- Earnix and digital business and IT services company NTT DATA announced a new collaboration.

- The partnership will help property and casualty insurers enhance the pricing, rating, and underwriting process, as well as increase policy personalization.

- Israel-based Earnix made its Finovate debut at FinovateSpring 2016.

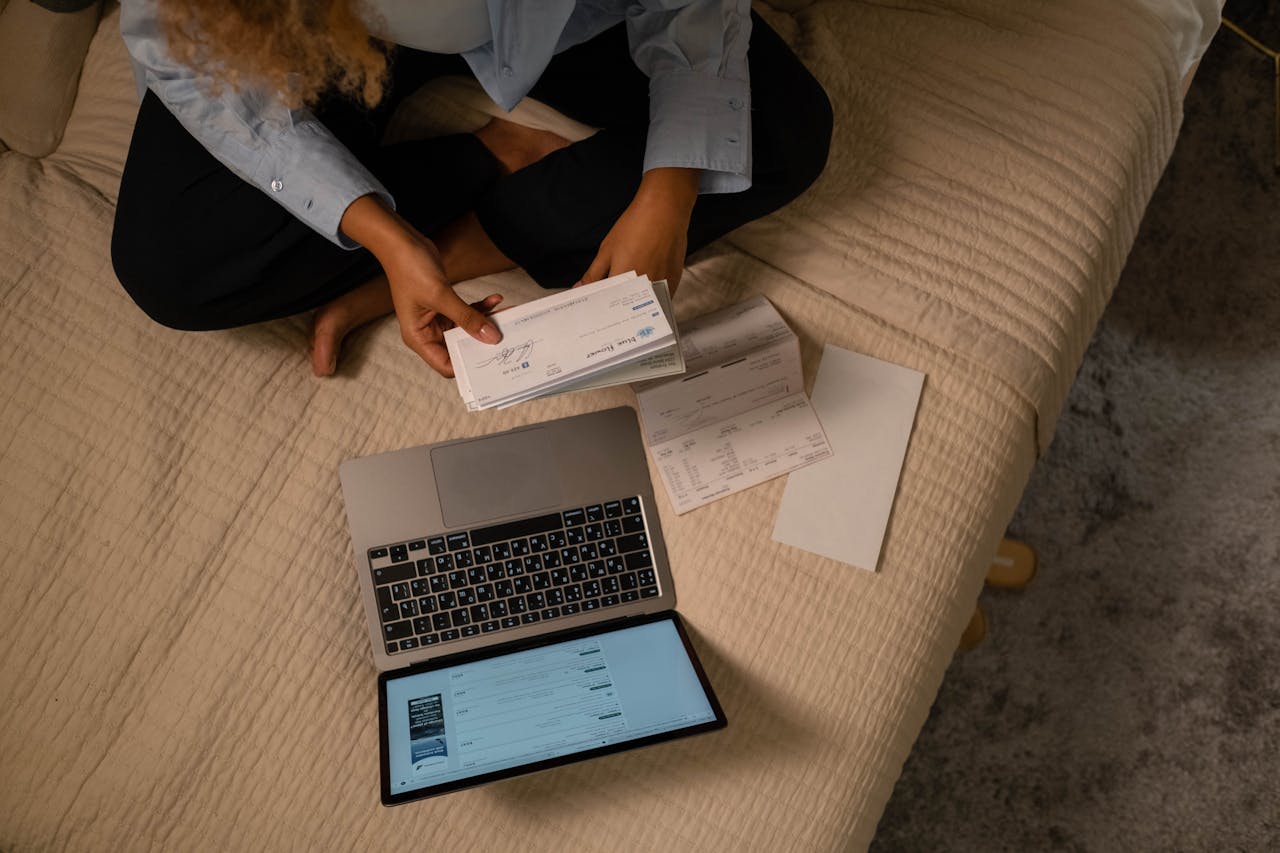

Financial services solutions provider Earnix has announced a collaboration with digital business and IT services company NTT DATA. The partnership will enable Earnix to give property and casualty insurance carriers intelligent solutions for pricing, rating, underwriting, and policy personalization. The integration, combined with NTT DATA’s pedigree in data migration, will accelerate insurers’ time to market and enhance their ability to put data to work in fostering innovation.

“We take pride in driving transformative change in the insurance industry with AI-powered solutions,” said SVP of Insurance Services at NTT DATA North America Rob Baughman. “By integrating our products and services, we help clients achieve long-term success and identify opportunities for growth.”

Earnix and NTT DATA are joining forces at a time when the international insurance analytics market is expected to grow from $11 billion, where it stood in 2022, to $35 billion by 2030, an annual rate of more than 15%. Accompanying this growth is an expectation from insurance consumers for products that are more relevant and tailored to their needs. Earnix has leveraged AI to address these preferences, enhancing the rate-making process and creating personalized experiences by incorporating real-time feedback.

“Our partnership with NTT DATA is a game changer for insurers,” Earnix Head of Business Development Ruth Fisk said. “Bringing together their powerhouse expertise in data management and pricing modernization with the strength of the Earnix platform, we can equip insurers with the insight and flexibility to respond quickly to shifting market needs.”

NTT DATA first demoed its technology on the Finovate stage at FinovateSpring 2018, and returned the following year to demo its latest innovation at FinovateFall in New York. The Tokyo, Japan-based company serves 75% of the Fortune Global 100 with business and technology services including consulting, data and AI, and industry solutions. NTT DATA also assists in the development, implementation, and management of applications, infrastructure, and connectivity.

Headquartered in Tel Aviv, Israel, and founded in 2001, Earnix made its Finovate debut at FinovateSpring 2016. In the years since, Earnix has grown into a major provider of cloud-based intelligent solutions for analytical underwriting, dynamic pricing, product personalization, and customer engagement. The company’s solution for insurers inserts a new SaaS layer into the firm’s existing tech stack, adding both intelligence and agility to the pricing, rating, and underwriting process. For banks and lenders, Earnix offers a digital decisioning solution that enables lenders to manage portfolio risk, loan profitability, origination volume, speed to market, and regulatory compliance.

With customers in more than 35 countries across six continents, Earnix has raised more than $100 million in funding from investors including Vintage Investment Partners and Israel Growth Partners. Insurance and fintech industry veteran Robin Gilthorpe joined the company as CEO in February of last year.