I’ve always been a “wanna be” tracker. I like watching the stats closely, but I also lose interest if the process, either capturing the data or compiling it, becomes tedious. But thanks to mobile (including wearables), the drudgery is disappearing and that has big implications for banking and financial services.

I’ve always been a “wanna be” tracker. I like watching the stats closely, but I also lose interest if the process, either capturing the data or compiling it, becomes tedious. But thanks to mobile (including wearables), the drudgery is disappearing and that has big implications for banking and financial services.

Some examples: I’ve used Mint since 2007 for personal and business expenses, so I have a massive database of transactions, which in theory should make it easy to locate just about anything I’ve charged to a credit or debit card in the past eight years. However, it’s never quite perfect because I will go for long periods without doing the required maintenance to keep every aggregated account flowing. Recently, I just fixed one of my main credit cards which has been on hiatus for two years. So, there are big holes in the data.

Then there’s BillGuard, another service I love and have been using for years. I love how it alerts me to questionable items as they hit my card accounts. However, BillGuard’s database is so good, that I rarely hear from them any more. This is good news for me (no questionable items), but less so for them. Because what’s invisible, loses its perceived value.

And I’ve tried tracking other things over the years, both financial and personal. And nothing seems to stick. Until now. I just hit my two-year anniversary using Fitbit, usually glancing at its tiny readout several times per day. So what is it about Fitbit that makes it addictive? And more importantly, how can financial institutions do the same for money management?

1. Make it easy to use: While Fitibit requires zero maintenance once you get it activated, you do have to remember to keep it on you. The same goes double for a bank’s credit or debit card. You not only have to remember it, but also must choose to use it at the point of sale.

1. Make it easy to use: While Fitibit requires zero maintenance once you get it activated, you do have to remember to keep it on you. The same goes double for a bank’s credit or debit card. You not only have to remember it, but also must choose to use it at the point of sale.

Action item: Incent users to get your card loaded into digital ecommerce sites such as Apple Pay, Amazon, iTunes, PayPal, Uber, Spotify and others. Capital One just unleased a great, albeit expensive, program with Uber to credit back 20% of rides to its cardholders (link).

