Know Your Customer (KYC) procedures have long been in place to help firms comply with Anti Money Laundering (AML) regulations. Whodini takes KYC to the next level by helping small businesses and bank branches know and engage with their customers on a personal level.

Using rewards, Whodini incentivizes users to disclose personal information, such as how they like their coffee. When customers walk past strategically placed Bluetooth low-energy (BLE) beacons inside a brick-and-mortar store or bank branch, merchants and branch managers are offered an enhanced view of their customers’ behavior and preferences.

Company facts:

- Tripled its employee base within the last year

- Raised over $500k

- Has a goal to install one million beacons at one million merchants around the world

Merchant implementation

To improve the customer experience, Whodini works as both a marketing and customer-service tool by helping businesses’ employees discover personal details about their customers. Whodini sends the merchant a peel-and-stick beacon which is placed inside the store. After a five-minute set-up process, the business is ready to gather more information about its customers’ behavior and thereby enhance marketing efforts.

Customers download the Whodini app and add basic personal data, as well as a profile picture. Once Whodini has a clients’ basic information, the app reaches out to them via push notifications to supplement details about their preferences.

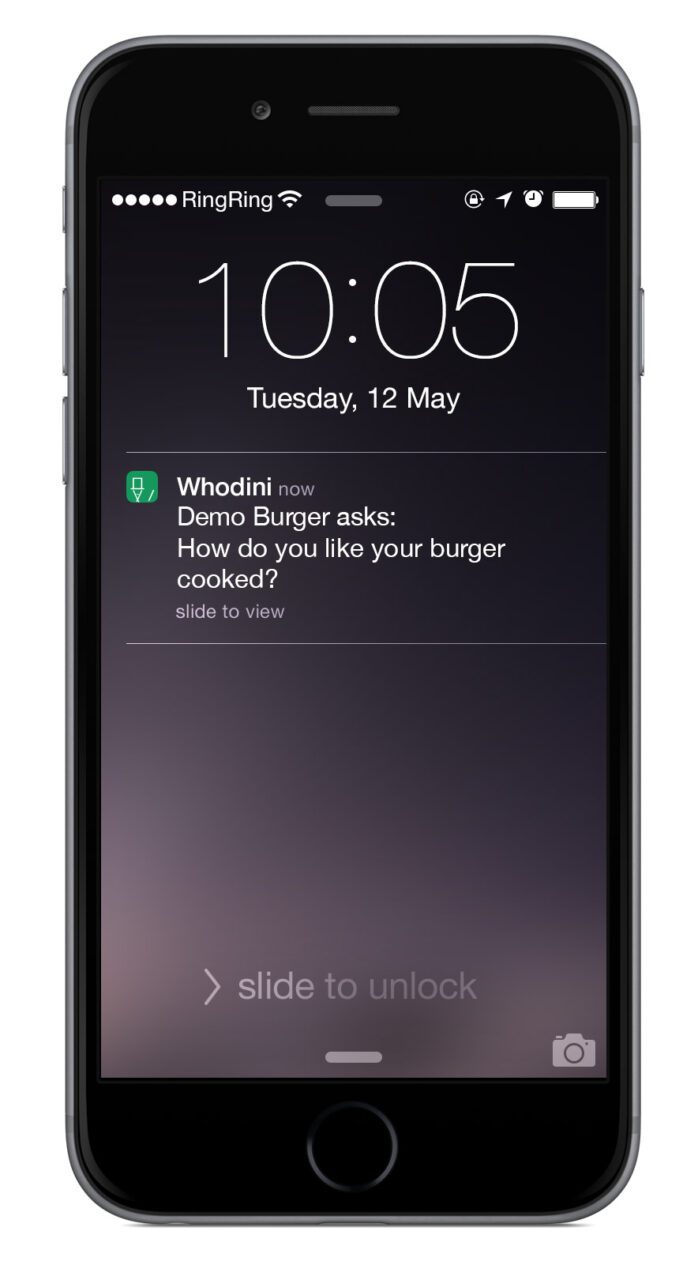

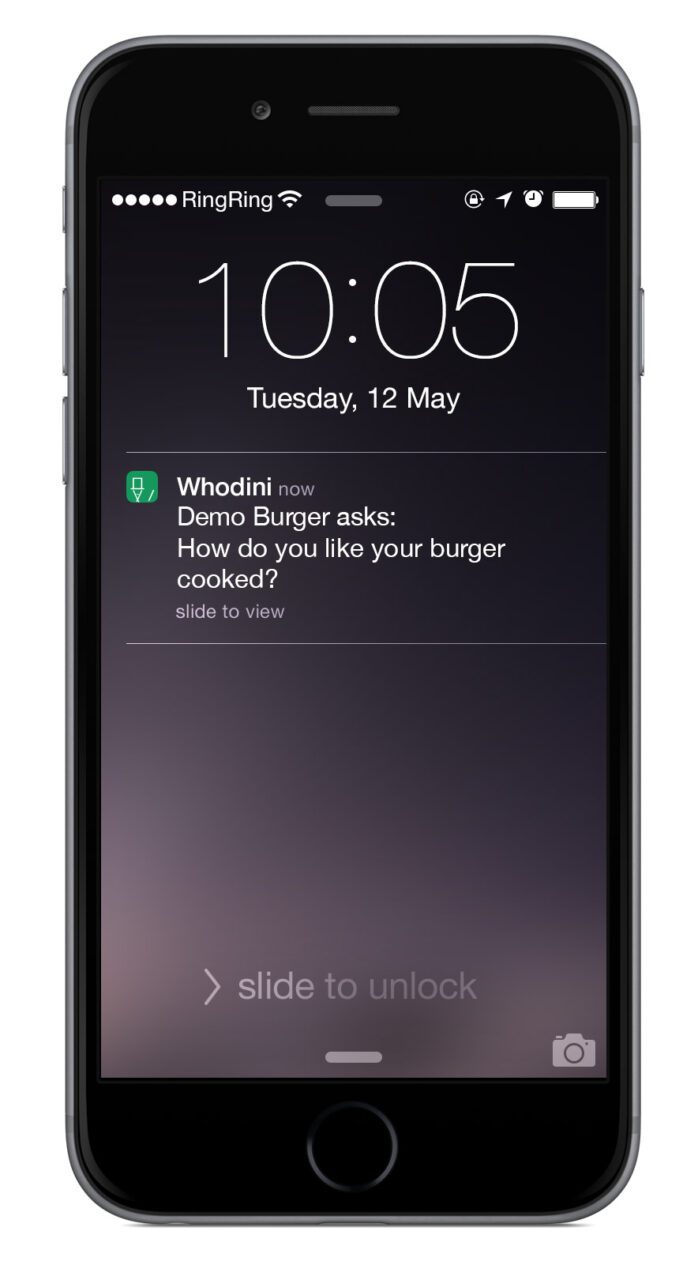

The screenshot below shows a sample push notification in which a burger joint asks a customer about a food preference.

To increase customer participation, Whodini enables merchants to offer customers small incentives in exchange for answering questions about their preferences.

