Headquartered in New York City, Tern is a fintech as a service innovator dedicated to enabling startups and established financial institutions alike to launch embedded banking and payments services products. The company, founded in 2015 by CEO Brion Bonkowski, offers a multi-currency, multi-language prepaid and stored-value platform with embedded AML, KYC, CIP, and fraud mitigation solutions.

We caught up with Brion to discuss a variety of critical topics in fintech – from the power of embedded finance and the future of neobanks, to the rise of BNPL and the challenge from Big Tech and Big Retail. We also discussed how Tern enables more companies to fulfill the promise of the banking as a service (BaaS) phenomenon.

What problem does Tern solve and who does it solve it for?

Brion Bonkowski: Tern is a fintech infrastructure company that exists to help virtually any company launch fintech products. Launching fintech products is hard and expensive. Anyone who has done it before knows the pains of contracting with banks, processors, and networks. Combined with long project timelines, these obstacles sadly prevent many programs from ever launching.

The emergence of Banking as a Service (BaaS) was the market’s initial reaction to try and serve this need. It was a way to package program management, processing, and banking under one roof. But BaaS had a narrow mandate aimed at serving startups for the most part when, in reality, the number and type of companies interested in launching financial services offerings is much broader.

Tern is the next evolution of BaaS in that we’re building tools that allow virtually any type of company to launch fintech products. This could include an early stage fintech startup, a legacy fintech, or a big global brand that wants to provide value-added financial services products to their existing customer bases. By offering no code (white labeled UX), low code (embeddable widgets), u code (API) options, we are striving to be every company’s answer to launching fintech products quickly and compliantly.

The rise of embedded finance has been one of the biggest trends in fintech of late. How do you see this trend evolving in 2022?

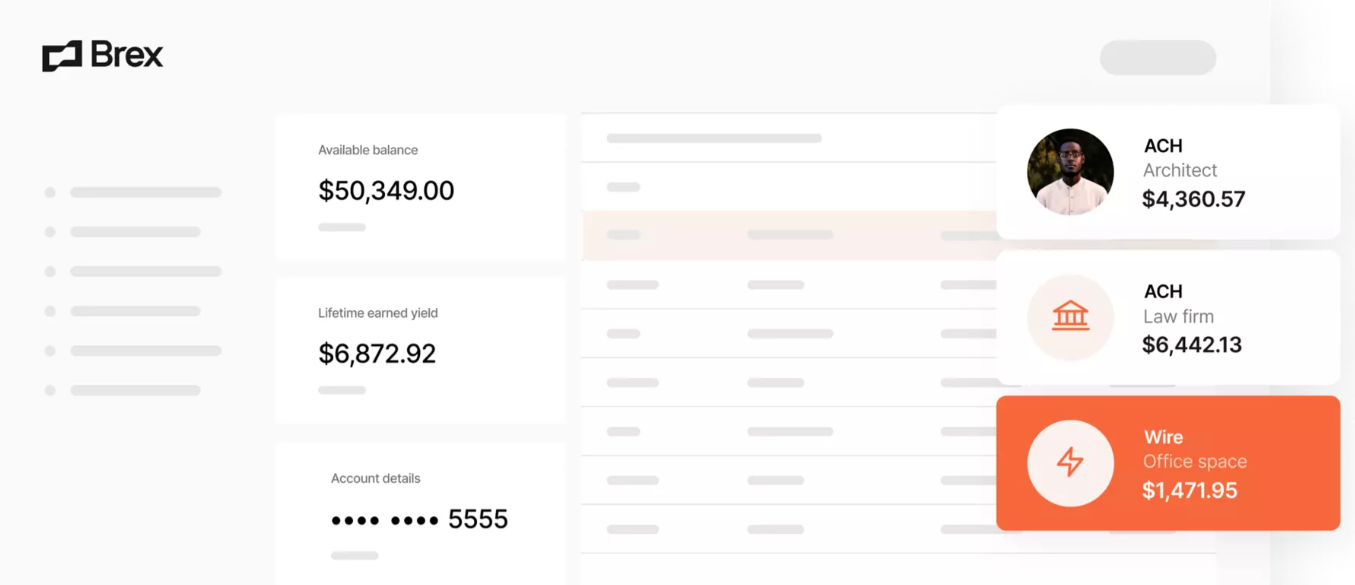

Bonkowski: We see a definite trend with more traditional enterprise players launching embedded finance applications, aiming to add stickiness to their service offering and additional lines of revenue to increase ARPU (average revenue per unit). The problem is, it is really hard to prototype, A/B test, and launch pilot programs to test a particular thesis in the market. We find marketing and product teams attempting to prototype and launch products quickly, however the problem is the complex compliance and regulatory oversight required. In response to this growing demand, technology providers will need to make their tools easier to deploy (with compliance baked in) to keep up with ambitious project timelines. Tern, for example, launched low code widgets to enable companies to launch core fintech services, such as onboarding, account issuance, and payouts, quickly and inexpensively.