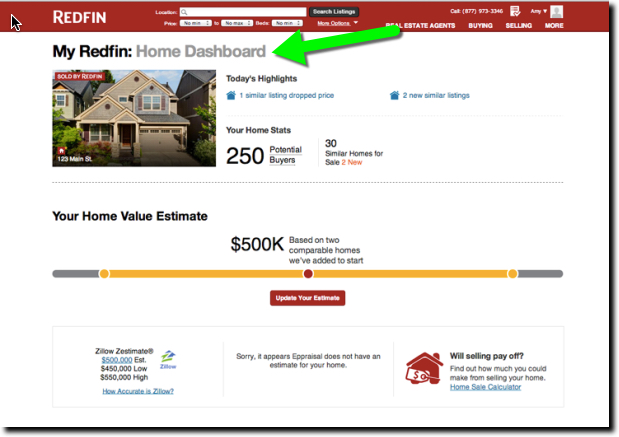

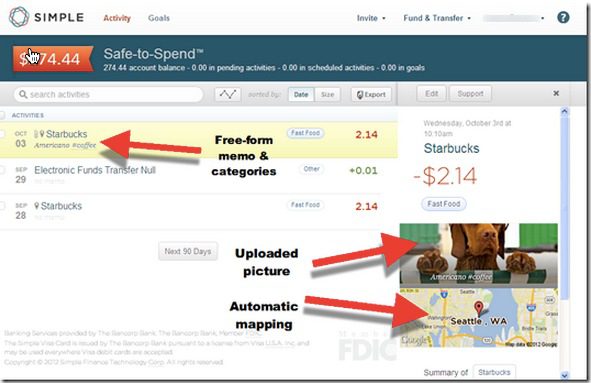

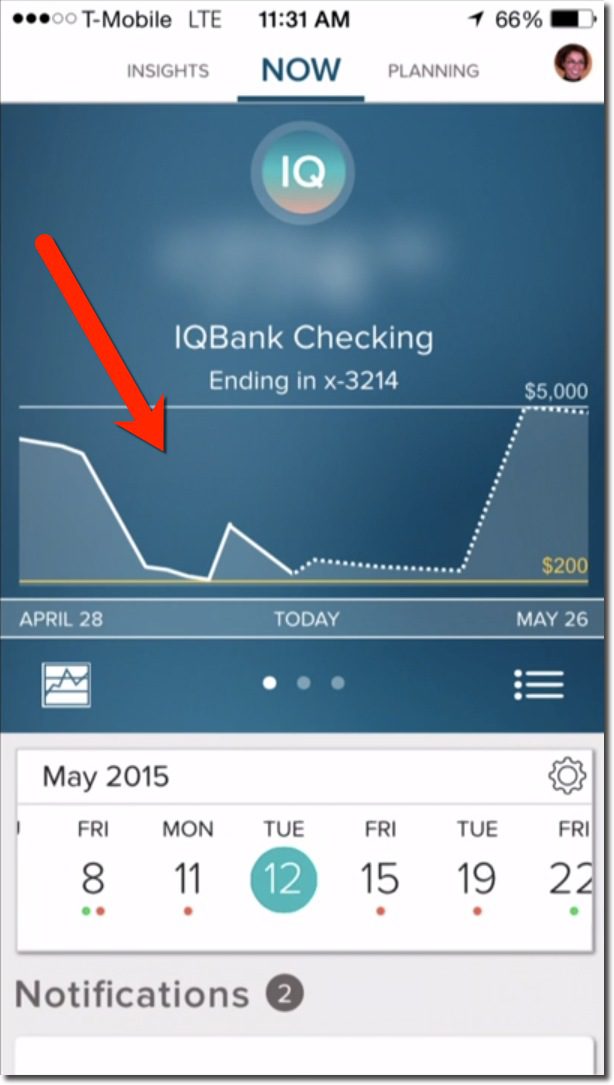

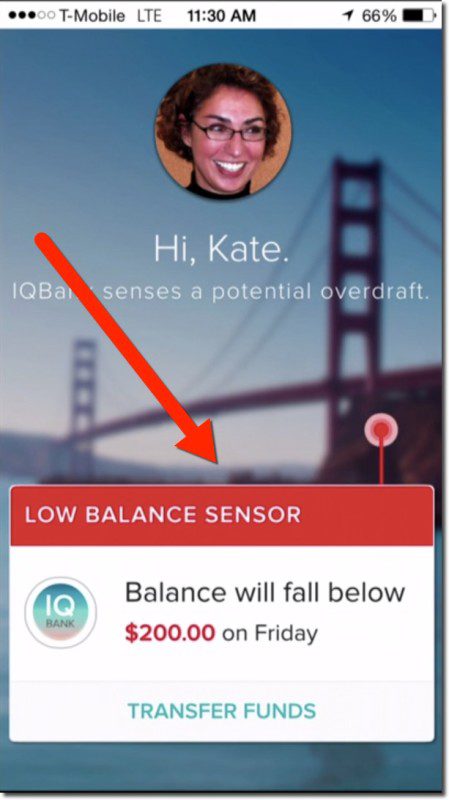

2. Make it easy to see exactly where you stand in real-time: Fitbit provides feedback literally every step of the day. It’s extremely motivating, though at times discouraging when you fall way behind in personal goals. Card issuers today do something similar delivering real-time alerts right to the smartphone homescreen (and soon to the Apple Watch). But transaction alerts still don’t tell you where you are.

Action item: Make notifications smarter by including daily, weekly, monthly transaction summaries and/or credit available. They could be included in the notification, or enabled with a swipe of the transaction alert.

3. Make it easy to compare to previous periods: This is still a missing piece of my ultimate Fitbit experience. The mobile app makes it easy to scroll backwards or look at bar charts to see how you are doing over time. But there are no simple month-over-month or year-over-year comparisons to see your progress in similar time periods.

Action item: Create single-click views of financial activity and balances compared to one month ago, one year ago, two years ago, etc.

4. Provide ongoing incentives: Similar to saving money being its own reward, burning calories by walking and climbing is clearly its own incentive to bump up your Fitbit numbers. But it doesn’t hurt to provide extra incentives along the way. An incentive can not only keep customers engaged, but also appreciative of the game provider. Unlike BillGuard, which so quietly goes about its business that I forget about it, Fitbit delights users with badges and pop-up notifications, for hitting various daily or lifetime milestones. (Fitbit actually needs to do more incentivizing, as experienced users can rarely get a new badge; I haven’t had a new one since last November).

