It’s been six months since we handed out an OBR Best of the Web award (archives; see note 1). Since then, many new enabling technologies and promising applications were launched. But with every passing year, it gets harder to raise the bar with a new digital financial product.

It’s been six months since we handed out an OBR Best of the Web award (archives; see note 1). Since then, many new enabling technologies and promising applications were launched. But with every passing year, it gets harder to raise the bar with a new digital financial product.

But Square did it this week. The company took P2P payments — which PayPal commercialized in 1999 (see last screenshot below) and CashEdge/Fiserv bankified in 2009/2010, and which Google simplified in May — and distilled the payment scheme to its essence. Just email money directly (via debit card) from any client, web, mobile, tablet or any other email-enabled device (or from the Square mobile app). No third-party accounts needed, no login, no challenge questions, no selecting your payment method, no navigating various fee structures. Just send payment like you would any other email by adding a cc to Square.

But Square did it this week. The company took P2P payments — which PayPal commercialized in 1999 (see last screenshot below) and CashEdge/Fiserv bankified in 2009/2010, and which Google simplified in May — and distilled the payment scheme to its essence. Just email money directly (via debit card) from any client, web, mobile, tablet or any other email-enabled device (or from the Square mobile app). No third-party accounts needed, no login, no challenge questions, no selecting your payment method, no navigating various fee structures. Just send payment like you would any other email by adding a cc to Square.

