-thumb-100x96-11879.jpg)

FinovateEurope 2014 is officially less than one month away. We will be returning to Old Billingsgate Market Hall in London for our fourth event in Europe and are excited to see and share the variety of fintech innovation our presenters will have on display. Get your ticket here today and see all 66 demos live.

Our Sneak Peek series is designed to help you get to know a little bit about each of our presenters ahead of time. If you’ve missed any of our earlier installments, take a look at FinovateEurope 2014 Sneak Peeks 1-3 below.

And now, meet another six companies who will be demoing next month at FinovateEurope 2014.

IT Sector presents a new approach to sales. Enable your commercial team to plan and close deals while on the road, with less effort, more results, and satisfaction from customers.

IT Sector presents a new approach to sales. Enable your commercial team to plan and close deals while on the road, with less effort, more results, and satisfaction from customers.

Features:

- Commercial lead generator

- Portable Sales Office

- Real-time access to commercial management

Why it’s great:

Close more deals with less effort with our innovative commercial GPS solution that covers the main activities of the sales process. Our software shines with strong usability and compelling value.

Joao Lima Pinto, IT Sector Board of Directors

Background in financial institutions and multichannel solutions. Masters and PhD from UMIST (UK).

Nous operates a free, day-trading simulator app which collects real-time predictions blended to generate a financial sentiment feed to help you predict the markets.

Nous operates a free, day-trading simulator app which collects real-time predictions blended to generate a financial sentiment feed to help you predict the markets.

Features:

- A mobile app gathering predictions from thousands of traders worldwide competing for prizes

- Real-time feeds help you predict markets

- Feeds use the intuitive and analytical abilities of real people

Why it’s great:

Our Spark Feed crowdsources alpha to help you understand and predict the markets.

Justin Short, CEO and Founder

Justin has worked in finance for 16 years, building quantitative algorithmic trading systems, strategies and teams.

Mick Horgan, Co-Founder

Mick has ten years experience building real time decision applications with Pega Systems. Prior to moving into software development. Mick worked as a turbine field engineer mostly in Africa and Taiwan.

Pixeliris’ CopSonic enables contactless sonic and ultrasonic communication between smart devices and mobile payment and passwordless authentication available on phones and smartphones.

Pixeliris’ CopSonic enables contactless sonic and ultrasonic communication between smart devices and mobile payment and passwordless authentication available on phones and smartphones.

Features:

- It turns any phone into a mobile payment device

- It is truly contactless and entirely secure thanks to One Time Password and strong authentication

- It replaces standard online passwords

Why it’s great:

With CopSonic, pay anywhere with any phone.

Brian Roeten, Director of Projects

Brian joined the team in 1999. Today, his experience and skills enable him to manage the company’s innovating international high-tech projects.

Emmanuel Ruiz, Founder

Since he has founded the company in 1995, Emmanuel Ruiz has initiated all innovations, from our first audio broadcasting systems to the recent sonic and ultrasonic contactless communication technology.

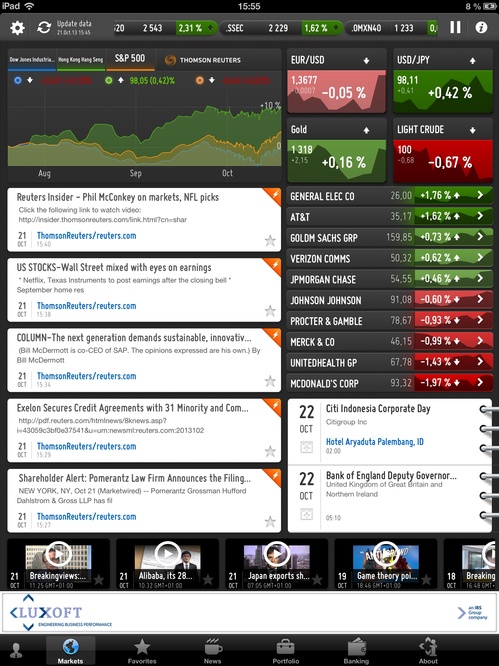

Temenos Treasury Management Dashboard App enables the transformation of treasury operations with a dynamic dashboard user interface accessible on a tablet device.

Temenos Treasury Management Dashboard App enables the transformation of treasury operations with a dynamic dashboard user interface accessible on a tablet device.

Features:

- Multiple source of real-time data accessible from single point

- Rich, intuitive user experience reducing the complexity of multifaceted data

- Holistic view of banks entire position

Why it’s great:

Visually excited dashboard enabling treasury managers to better understand the data and be far more responsive and effective in making critical business decisions anytime, anywhere.

Dharmesh Mistry, UXP and Mobile Product Director

Adam Gable, Product Manager, Treasury

(not pictured)

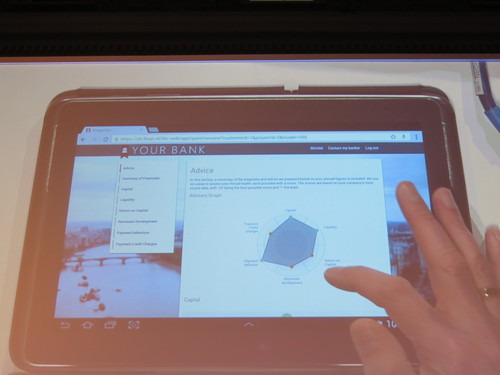

Topicus Financial focuses on business lending value chain integration with innovative web-based technology.

Topicus Financial focuses on business lending value chain integration with innovative web-based technology.

Features:

- The entrepreneur gets the lead of business lending

- What-If scenarios to asses the financial impact of future plans in real-time

- Freeing the entrepreneur from all banking complexities

Why it’s great:

Topicus Finan believes that self-service is an important factor in keeping operational and risk costs at an affordable level, while increasing transparency and fit with credit demand.

Michiel Schipper, CEO

Jamie Burink, Senior Consultant Innovative Banking

Yseop is natural language generation software based on artificial intelligence that boosts sales productivity and turns each financial advisor into an expert without additional training.

Yseop is natural language generation software based on artificial intelligence that boosts sales productivity and turns each financial advisor into an expert without additional training.

Features:

Yseop automates the sales process from lead generation to the writing of prep-to-meeting reports, customer follow up and personalized marketing communications – automatically.

Why it’s great:

Yseop turns data into text, leads into clients, and salespeople into experts. Double your sales force productivity overnight with the power of artificial intelligence.

Elizabeth Farabee, VP of Marketing

Has a background in inbound and direct marketing. She is passionate about Yseop’s personalized marketing potential in both the B2C and B2B markets.

Arden Manning, Director of Communications and UK Business Development

Brings nearly 10 years of experience in public relations, strategy, and product management.

Kreditech secures $200 million credit line from Victory Park Capital.

Kreditech secures $200 million credit line from Victory Park Capital.