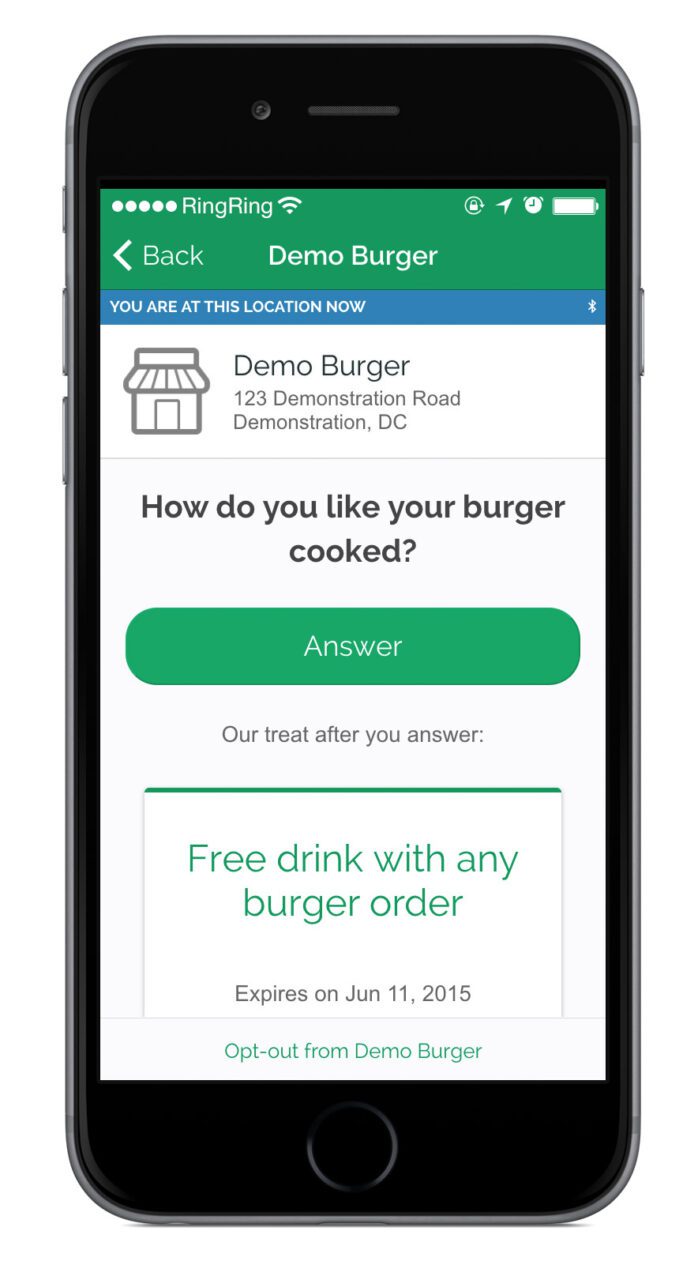

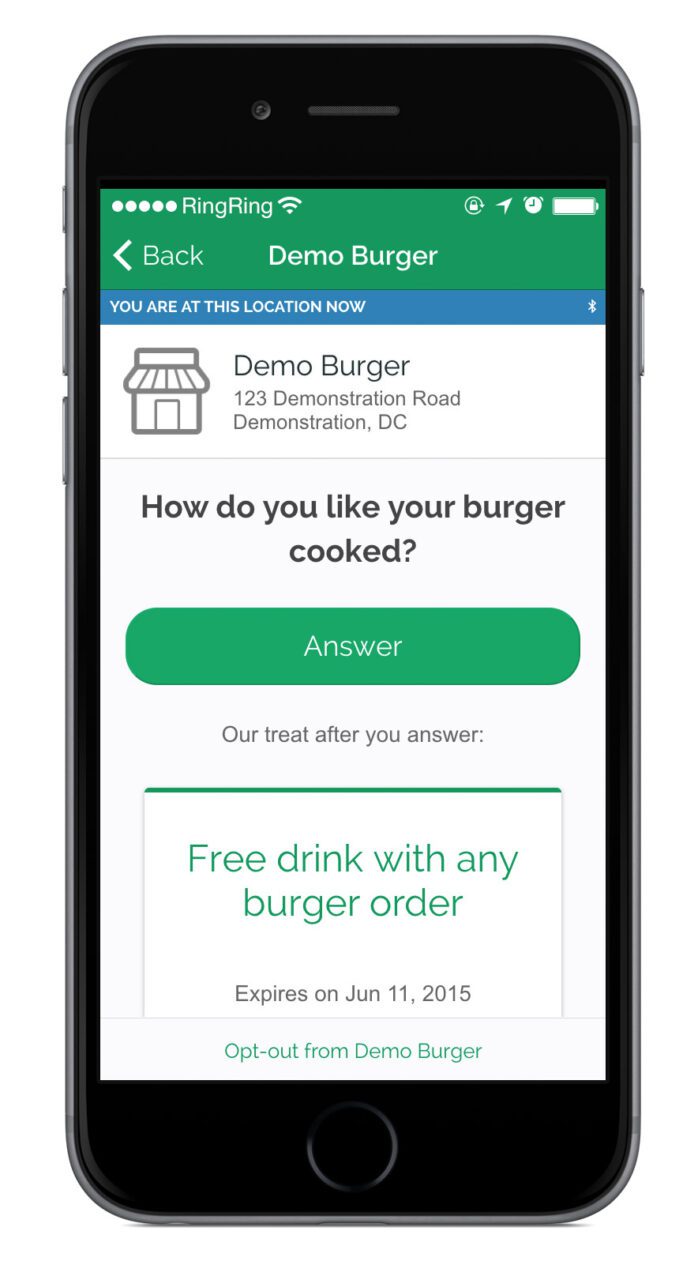

The screenshot below shows the Whodini app from a customer’s point of view. They see the question, the reward, and an easy way to opt-out if they are not interested.