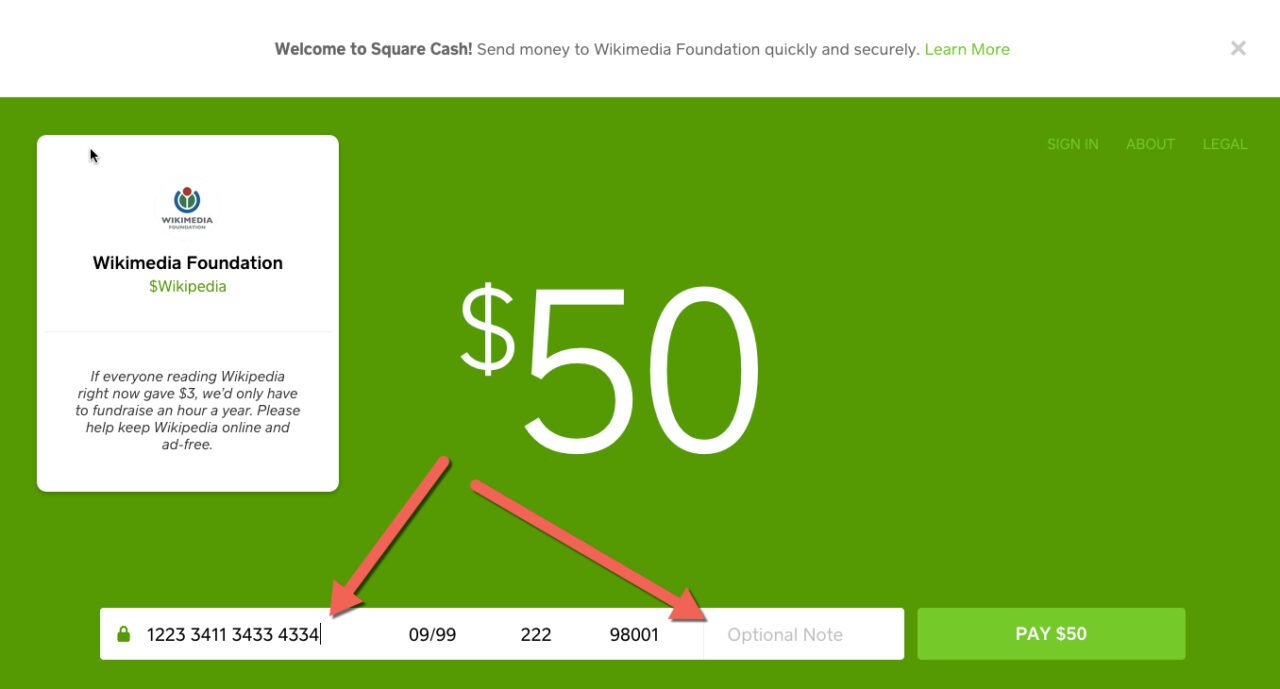

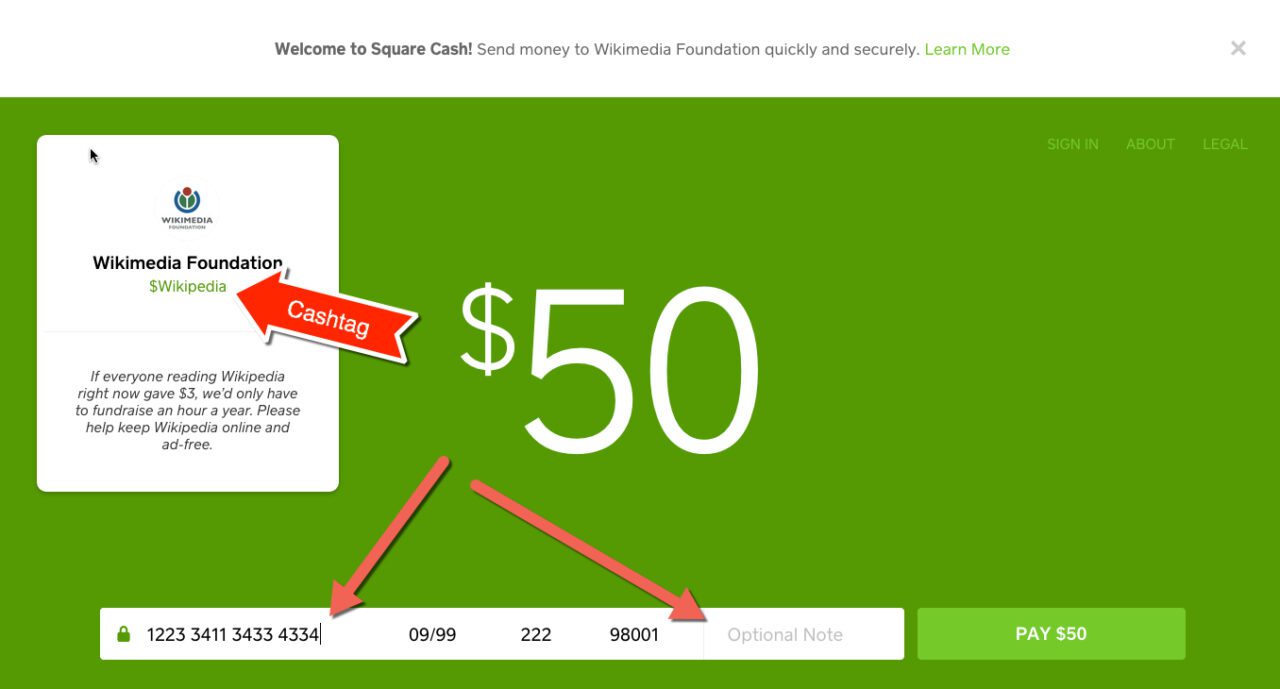

And amazingly, neither the sender nor recipient need be preregistered with Square. All it takes to send or receive small amounts ($250/week) is a U.S. based MasterCard or Visa debit card number, expiration date and ZIP code (see third screenshot; note 3). And once you’ve entered that the first time, you can literally send a P2P payment in two or three seconds (assuming you were already in your email client).

It’s hard to imagine P2P payments being any simpler. And Square is doing it all for free.

The biggest hurdle, as Walt Mossberg pointed out in the Wall Street Journal, is trust. The system is so easy to use, that it almost doesn’t seem possible. The other limitation is that users can register only one debit card per email address. There is no way currently to substitute a different card.

________________________________________________________

Analysis

________________________________________________________

Since this is Square (fintech’s Apple), the design is gorgeous and the user experience is outstanding (Jim Marous breaks it down here). But the pundits are scratching their heads a bit about why the company launched a service with negative margins (note 4) that isn’t solving any major consumer headache and is disconnected with its consumer wallet and Square Register-acquiring business.

I think they are doing it to get millions of debit cards registered with their service. Then when new customers show up at a Square merchant, the company will try to switch what would have been a credit card transactions over to debit. This could potentially save gazillions in interchange, especially when debit price controls are expected to lower the interchange into sub 10-cent-per-transaction territory.

But how they accomplish this integration is still a mystery. The company is so far silent on the end-game for Square Cash.

_______________________________________________________

Financial institution opportunities

_________________________________________________

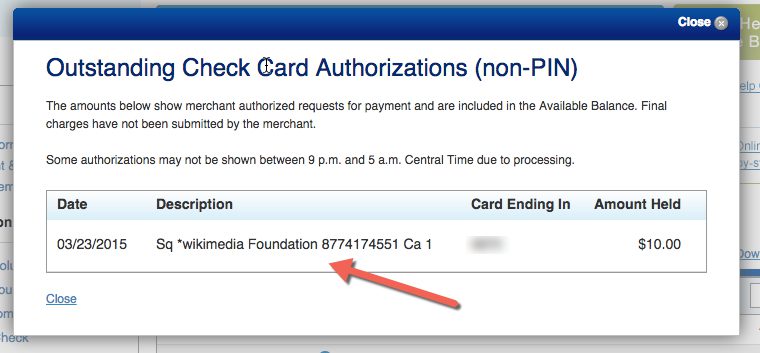

Since Square is paying interchange to debit card issuers, financial institutions should be neutral about this service (note 3). Sure it takes P2P payments out of your control, but if your debit card is linked to the service, it increases usage. For those with a fee-based P2P offering such as POPmoney, Square Cash is a competitor, but with its transaction limits and other consumer uncertainties, it’s not on equal footing and initially shouldn’t be a huge threat.

In fact, banks and credit unions might consider integrating Square Cash directly into online/mobile banking. A script could write the payment email and send it directly from online/mobile banking. The primary drawback would be the confusing email confirmations from Square and the initial debit card signup on the Square page (screenshot #3), so it would take some customer education. But once customers got through that, it could be a minor profit center (see caveat, note 4).

——————————–

The simplest P2P payment process in the world

Three steps:

1. Choose email address from contacts (or type in)

2. CC [email protected]

3. Type amount in subject line

Note: A message in the body is optional. It can just as easily be left blank.

Square customer announcement (2 PM, 17 Oct 2013)

Note: In this email to an existing Square Wallet customer, the company pushes users to download its new standalone Square Cash app

Signup/application process (webpage)

PayPal “beam money” interface at its 1999 launch (15 Nov 1999)

———————————-

Notes:

1. Since 1997, our Online Banking Report has periodically given OBR Best of the Web awards

to companies that pioneer new online- or mobile-banking features. It is not an endorsement of the company or product, just recognition for what we believe is an important industry development. In total, 90 companies have won the award. This is the first for Square. Recent winners are profiled in the Netbanker archives.

2. In a Quora post, Brian Roemmele estimates Square pays between $0.10 to $0.25 per transaction to MasterCard or Visa and Chase, its acquiring bank (and Square investor).

3. Recipients can also deposit directly into a bank account if they don’t have a debit card.

4. It should be a net positive to the bottom line, unless there are unintended consequences, such as customer support or increased fraud.

5. For more info on peer-to-peer payments (P2P), see our Online Banking Report issue devoted to the topic (Dec 2009, subscription).