FinDEVr New York 2017 begins tomorrow, Tuesday, March 21st. And after the successful launch of FinDEVr New York last year, we can’t wait to see what this year’s collection of developers, engineers, and technologists have in store for us.

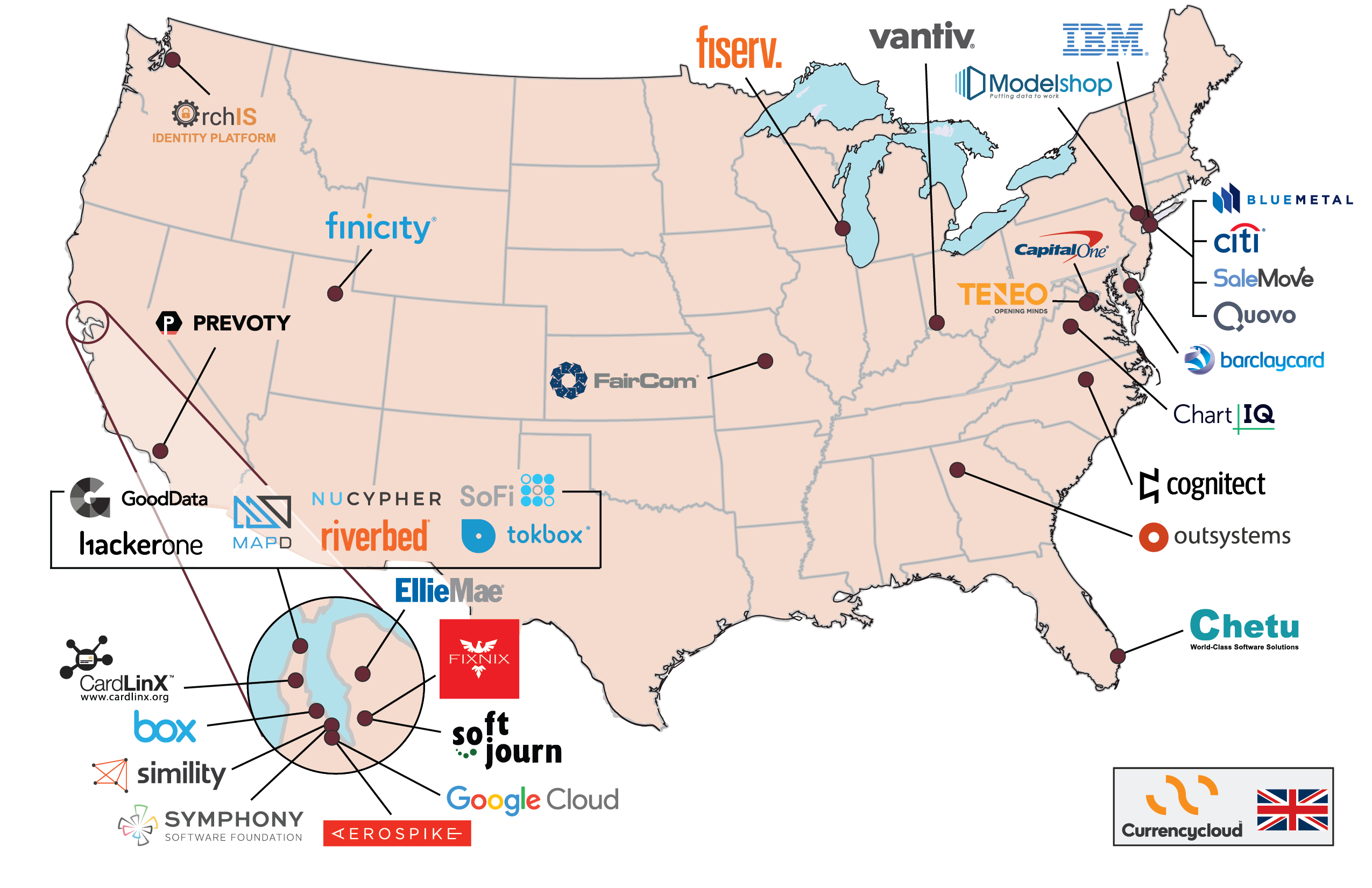

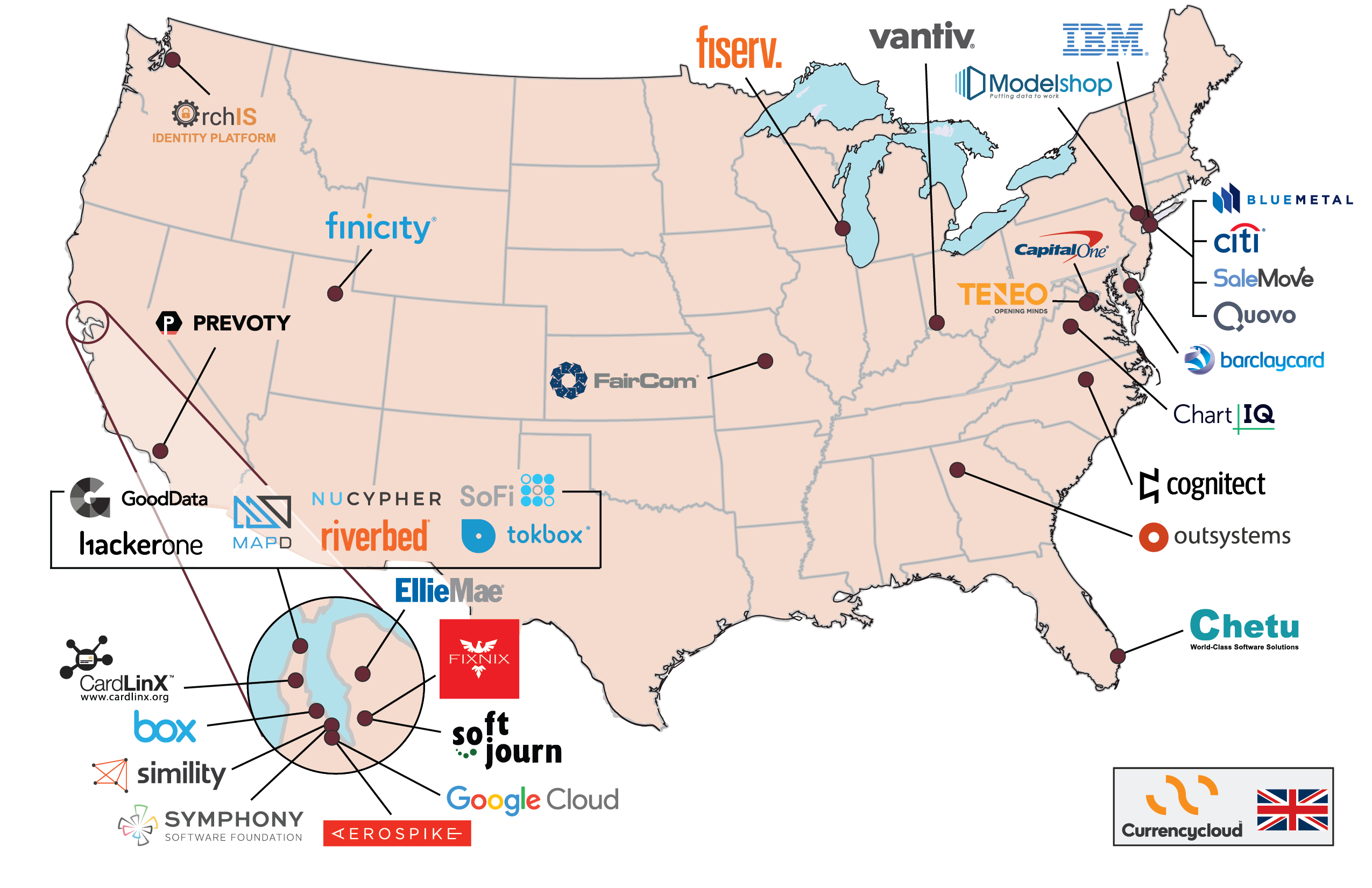

FinDEVr is a bicoastal affair, with conferences in Silicon Valley in the fall and New York in the spring. And this year, much the same can be said of our presenters. As our FinDEVr New York 2017 presenter map below reveals, the majority of this year’s presenters hail from either California on the west coast or from any one of a number of locations from as far north as New York City to as far south as Florida on the east coast.

And this takes nothing away from the legions of talented fintech developers innovating in places as diverse as Utah and Wisconsin, Missouri and Ohio, Washington state and Georgia. From companies and startups large and small, we’re looking forward to two days of unique insights into the way some of our most talented developers, engineers, and CTOs put the “tech” in fintech.

So to help you make the most of FinDEVr NewYork, here are a few notes and things to keep in mind:

