More than 60 leading fintech innovators, both startups and established companies, are gearing up to present at the biggest Finovate ever, Sept. 20/21 in NYC.

More than 60 leading fintech innovators, both startups and established companies, are gearing up to present at the biggest Finovate ever, Sept. 20/21 in NYC.

Each company provided a sneak peek of what they’ll be demoing on stage next month. Below is the second installment of these teasers (

see part 1 here). We’ll have more next week.

_____________________________

Customers use different communication channels throughout the day and expect the same from their FI. But to reach and interact with the greatest number of customers – and deliver reward value to both institutions and their customers – banks and reward vendors alike must fully support the growing range of channels: online, mobile, social, e-mail and more, while providing requisite security and privacy for email communications featuring sensitive data.

Cardlytics & ActivePath combine powerful technology to personalize reward offers based on transaction data that can be securely delivered and transacted directly within interactive email, enabling customers to respond at their convenience, anytime, anywhere.

Innovation type: Cards, communications, rewards

-thumb-170x41-3860.jpg)

Andera’s FortiFI product stops online new account fraud. It scans applications submitted online at over 500 institutions, discovering patterns used by fraud rings only visible on an industry-wide scale, and flags applications matching known patterns before an account is opened.

FortiFI is available as part of Andera’s hosted account-origination solution and its Software Development Platform that gives developers “plug and play” access to the services and software components (e.g., ID verification, application risk management, funding risk management, funds transfer, etc.) used by Andera’s popular hosted online account-opening solution, reducing the time and cost to bring innovation to market.

Innovation type: identity, marketing, sales

Online and mobile banking has created a new breed of cybercriminal. New forms of defense are needed.

Authentify will unveil publicly for the first time, Authentify 2CHK. It is an app that will transform an end user’s mobile device into a secure transaction authenticator. The device becomes a defensive weapon in the battle against cybercrime. Authentify 2CHK is a natural extension of Authentify’s out-of-band technology and will help satisfy audit requirements for end user and transaction authentication spawned by FFIEC guidance updates.

Innovation type: Identity, payments, security

BillGuard is the world’s first antivirus for bills. This free, Web-based solution empowers consumers with the assurance of an unheard-of level of personal finance security. The easy-to-use service has already saved consumers more than $300,000 from unwanted or unauthorized charges.

BillGuard aims to be the “seal of approval” that merchants and financial institutions display so consumers recognize that their accounts are protected and that all posted charges are accurate. In the future, it will be imperative to display a BillGuard badge to gain customers.

Innovation type: cards, identity, security

Gen Y embraces frugality and seeks “engagement banking” with rich, interactive online experiences around their $200 billion in income.

Bobber represents a profound shift in how Gen Y relates to their money, integrating the most effective social engagement mechanics for cost-efficient acquisition, sustained loyalty, and increased wallet share. Bobber’s cash-management tool simplifies daily spending and incentivizes goal achievement. Users engage in a highly interactive debit rewards program grounded in their personal savings goals.

Bobber’s technology is architected into the Facebook ecosystem for low-friction onboarding, social collaboration, and experiences tailored to users’ Facebook data.

Innovation type: banking products, cards, marketing, online UI

CarryQuote IntelliCast is a private-labeled solution that allows you to securely deliver proprietary research and mul

ti-media content directly to your clients’ Apple, Android, BlackBerry, or Microsoft smartphones and tablets.

Through CarryQuote’s unique, SaaS-based mobile technology platform, which offers compatibility across all five major mobile platforms, CarryQuote IntelliCast allows you to place a highly advanced, branded mobile application in your clients’ hands, and become their “go to” source for the latest financial research. Notably, this turnkey solution can be customized and deployed across all platforms in fewer than six weeks.

Innovation type: communications, investing, mobile and tablet UI

Cartera Commerce is re-inventing the deal with card-linked offers.

Cartera, the leading provider of card-linked marketing solutions, will unveil its solution that enables banks to tap the explosive growth of the local deals market popularized by daily deal sites.

For banks, issuers and loyalty programs, Cartera provides the industry’s most comprehensive card-linked offer platform powering personalized in-store and online shopping programs that build consumer engagement, maximize card spend and create new revenue streams. For merchants, Cartera powers the industry’s largest card-linked advertising network, targeting and tracking shopping offers to 150 million+ loyal consumers.

Innovation type: cards, marketing, rewards

CashStar, the preferred digital gifting and incentives partner for retailers and incentive partners, provides consumers with the most personal, compelling and convenient gifting experiences available. The only company to successfully combine an on-demand digital gifting and incentives platform with innovative multichannel marketing strategies, CashStar is changing the way rewards currency is exchanged from the digital world to the brick and mortar.

At FinovateFall 2011, CashStar will unveil a first-of-its-kind, location-based iPhone application that enables consumers to instantly turn credit card points into digital currency while they are in a participating retailer’s store.

Innovation type: cards, marketing, rewards

How do you know whether to trust online profiles? Where do you turn for assurance or accountability? The ability to demonstrate financial ‘good sense’ would give you an invaluable edge to stand out and succeed in career, business and personal objectives.

At FinovateFall 2011, Credit Sesame, one of the Internet’s most trusted credit management sites — backed by global financial institutions and world-class science, technology and financial experts — will reveal how to get that “edge.”

Whether you’re applying for a new job, transacting commerce online, or interacting with someone on the Web for business or personal reasons, Credit Sesame can help.

