One of my favorite sayings popularized by the current Democratic Party candidate for president is “don’t tell me your values. Show me your budget.” The implication is that, at the end of the day, talk is cheap. Show me how you actually spend your money, and I’ll learn all I need to know about what matters to you and what does not.

By that metric, the news that Dutch fintech and Finovate alum Ohpen has acquired Saas-based, crossborder mortgagetech Davinci tells us quite a bit about what what the Amsterdam-based cloud core banking engine maker thinks about the importance of expanding beyond its competencies in savings, investments, loans, and current account products.

“We are a growing company with huge ambitions,” Ohpen CEO Matthijs Aler said. “Together, we intend to lead the charge in directly challenging incumbent providers with outdated technology. Our mission is – and always has been – to set financial institutions free from legacy software. Now we can help a broader range of financial institutions deliver tangible change to meet the needs of tomorrow’s customers.”

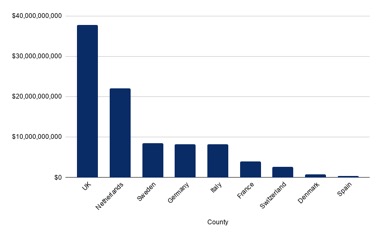

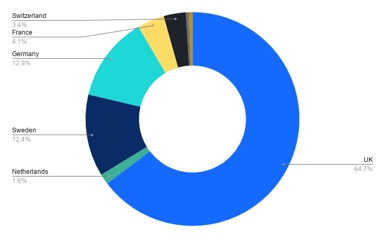

Ohpen put the acquisition announcement in the context of its global growth strategy. This includes scaling operations in the Netherlands – where the company is a market leader – the United Kingdom, and Belgium initially, as well as expansion to other areas. Ohpen also plans to scale up its development centers in Spain and Slovakia.

The terms of the acquisition were not disclosed, but the combined entity will have 350 employees and $35 million in revenue. Davinci is Ohpen’s second acquisition. The company purchased core banking system implementation consultancy FYNN Advice in the fall of 2017.

Davinci leverages machine learning and AI to enhance and accelerate digital onboarding and acceptance during the mortgage lending process. Delivering cost savings of as much as 80%, the company’s signature solution is Close, a cloud-native platform for mortgage loan origination and servicing.

Calling the acquisition, “the natural next step” for both companies, Davinci Director Alwin van Dijk said, “We are the only two players with a real focus on back and middle office innovation for new and existing propositions.” van Dijk added that the ability to offer a broader range of products will be a “market game changer.”

With $47 million (€40 million) in funding from investors including NPM Capital and Amerborgh, Ohpen began the year teaming up with pensions administrator TKP Pensioen. The partnership with the Groningen, Netherlands-based digital pension platform enabled Ohpen to enter the pension market for the first time. Aler pointed out that the integration would enable the “originally conservative industry” of pension management to have a “fully digital and futureproof pension solution at its disposal.” This spring, Ohpen partnered with another pension management firm, Ortec Finance, integrating the company’s forecasting engine with the Ohpen platform.

Photo by Kaboompics .com from Pexels