What is SuperMoney? CEO Miron Lulic urges you to think of the “serendipity” of real-time offers provided on platforms like airline fare aggregator Kayak, and imagine the same user experience in financial services. “SuperMoney guides our users to loan offers that are in their best interest,” Lulic said at the beginning of the company’s FinovateSpring demo earlier this year.

And “best interest” is key. As the company’s Managing Partner Harry Langenberg pointed out, SuperMoney is taking the same approach to loan comparison that “won Google the search engine wars.” He explained, “rather than ranking results based on payout, Google’s algorithms presented results based on relevance. Similarly, we believe that by representing the best fiduciary interests of our borrowers, that SuperMoney will become the number one site that consumers trust when searching for a personal loan.”

Pictured: SuperMoney Managing Partner Harry Langenberg demonstrating the Supermoney loan offer comparison tool at FinovateSpring 2017.

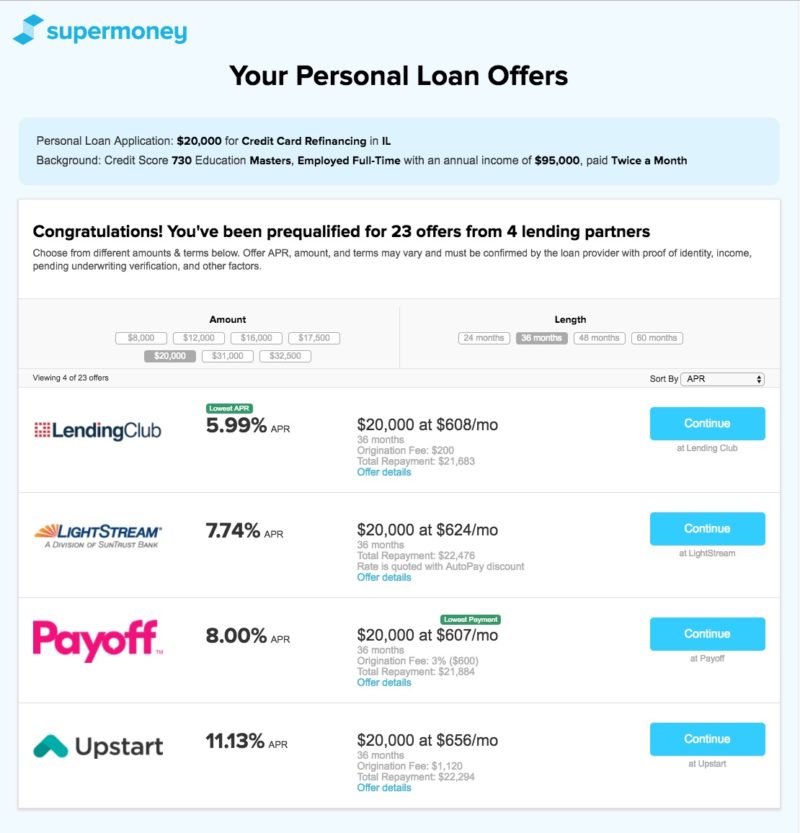

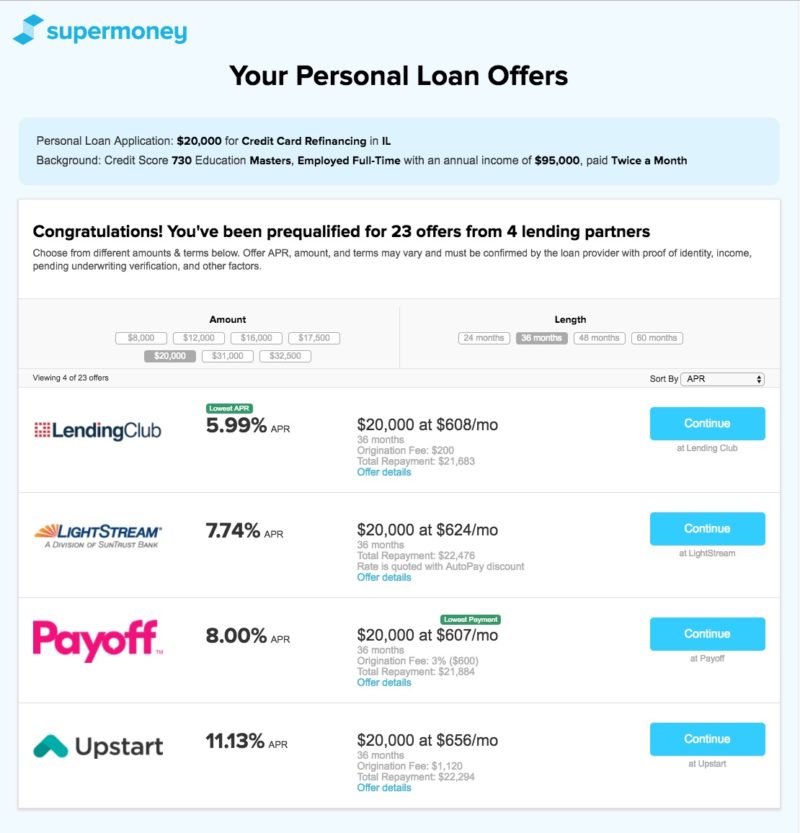

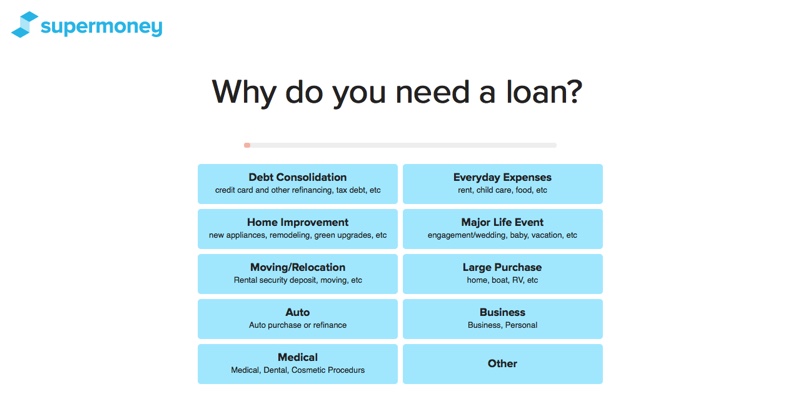

Langenberg demonstrated how prospective borrowers enter some basic personal information (type of loan desired, the loan amount, credit score estimate, education level, employment status, home type and location, military status if any) at the SuperMoney website. “All of this data that we are collecting is matched against a database of attributes that we have for every one of our lenders,” Langenberg said. “That way we’re able to filter out any of the results that don’t necessarily match to their underwriting interests.”

Lenders on the platform do a “soft pull” so as not to impact the borrower’s credit score and in moments the borrower is presented with a set of prequalified and/or preapproved loan offers. “Users can easily compare their APRs, loan amounts, payments, even their total repayment costs, origination fees, and other details for the loan,” Lulic said. The platform enables borrowers to search from among the offers using a wide variety of criteria – such as payment-for-payment affordability – and each loan offer also features user reviews which Lulic said “provides a qualitative dimension that users can consider in their loan search.”

SuperMoney also hosts a wealth of personal financial information on topics ranging from auto insurance and business credit cards to tax planning and wealth management. The website features more than 11,000 expert and consumer advice columns and reviews. Expansion into other verticals beyond personal loans is also in the plans for the company. “We will soon be launching our auto loan offer engine, followed by our mortgage offer engine, and eventually our insurance offer engines,” Langenberg said. For now, the company is partnering with lenders to help them better serve customers they are not able to work with (“turn-downs”) by sending them to SuperMoney.

Company facts

- Founded in 2013

- Headquartered in Santa Ana, California

- Published more than 2,000 expert reviews and more than 9,000 consumer reviews

- Generated more than one million clicks for its partners

We caught up with the SuperMoney team briefly at FinovateSpring during rehearsals and followed up with a few questions for company CEO Miron Lulic. Here are his responses.

We caught up with the SuperMoney team briefly at FinovateSpring during rehearsals and followed up with a few questions for company CEO Miron Lulic. Here are his responses.

Finovate: What problem does your technology solve?Â

