by more than 80,000 people in 150 countries. More than $180 million has been transacted via the app, saving users an estimated $15 million. With the RevolutCard, users can make purchases worldwide in any one of 90 different currencies. And with the Revolut app, users can make instant money transfers through SMS, social media, and email, all without fees or a bank intermediary.

Founded with a mission to eliminate the fees that often accompany both spending and transferring money, Revolut has been used by more than 80,000 people in 150 countries. More than $180 million has been transacted via the app, saving users an estimated $15 million. With the RevolutCard, users can make purchases worldwide in any one of 90 different currencies. And with the Revolut app, users can make instant money transfers through SMS, social media, and email, all without fees or a bank intermediary.