Although, I’ve been married since Ghostbusters was in the theatres, I still (sort of) remember what it was like to have just one person’s finances to manage. If I recall correctly, it went something like this:

Although, I’ve been married since Ghostbusters was in the theatres, I still (sort of) remember what it was like to have just one person’s finances to manage. If I recall correctly, it went something like this:

Money in. Money out. Then hopefully, a dollar or two leftover.

But then you get married, and even if you have separate accounts (we don’t), there is quite a bit more to it:

Money in. Discuss. Money out. Discuss. Oops, too much money out.

Point fingers. Discuss a lot. Compromise. Try to do better next month.

And then you have kids and it gets even more complicated.

And then you have kids and it gets even more complicated.

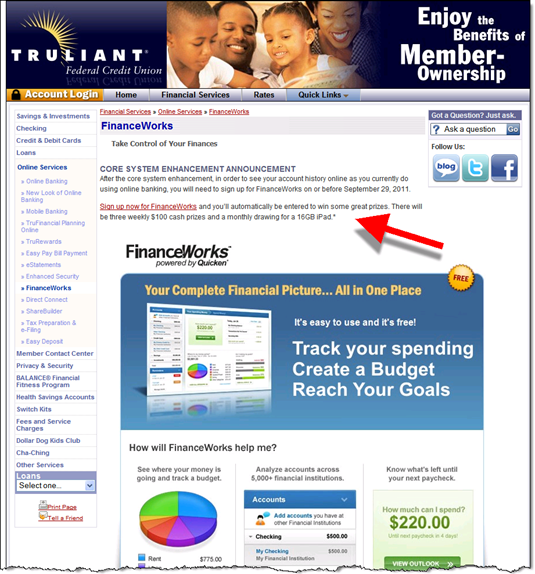

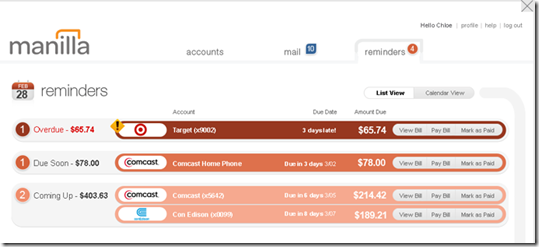

So why are PFMs all about the data and do little to help you collaborate about your money? Because they were mostly designed by single, urban, 20-somethings (I know that’s not entirely true, but you get the point).

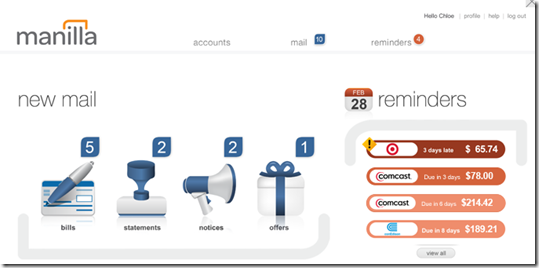

What we need is the “Facebook of PFMs” where you can share appropriate financial details with your spouse, family, parents and other financial stakeholders in your life (CPA, bank, advisor, etc). The same concept extends to businesses who have even more stakeholders to communicate with.

While I haven’t seen anything that does this in the PFM space yet. There are some interesting web apps being developed that help couples sync their lives together. The first one I heard about was Pair, which has gotten quite a bit of press.

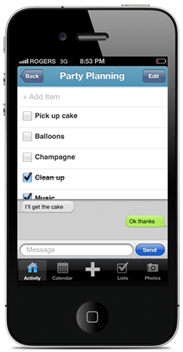

But there’s a new entry, Toronto-based SimplyUs is more of an organizational tool that a photo sharing app (note 1). Right now it focuses on calendar and todo list sharing (screenshots inset & below). That’s a great start, but an obvious next step is financial collaboration.

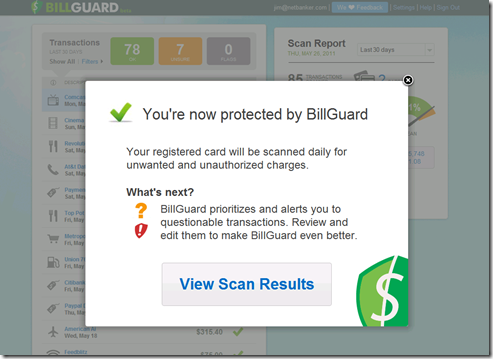

Bottom line: There is a large unmet need for collaboration tools linked to transaction accounts (for more info, see note 2). The opportunity is both for families and also micro and small businesses who will pay monthly fees for the service.

No tool can make financial management as simple as it was for our 23-year-old single self. But by harnessing the power of the synced mobile banking app, it should be much more manageable.

———

SimplyUs iPhone app (25 May 2012)

——————————-

Notes:

1. For more info on SimplyUs, see last week’s TechCrunch post.

2. For more info on the importance of banking the kids, see our Online Banking Report on Family Banking (July 2011). For more on financial collaboration, see Bank Transaction Alerts & Streaming (July 2010). And finally, our last PFM report is here (May 2010; subscription required for all).