In a round led by Home Credit Group, core banking technology innovator NYMBUS raised $16 million in new capital. The funds build on the $12 million the FinDEVr/Finovate alum raised in the second half of last year, bringing its total capital to $28 million.

NYMBUS executive chairman Scott Killoh pointed to reliance on outmoded legacy core technology as holding back many institutions in the financial services industry. Because of this, he said “tens of thousands of banks and credit unions are not capitalizing on strategic growth opportunities.” The investment from Home Credit Group will help NYMBUS provide FIs with the modular, third-party friendly core banking technology that will enable them to keep pace with the demands of their customers. NYMBUS President David Mitchell called it “helping … implement digital-first strategies in order to drive customer growth and competitive differentiation.”

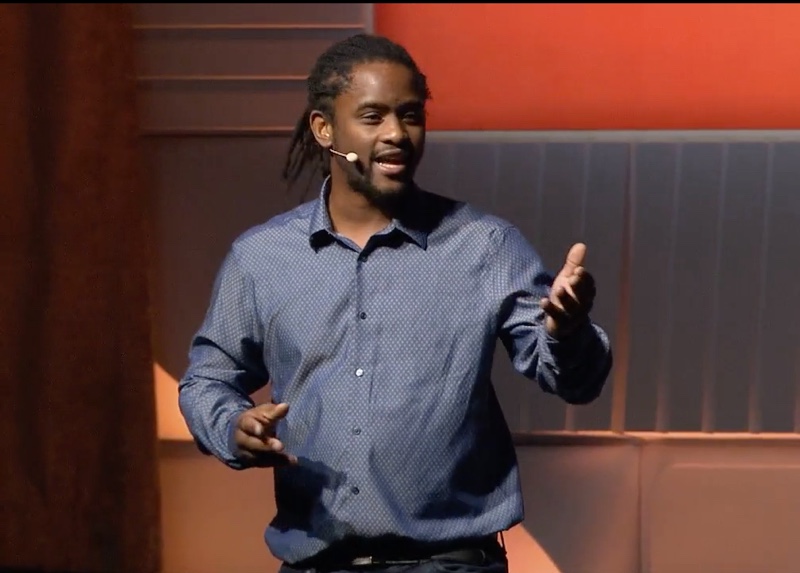

Pictured: NYMBUS President David Mitchell during his presentation “NYMBUS: The Next Evolution in Core Processing” at FinDEVr New York.

Founded in 2015 and headquartered in Miami Beach, Florida, NYMBUS presented “The Next Evolution of Core Processing” at FinDEVr New York last year, during which Mitchell explained why the company decided to focus on core processing technology. “If I asked who in this audience has a pager or a Walkman,” Mitchell told the attendees at last year’s event, “not too many people are going to raise their hands. “But community banks right now are on 30-year old, 20-year old technology,” he said. “(It’s) the oldest technology in the world. It’s been lipstick on a pig, mainframes, green screens for 20 or 30 years.”

NYMBUS, in contrast provides an advanced, core processing platform, SmartCore, with a wide variety of APIs, customizable UI, a conversion layer, and an ecosystem of banking apps. The platform keeps all critical banking functions in a single system with a single sign-on and data set. Home Credit International Group Head of Special Projects Miroslav Boublik called NYMBUS “best positioned to stand at the core” of the disruption of the traditional banking model today. “NYMBUS’ technology is both many years ahead of traditional banking system vendors and most viable among emerging (fintech) providers,” Boublik said.

Earlier this month we shared news of the company’s partnership with California’s Kaiperm Diablo FCU to deploy its core banking technology, SmartCore. Kaiperm Diablo’s announcement comes just a few months after Pennsylvania-based CHROME Federal Credit Union reported that it would use SmartCore as part of its goal of transitioning to a digital-first credit union. NYMBUS has also been an active acquirer, buying Sharp BancSystems, KMR, and R.C. Olmstead in the summer of 2016. Also a veteran of Finovate, the company demonstrated its technology at FinovateSpring 2016.

Chairman and CEO of TIO Networks, Hamed Shahbazi (pictured), emphasized this point as well. “We founded TIO to make speed and access part of the bill payment experience for the underserved, and we believe that we have created affordable products to serve the needs of all customers,” Shahbazi said.

Chairman and CEO of TIO Networks, Hamed Shahbazi (pictured), emphasized this point as well. “We founded TIO to make speed and access part of the bill payment experience for the underserved, and we believe that we have created affordable products to serve the needs of all customers,” Shahbazi said.