Innovation type: identity, lending, PFM

You’ve seen it all: savings tools, financial games, virtual banks and so on. But these products have a limited reach with your customers. DoughMain is the first and only service to combine family coordination and financial education into one simple and convenient platform.

Achieve a new level of engagement with your adult customers who have active families. Integrate your bank and financial service products in a completely new way and upsell your offerings to a lucrative market.

Innovation type: banking products, marketing, PFM

Samurai is the easiest and most elegant gateway on the market. It gives you ultimate flexibility at an affordable price.

With Samurai, you’ll be able to integrate payments on your site in minutes. Samurai boasts premium features such as intelligent routing, data portability, and gateway emulation. Send payments anywhere with Samurai — it’s universally compatible. Oh yeah, and that’s just a sneak peek at all that Samurai has to offer.

Innovation type: back office, payments, small business

Google Advisor makes it fast, safe, and easy for consumers to find personal finance products. Google will be showing the latest version of Advisor and be available for conversations with potential partners who are interested in the platform.

Innovation type: banking products, online UI

-thumb-150x65-3844.jpg)

IND Group “wow” innovation is a new online and mobile banking platform that has reinvented the way a bank can communicate with its customers. The platform’s simplicity and ease of use is underpinned by natural language and data visualization — key differentiators.

Easy-to-use main features are the account and transaction visualization, wizard-type money transfers and investments, zero-effort personal finance management, online sales engine and

the support center. IND Mobile banking is more than just the extension of online banking features, unique ergonomic design, user experience, security and the fact that it is always-online.

Innovation type: mobile and tablet UI, online UI, PFM

See Kony’s mobile commercial banking solution in action. It allows the corporate treasurer and executives to approve transactions from any mobile device, including tablets.

Each user is able to view the transaction amount, date, account involved, the approval status of other users, and a memo. This speeds the process of approving transactions as well as tracking the progress. Plus, from the development perspective, the application is updated and deployed to any mobile device, mobile Web or tablet from a single application definition.

Innovation type: banking products, mobile and tablet UI

LearnVest believes that financial planning should not be a luxury.

LearnVest is making personal financial advice accessible and affordable to millions of Americans. The company does this by providing the content, tools and advice to help women get informed, get organized, and get support.

LearnVest’s new My Money Center and the LearnVest Advice Center are the keys to this transformation. By helping members create everything from a personalized budget to a retirement savings plan, LearnVest empowers women to build their wealth and afford their dreams. Come learn more about the new LearnVest Method and see where the company is headed.

Innovation type: communications, PFM

There’s a tremendous opportunity to gain share of cash and check spending by small businesses; if only business owners felt they could adequately delegate and manage the credit, debit or prepaid card spending of their employees. Now they can.

MasterCard inControl Small Business Controller empowers small business owners to more confidently and securely delegate card spending to employees, improving expense control and helping to better manage cash flow. Small business owners can also create profiles with controls and alerts for each employee card and use virtual card numbers to shop more safely online.

Innovation type: cards, online UI, small business

miiCard is a revolutionary digital passport. It enables users to prove their identity online to the same level of authority as a drivers license or passport would do offline.

By creating trust in an environment characterized by anonymity and transient identities, miiCard will open up opportunities for business online and put Internet users back in control of their personal information on a global basis.

Innovation type: identity, payments, security

Retailers are constantly looking for new ways to increase sales.

Over US$20 billion is spent on consumer promotions each year, but while promotions can be effective, they are costly and reduce margins.

Offermatic already enables any merchant today to precisely target Offermatic members based on their actual spending history. Merchants can acquire guaranteed-new customers, who are already spending in the category, on a 100% pay-for-performance basis.

At FinovateFall 2011, Offermatic will announce its latest innovation. This new model will enable merchants to run a free promotion and grow sales at no cost!

See you on September 21st.

Innovation type: marketing, rewards, coupons, small business

-thumb-160x49-3867.jpg)

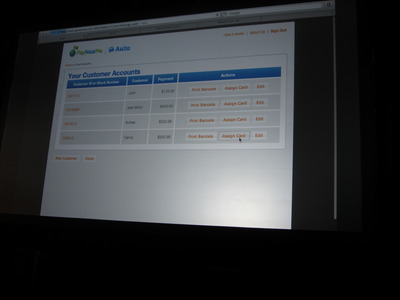

PayNearMe offers a convenient payment option to individuals who prefer to make payments in cash, as well as the more than 60 million adults who are unbanked or underbanked.

PayNearMe will demonstrate an easy and inexpensive way for these consumers to pay their rent and auto loans with cash at their local 7-Eleven store. And with our self-service portal, merchants of any size will soon be able to take advantage of this simple payment alternative.

Innovation type: payments

RobotDough will be presenting a new product that helps people protect their investments.

Innovation type: investing and asset management, PFM

Wall Street Survivor is relaunching at FinovateFall 2011 with a website that finally demystifies investing. Wall Street Survivor couples a real-time stock market simulator with content t

o create missions.

The product helps users understand financial concepts, such as creating a virtual portfolio, how to manage it, and how to find good stocks, all in a fun and rewarding way. If you want to learn how to invest better, or just want more confidence when speaking to your financial advisor or stockbroker, then the new Wall Street Survivor is for you.

Innovation type: Investing and asset management

American Banker reports SmartyPig adds office in India.

American Banker reports SmartyPig adds office in India.

California-based

California-based

-thumb-150x65-3844.jpg)