Miron Lulic: Within the personal loan industry alone, there are literally hundreds of lenders to choose from and all of them are different. Â You can go from lender to lender to lender, filling out applications to try and find your best option, but thatâs a ton of effort. Lending aggregators popped up to solve this problem by âmatchingâ borrowers with lenders. But the dirty little secret behind most loan aggregation websites is that they run on a ping tree model.

Ping trees chuck borrowers down a lead delivery waterfall that attempts to sell the lead to the highest bidder. If the highest bidding buyer rejects the lead, the system attempts to sell to the next buyer with the borrower ultimately being sold to whoever will pay the most for that lead. This ping tree model works quite well for the aggregating site, as itâs rigged to produce the highest payouts. But as you could probably surmise, the âmatchesâ produced by ping trees seldom connect consumers with the loans that are most financially beneficial to the borrowers themselves.

Finovate: How does your solution solve the problem better?Â

Lulic: When consumers shop for an airline ticket they expect real offers in real-time. Â Well, weâve brought that great Kayak-like comparison shopping experience to financial services. Our Loan Offer Engine transparently allows consumers to submit a single, soft-pull loan application to all the leading online lenders and returns real loan offers back. SuperMoney users can transparently discover the best option based on their needs and that serve their best interest.

Finovate: Who are your primary customers?Â

Lulic: SuperMoney is a two-sided marketplace platform with consumers looking for financial services on one end and financial service providers on the other. On the financial services side, we have a wide array of financial verticals represented in our publicly accessible reviews website. Within the personal loan offer engine, we are currently partnered with leading marketplace lenders, direct lenders, and banks. We aim to extend the platform to integrate credit unions and other players in the ecosystem not currently represented.Â

Finovate: What in your background gave you the confidence to tackle this challenge?Â

Lulic: Our founding team is the same founding team that launched Optima Tax Relief in 2011 and grew it from nothing to the #3 Fastest Growing Company In America according to Inc. Magazineâs 2015 ranking. We also co-founded another Finovate alum named LoanNow which is a direct lending business. Our experience there opened our eyes up to many of the challenges consumers and businesses face related to financial services online.Â

Finovate: What are some upcoming initiatives from SuperMoney that we can look forward to over the next few months?Â

Lulic: We are soon launching the same great loan offer engine experience in the auto lending vertical and aiming to follow that up soon after with a mortgage version. Our goal is to extend the framework we developed into all lending-related verticals initially, and then to other financial services where consumers can benefit from apples-to-apples comparisons and transparency.Â

Finovate: Where do you see SuperMoney a year or two from now?

Lulic:Â Our goal is simple. To build the brand consumers think of first whenever they need a financial service. We aim to get there within two years.Â

Miron Lulic (CEO) and Harry Langenberg (Managing Partner) demonstrating the Supermoney Loan Comparison Tool at FinovateSpring 2017.

We caught up with the SuperMoney team briefly at FinovateSpring during rehearsals and followed up with a few questions for company CEO Miron Lulic. Here are his responses.

We caught up with the SuperMoney team briefly at FinovateSpring during rehearsals and followed up with a few questions for company CEO Miron Lulic. Here are his responses.

Presenters

Presenters Harry Langenberg, Managing Partner

Harry Langenberg, Managing Partner