Action item: The badges may be cheesy, but the email congratulations are powerful (see inset from Fitbit the first time you walk 20,000 steps in a day). This has to be one of the simplest things you could do to reinforce good money management. Send an email congratulating a customer when their savings balance, rewards points, interest earned, or whatever, increases compared to a month ago or a year ago. Who doesn’t appreciate an “atta boy or girl” every now and then (even if it is from your bank).

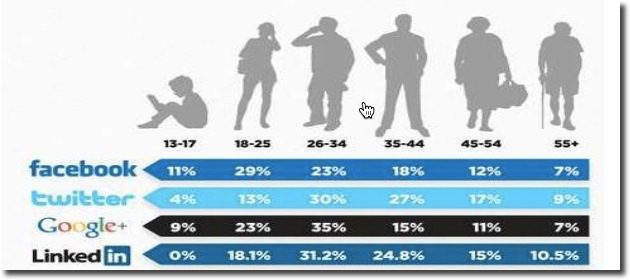

5. Get social: While I’m not of the social media generation, I do understand its appeal. Just today, Fitbit sent me a reminder to add friends. This allows users to compete against friends and family, a potentially motivating way to get you off the couch and moving. And while I’d never share Fitbit data with friends, I do enjoy a friendly competition with my wife. The key is to make sharing highly selective, customizable, and easy to switch on and off.

Action item: While financial information is not as readily shareable as fitness data, Venmo has proven that it has potential. The youthful set who’ve taken to using Venmo (see the Venmo line), enjoy sharing payment activity, but only without revealing the actual dollar amount, and allowing for maximum snark in the share. And there are also plenty of serious use-cases for sharing financial data, such as employees with their employers, kids with their parents, etc. Card issuers should add optional sharing to all card-management platforms.