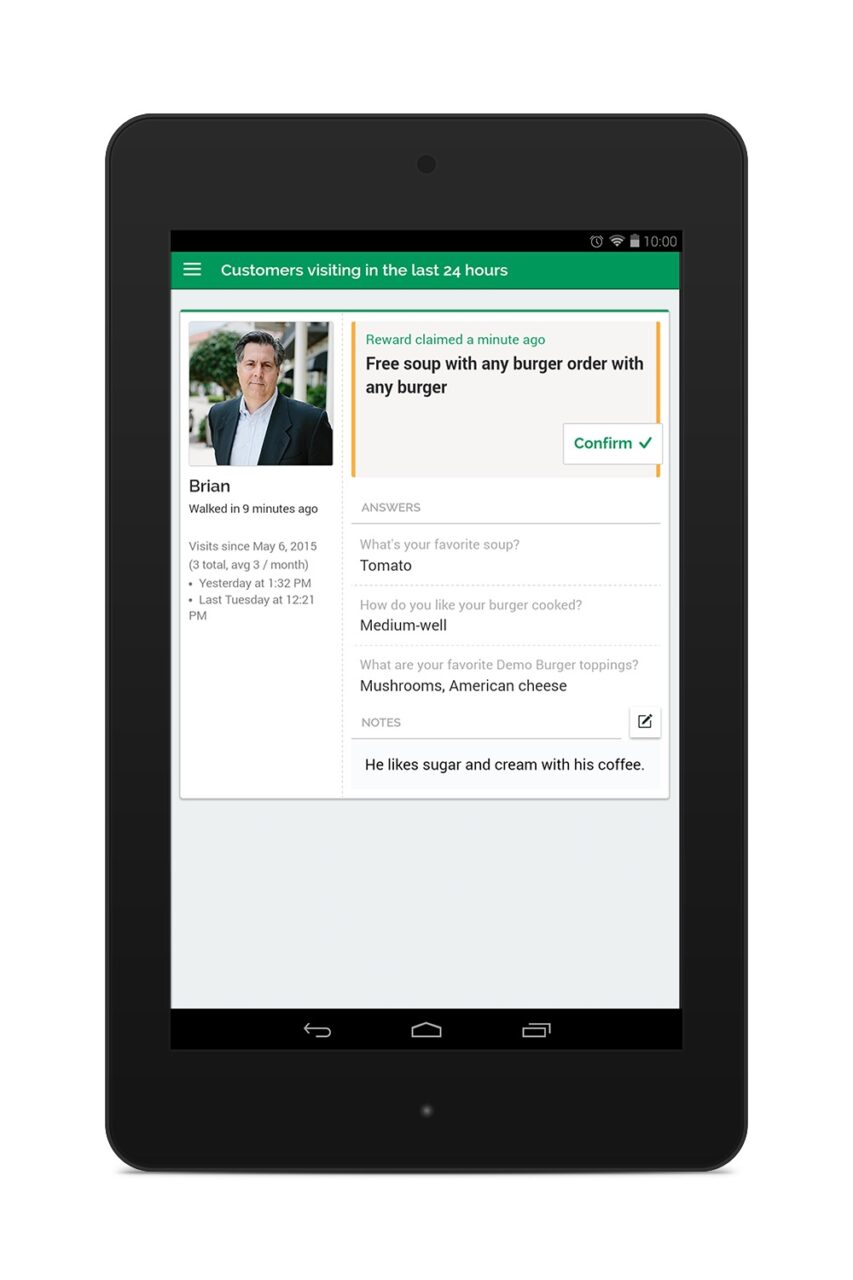

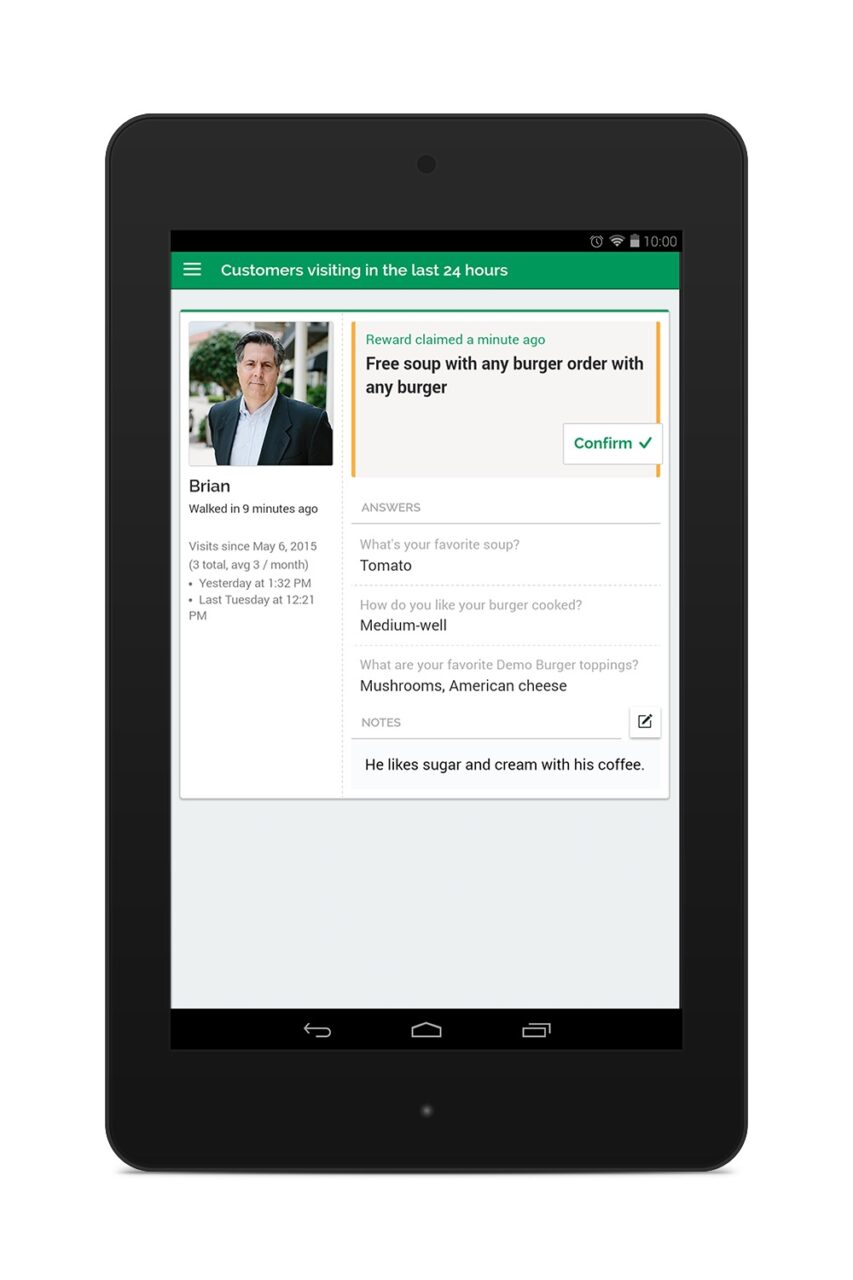

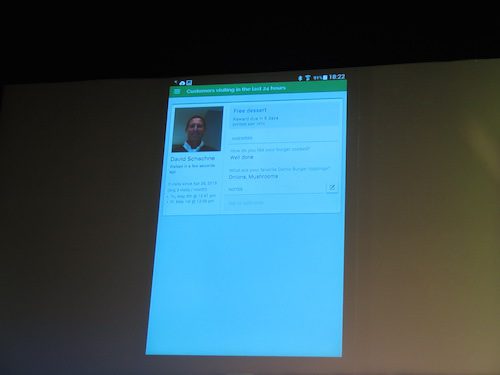

When participating customers walk past a beacon in the merchant’s store, the customer’s profile appears on the merchant’s device, which can be a tablet at the counter or even their smartphone. The profile picture helps the employee identify the customer, their preferences, and how frequently they visit the store.

The screenshot shows the merchant’s view of their tablet when a customer walks into their store and past a beacon.

Whodini not only helps employees learn more about customers and their habits, but also enables merchants to send offers to specific customer segments. As a marketing tool, it lets customers send feedback directly to merchants about their experience.

The app does not require added skill, and the rewards can be applied to any POS system; the only extra hardware that merchants need is the beacon.

Bank implementation

Banks can work with Whodini in two ways:

1) Partnership:

Banks with small business (SMB) customers can offer Whodini as a value-added service to their SMBs with merchant accounts.

2) Inside brick-and-mortar bank branches:

This works similarly to the brick-and-mortar merchant application described above.

When participating bank customers walk into a branch, employees will see the customer’s name, picture, and profile information, such as:

- How long they’ve been with the bank

- Date of their last branch visit

- Frequency of branch visits

- Account types they hold with the bank

When banks’ clients add information such as their interest level in loans and mortgages, or their saving plans for retirement, they receive a reward for each answer. While each bank is given the discretion to decide what that reward is, Whodini suggests offering a bank product, such as free checking, or increased basis points on a savings account.

What’s next?

When I met with Whodini CEO Brian Lawe last month, he told me that the company has big plans for the future, but is not disclosing them quite yet. For now, Lawe has stated, Whodini will first scale its merchant base, then work on building its customer base.

If you missed Whodini’s demo at FinovateSpring 2015 in San Jose, check out the demo video here.

Money Amigo is a social money interaction platform that solves the lack of simple and clustered services for the unbanked and underbanked.

Money Amigo is a social money interaction platform that solves the lack of simple and clustered services for the unbanked and underbanked. Outski’s

Outski’s

Whodini helps merchants engage customers using social media marketing, reaching loyal customers with targeted offers.

Whodini helps merchants engage customers using social media marketing, reaching loyal customers with targeted offers.