The rise of insurtech – entrepreneurs and innovators looking to do for insurance what fintechs have done for financial services – is a global phenomenon. And one of the areas where insurtech is beginning to take hold is Vietnam. The country experienced a fintech mini-boom from 2017 to 2019 which, among other things, helped put the country’s nascent insurtech market on the map. This week’s Finovate Global Lists shares Fintech News Singapore’s roundup of insurtechs operating in the APAC market of Vietnam that are leveraging everything from mobile to machine learning to bring digital insurance to the more than 97 million citizens of the country.

INSO. Founded in 2018. Headquartered in Hanoi, INSO offers insurance products online as well as the ability to make claims online. The company was among the first in the country to offer flight delay insurance. Vũ Nguyễn Thuỳ Vân is CEO.

OPES. Founded in 2018. Headquartered in Hanoi, OPES Insurance Joint Stock Company is a pioneer in Vietnam’s digital insurance industry. OPES specializes in providing personalized insurance solutions to empower customers rather than brokers.

Papaya. Founded in 2018. Headquartered in Ho Chi Minh City, Papaya offers a one-stop shop for employee benefits to promote health and wellness. Hung Phan is co-founder and CEO.

Save Money. Founded in 2013. Headquartered in Ho Chi Minh City, Save Money is a B2B2C digital insurance platform for banks, hospitals, and telecommunication companies. Trần Quang Ninh is founder and CEO.

Wicare. Founded in 2018. Headquartered in Hanoi, Wicare is a lifestyle insurance company that leverage gamification to boost engagement and encourage customers to exercise. Quang Ngoc Nguyen is founder and CEO.