——–

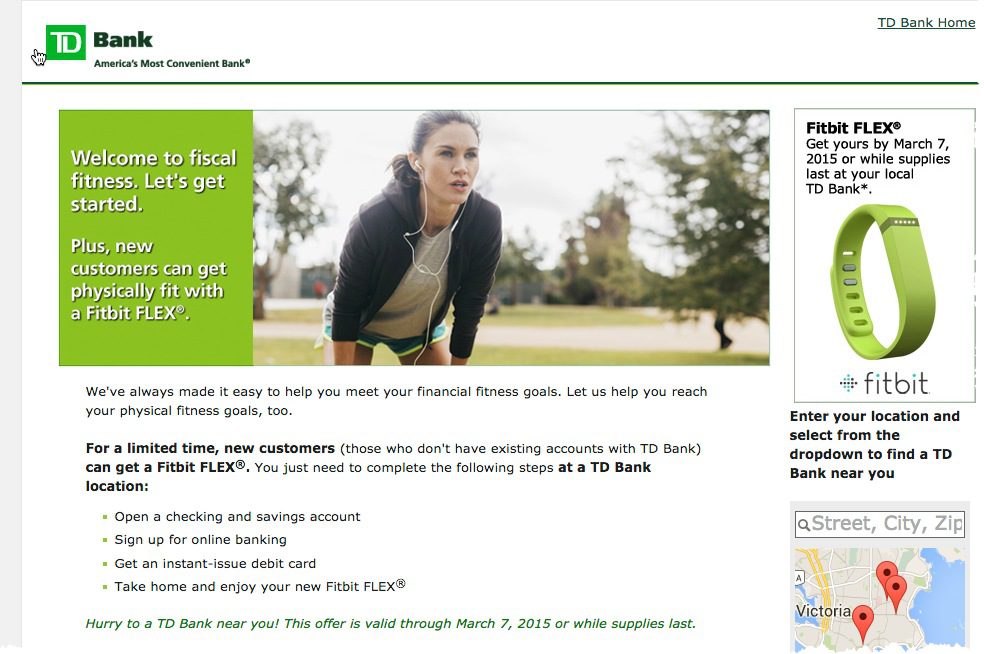

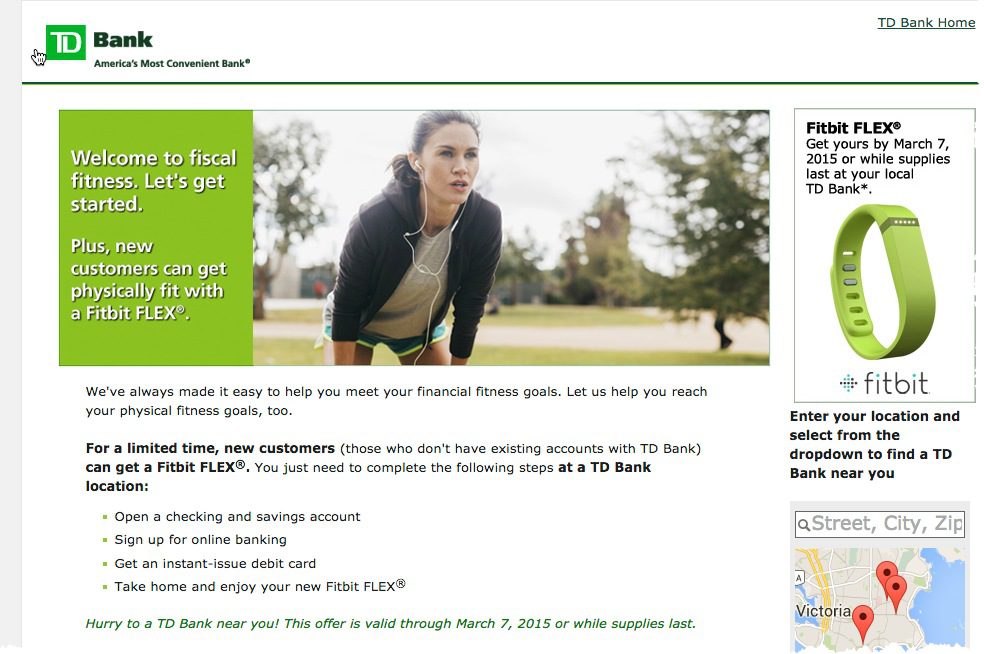

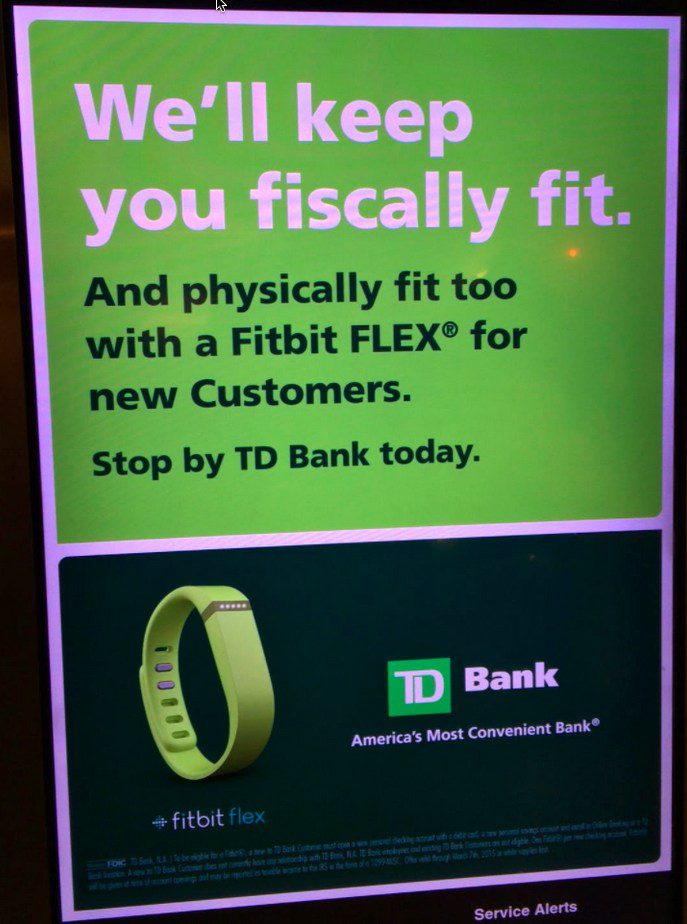

Screenshot: TD Bank landing page (22 April 20015, link)

—————–

Picture Credit: TD Bank has been giving away Fitbit Flex trackers to new checking account customers (screenshot above). A reader from MaximizingMoney.com contributed this upper-right photo of TD signage in the NYC subway.