Looking ahead, the real uptick in embedded finance will come when enterprise legacy companies, with established customer bases, realize the ROI of launching fintech services across a broad range of industries, and have a deployable vehicle to bring them to market. So, really, I would say we’re still at the beginning of this trend, and that’s exciting.

Another major trend in fintech is the proliferation of neobanks – especially those serving specific communities and consumer segments. What is driving this and how sustainable is it?

Bonkowski: New neobanks are popping up all over the place, and for good reason. Consumers have decreasing loyalty to traditional banks, so when a new online bank with messaging targeting a specific demographic appears, that demographic will typically at least test the waters, especially if motivated to do so by their peers. This is especially true if the account is free and offers services traditional banks do not, like earned wage access (EWA). Challenger banks like Chime started the wave of EWA programs and we find this function to be a big driver for neobanks to differentiate themselves and add new customers. Unfortunately, outside of EWA offerings, many of these neobanks have little to no differentiation. Many rely on celebrities and influencers to get the word out which is definitely not sustainable. Coupled with a bullish fintech venture market, we are sure to see some major casualties in the coming years.

Neobanks with specific functionality catering to their audience, however, still have a fighting chance at disruption. These differentiators vary, but even something like lowering the friction of moving funds into or out of accounts, or adding a utility like crypto or remittance to a portfolio, can be very powerful.

We’ve seen a number of different types of industries – from Big Tech to Big Retail – move into the banking services space. What kind of challenge does this represent for both “traditional” fintech providers as well as for banks?

Bonkowski: One distinct advantage that Big Tech and Big Retail have over banks and “traditional” fintechs is data. They know who their customers are, how they spend their time, and what they buy, which gives them a significant leg up in offering financial services and credit products. Traditional banks and processors see transaction data and know if you have paid your bills on time, but they haven’t a clue as to who their customers are and what makes them tick. Big data is playing an increasing role in establishing very specific cohorts of users. Within this construct, they can facilitate the orchestration of a variety of financial services, offered in different formats with cohort specific messaging, to see which one works.

The one saving grace traditional banks have is regulation and oversight, two things Big Tech and Big Retail want to stay as far away from as possible. They are already under the federal microscope, and the thought for some is that adding banking regulatory obligations could stifle growth and innovation. This has moved Big Tech and Big Retail to partner with banks, rather than compete against them…at least for now.

The Buy Now Pay Later e-commerce phenomenon seems very much in a boom phase. Is regulatory scrutiny inevitable and how might it change the way BNPL services are offered?

Bonkowski: BNPL feels like it’s the wild west of payments right now with little to no oversight. These services are, in fact, credit products and we feel they will eventually be treated as such by the CFPB. We expect new regulations and standards for things like fees, disclosures, payment due dates, penalties, etc. Our fear is these new regulations may stifle the BNPL form factor by adding steps to the process or forcing consumers to accept multiple onerous disclosures. This may increase shopping cart abandonment, the very thing BNPL is looking to obfuscate. With many products and programs, we feel the best and cleanest end use experience will prevail. BNPL providers need to remain agile and incorporate these new regulations as they come up with the least amount of end user friction possible.

This fall Tern announced a partnership with TransferMex. How did this collaboration come about and how does it help fulfill Tern’s mission?

Bonkowski: TransferMex is a great case study on the power of partnership. In 2020, Tern was approached to help an institutional Mexican labor supplier issue bank accounts for H2 Visa workers. The driver for the program was to service the employers by eliminating paper checks and, in turn, the exorbitant cost for employers to track down workers that have to leave unexpectedly to deliver their final paycheck. Looking to add value to not just the employer, but the workers, Tern suggested adding simple and inexpensive remittance capabilities to the program and TransferMex was born. The TransferMex team had limited technical resources or fintech experience so they chose to use Tern’s No Code deployment option, essentially outsourcing the entire program to Tern.

Today, the TransferMex program is live and is seeing dramatic increases in the number of workers and employers using the service. The TransferMex team does all of the marketing, onboarding, and customer support, while Tern hosts and manages all of the technology, applications, and fintech components. Tern sees growing demand for this model of issuing prepaid cards with remittance capabilities to existing brands, and will be launching two telecom companies with similar functionality in early 2022.

Photo by omer havivi from Pexels