- Who and What? You – and maybe a colleague or two – joining dozens of companies for two days of high-level, code-friendly demonstrations and presentations on the key technologies driving fintech innovation today. If you haven’t picked up your ticket, visit our registration page and save your spot. But before you buy, be sure to use the promo code “FinDEVrBlog” and save 10% off the ticket price.

- When and Where? This year, FinDEVr New York 2017 will be held at the Metropolitan Pavilion on West 18th Street.

- How and Why? To learn a little bit more about the companies that will be presenting on stage Tuesday and Wednesday as well as the technologies they specialize in, check out our FinDEVr New York 2017 Preview series.

We’re excited for FinDEVr New York 2017 and hope to see you there. If you’ve got any questions about the event, please check the FAQ section of the FinDEVr New York website or contact us at [email protected].

FinDEVr New York 2017 is sponsored by Google Cloud and Box.

FinDEVr New York 2017 is partnered with American Banker, BayPay Forum,BiometricUpdate.com, Breaking Banks, Byte Academy, Canadian Trade Commissioner Service,Celent, CIOReview, Cointelegraph, Colloquy, CooperPress, Distributed, Economic Journal,Empire Startups, Femtech Leaders, Finmaps, Fintech Finance, Harrington Starr, Level39,Mercator Advisory Group, The Paypers, Plug and Play Tech Center,SecuritySolutionsWatch.com, Swiss Finance + Technology Association, and Women Who Code.