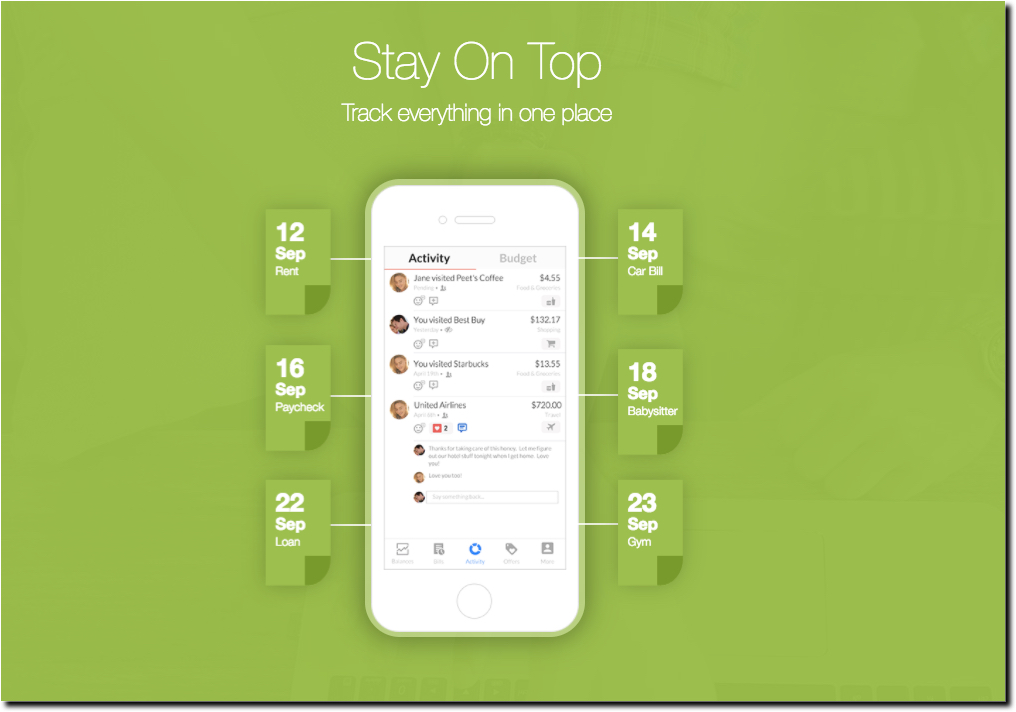

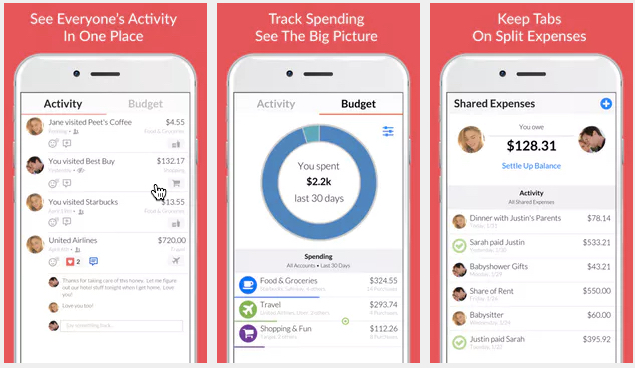

Enter the newest PFM player, HoneyDue (formerly WalletIQ), currently toiling away in Y Combinator’s summer class (S17). After a stint as one of Apple’s favorite apps in May, the company already has 20,000 registered users, 60% of which are female. The app debuted on Product Hunt two days ago, and was the most popular product of the day (currently 820 upvotes) and so far is fifth highest of the week. You’ll be hearing more about them in two weeks when they officially debut at the incubator’s demo days (Aug 21-23).

Enter the newest PFM player, HoneyDue (formerly WalletIQ), currently toiling away in Y Combinator’s summer class (S17). After a stint as one of Apple’s favorite apps in May, the company already has 20,000 registered users, 60% of which are female. The app debuted on Product Hunt two days ago, and was the most popular product of the day (currently 820 upvotes) and so far is fifth highest of the week. You’ll be hearing more about them in two weeks when they officially debut at the incubator’s demo days (Aug 21-23).

While the term PFM is dead, the concept, employing software to watch over your finances, is more widespread than ever. It’s just called AI, spending management, or nothing at all since it’s now baked into many digital banking offerings.