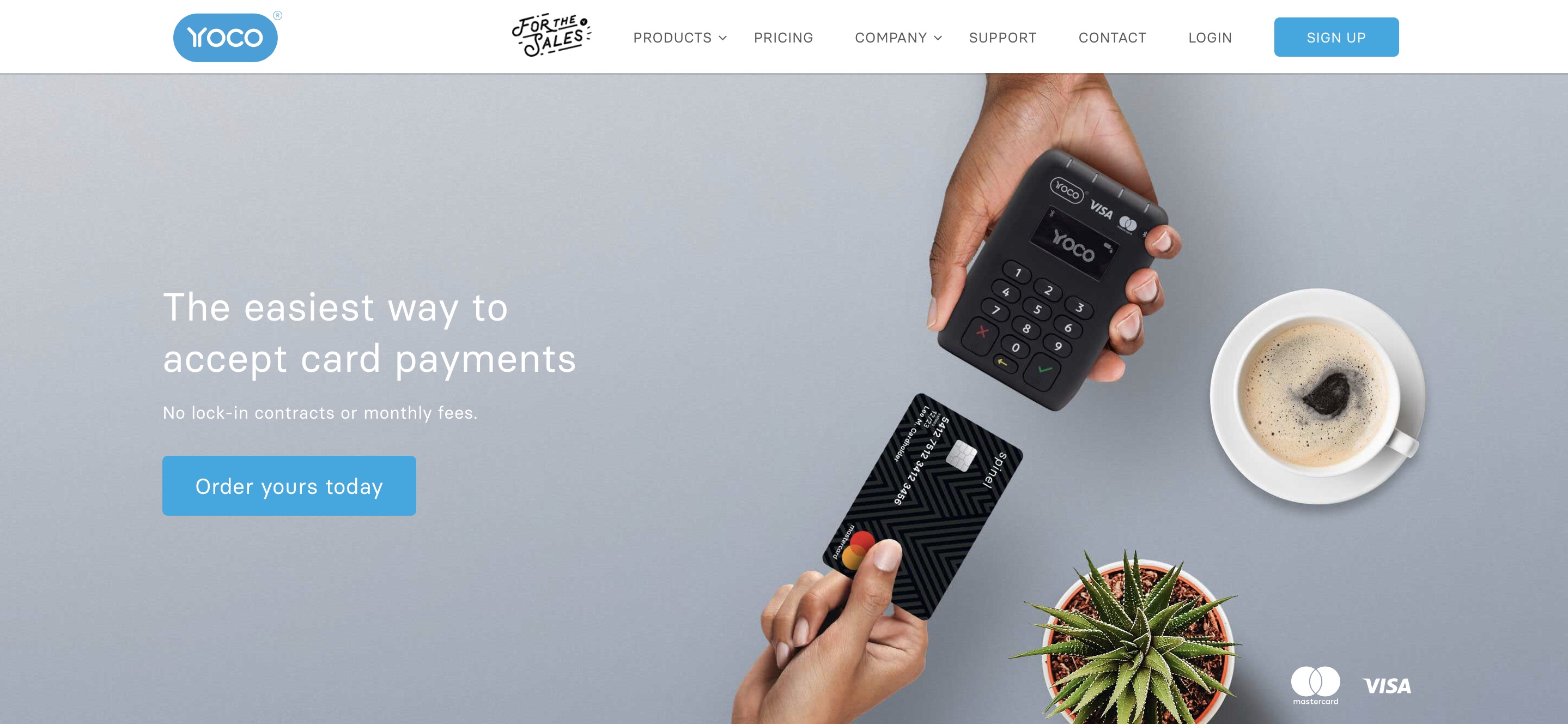

It’s been more than two years since Finovate launched its first conference on the African continent. In that time, we’ve seen a number of alums from FinovateAfrica in the fintech news headlines: Best of Show-winning digital wealth technology company Bambu raised $10 million, credit decisioning solution provider RISQ teamed up with Aion Digital, and this week, small business solution provider Yoco, headquartered in Cape Town, South Africa, reported that it has reached a major milestone: more than 120,000 small businesses served.

“Through our platform and the results of a recent merchant survey, we have seen up to a 90% decrease in in-person transactions since the lockdown began,” Yoco CEO told TechGist Africa last year when it launched a trio of new payment solutions to support online transactions for small businesses. “We knew that the best way to support our merchants was to develop products that would enable them to do business online and keep money coming in through this period.”

This week for Finovate Global Voices we present Bradley Wattrus, Yoco CFO and co-founder, and Clayton Brett, Capital Product Owner, demoing the Yoco Capital solution for SMEs at FinovateAfrica 2018.

Here is our look at fintech innovation around the world.

Asia-Pacific

- South Korea’s Financial Services Commission (FSC) announced plans to expand its open banking ecosystem, which launched in December 2019. The goal initially is to support the use of contactless financial services, with the inclusion of financial investment companies to follow.

- Indonesian fintech GajiGesa, which provides banking services to underbanked workers, secured $2.5 million in seed funding.

- Philippines-based neobank Tonik partnered with alternative credit scoring company Finscore.

Sub-Saharan Africa

- FinovateAfrica alum Yoco, which operates a digital payments network based in South Africa, announced that it now serves 120,000 small businesses in the country.

- Carbon, a digital bank based in Nigeria, reported $240 million in payments processed in 2020, a gain of 89% over the previous year.

- Digital fintech platform company Ukheshe announced plans to issue physical and virtual cards across East Africa courtesy of a partnership with KCB Bank Kenya.

Central and Eastern Europe

- Kompany, a regtech company based in Austria, introduced its technology to improve ultimate beneficial ownership (UBO) discovery for compliance teams.

- SumUp announced acquisition of Lithuanian core banking system provider, Paysolut.

- Russia’s Sberbank unveiled a $400 million investment as part of its decision to take on the country’s e-commerce market.

Middle East and Northern Africa

- Banking-as-a-service company NymCard secured $7.6 million in Series A funding in a round led by Shorooq Partners. Based in Abu Dhabi, NymCard has raised a total of $12 million in capital.

- Bottomline Technologies acquires Lebanon-based treasury management specialist TreasuryXpress.

- Egypt-based fintech Digital Finance Holding unveiled plan to launch a robo-advisor, wealth management platform, and venture debt fund dedicated to startups.

Central and Southern Asia

- A partnership between Mastercard and subscription-based payments firm Sokin will bring the company’s fixed-price currency exchange services to markets in India, Sri Lanka, Bangladesh, Nepal, and the Maldives.

- Inc42 looked at the role of eKYC in enhancing fintech services in India.

- Online investment platform Vested Finance, which helps Indian investors buy and sell U.S. stocks, secured $3.6 million in seed funding.

Latin America and the Caribbean

- Flink, Mexico City-based stock trading platform for retail traders, secures $12 million in funding courtesy of a Series A round led by Accel.

- Latin American financial receivables marketplace Monkey raised $6 million in Series A funding. Quona Capital and Kinea Ventures co-led the round for the Sao Paulo-based startup, which was founded in 2016.

- Uruguay-based cross-border payments company dlocal partnered with lending platform Dinie.

Photo by Arnie Chou from Pexels

Clayton Brett, Capital Product Owner

Clayton Brett, Capital Product Owner