While the term PFM is dead, the concept, employing software to watch over your finances, is more widespread than ever. It’s just called AI, spending management, or nothing at all since it’s now baked into many digital banking offerings. Consumer value prop

Consumer value prop

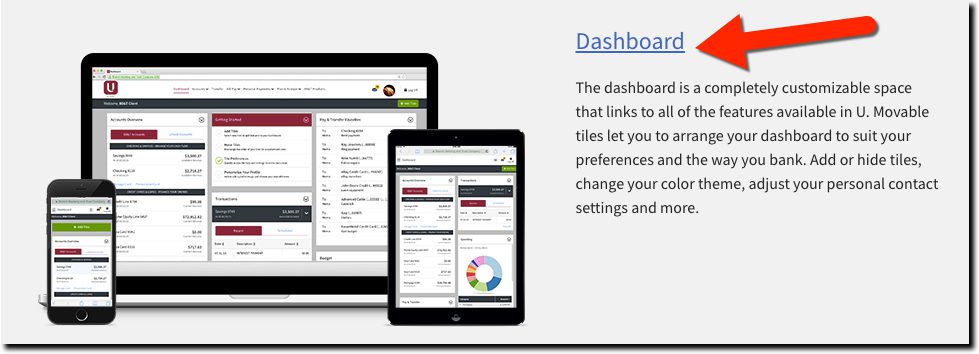

That still leaves the problem of what to call it on a menu, or in a tab, if you offer a stand-alone service. Outside of banking, I think the most common term today is Advanced as in Google’s Advanced Search. Or, if you are potentially going to charge a fee, Pro is commonly used. If that seems too specific, it could be Premium or Select. Even the old credit card standbys, Gold, Platinum or Black, could be used.

That still leaves the problem of what to call it on a menu, or in a tab, if you offer a stand-alone service. Outside of banking, I think the most common term today is Advanced as in Google’s Advanced Search. Or, if you are potentially going to charge a fee, Pro is commonly used. If that seems too specific, it could be Premium or Select. Even the old credit card standbys, Gold, Platinum or Black, could be used.

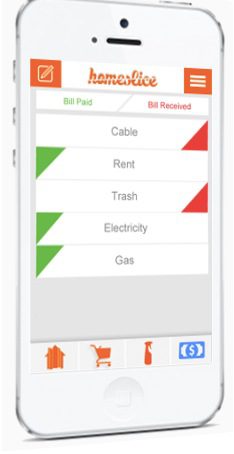

Editor’s note: We are starting a new series showcasing very early-stage

Editor’s note: We are starting a new series showcasing very early-stage Why it’s a good strategic bet for financial institutions: Students and young adults are an attractive, albeit difficult, segment to win over. Yet, they are the future, and could be customers for 70+ years. So helping them with early money-management problems could pay huge dividends over time, assuming you are able to upsell profitable financial products. Furthermore, if a “parent view” could be added to the functionality, the app could be appealing to the income-producing part of the family.

Why it’s a good strategic bet for financial institutions: Students and young adults are an attractive, albeit difficult, segment to win over. Yet, they are the future, and could be customers for 70+ years. So helping them with early money-management problems could pay huge dividends over time, assuming you are able to upsell profitable financial products. Furthermore, if a “parent view” could be added to the functionality, the app could be appealing to the income-producing part of the family.

I’ve always been a “wanna be” tracker. I like watching the stats closely, but I also lose interest if the process, either capturing the data or compiling it, becomes tedious. But thanks to mobile (including wearables), the drudgery is disappearing and that has big implications for banking and financial services.

I’ve always been a “wanna be” tracker. I like watching the stats closely, but I also lose interest if the process, either capturing the data or compiling it, becomes tedious. But thanks to mobile (including wearables), the drudgery is disappearing and that has big implications for banking and financial services. 1. Make it easy to use: While Fitibit requires zero maintenance once you get it activated, you do have to remember to keep it on you. The same goes double for a bank’s credit or debit card. You not only have to remember it, but also must choose to use it at the point of sale.

1. Make it easy to use: While Fitibit requires zero maintenance once you get it activated, you do have to remember to keep it on you. The same goes double for a bank’s credit or debit card. You not only have to remember it, but also must choose to use it at the point of sale.