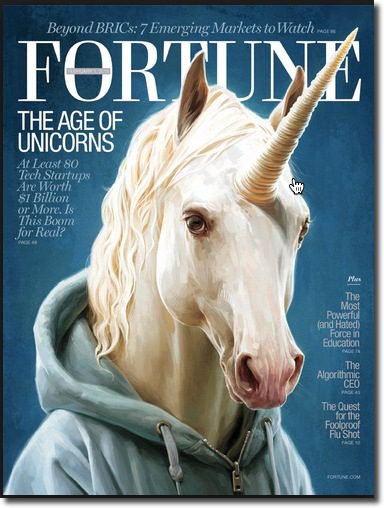

While the week got off to a slow start, the money arrived in buckets the past 48 hours. Counting the $250 million in new debt to alt-small-biz lender LiftForward, the weekly total was $454 million. But the more widely tracked equity total was still a sizable $204 million across 20 companies including three Finovate alums: Apprenda which raised an impressive $24 million; DealStruck with $10 million to fuel its small-biz lending; and Revolut bringing in $2.3 million for its mobile P2P payment service.

While the week got off to a slow start, the money arrived in buckets the past 48 hours. Counting the $250 million in new debt to alt-small-biz lender LiftForward, the weekly total was $454 million. But the more widely tracked equity total was still a sizable $204 million across 20 companies including three Finovate alums: Apprenda which raised an impressive $24 million; DealStruck with $10 million to fuel its small-biz lending; and Revolut bringing in $2.3 million for its mobile P2P payment service.

The biggest equity round ($50 million) went to Remedy Partners, a Connecticut-based health tech company. While not a pure fintech play, we included it here because its primary customers are the big insurers, including the U.S. government. The second biggest round was also in the insurance arena, as Sweden’s BIMA (aka Milvik) raised $38 million for its micro-insurance products in emerging markets.

Here are the deals from 18 July through 24 July 2015, ranked by size:

Remedy Partners

Bundled care and payment programs for health insurers

HQ: Darien, Connecticut

Latest round: $50 million Series B

Total raised: $86.2 million

Tags: Insurance, health care, payments, accounts receivable, accounting

Source: Crunchbase

BIMA (Milvik)

Mobile insurance provider in emerging markets

HQ: Stockholm, Sweden

Latest round: $38.4 million Series C

Total raised: $60.4 million

Tags: Insurance, mobile, underbanked, pay-as-you-go, microinsurance

Source: Crunchbase

Mswipe

Mobile point-of-sale solution for feature phones

HQ: Mumbai, India

Latest round: $25 million Series C

Total raised: Unknown

Tags: mPOS, acquiring, credit and debit cards, payments, merchants, SMB

Source: Crunchbase

Apprenda

Platform-as-a-service provider

HQ: Troy, New York

Latest round: $24 million

Total raised: $55 million

Tags: Enterprise, development platform, Finovate alum

Source: Finovate

CircleBack Lending

Consumer lending P2P marketplace

HQ: Boca Raton, Florida

Latest round: $17.5 million Series A

Total raised: $22 million

Tags: Lending, credit, consumer, loans, investing, person-to-person

Source: Crunchbase

DealStruck

Marketplace lender for small biz

HQ: Carlsbad, California

Latest round: $10 million Series B

Total raised: $69.5 million ($19.5 million equity; $50 million debt)

Tags: Lending, underwriting, loans, SMB, P2P, peer-to-peer, investing, Finovate alum

Source: Crunchbase

Innovati

Payment-acceptance technology

HQ: Bangalore, India

Latest round: $5 million

Total raised: $6.6 million

Tags: Payments, merchants, POS, point-of-sale, acquiring, SMB

Source: Crunchbase

DataFox

Discover and track companies for investing, sales

HQ: San Francisco, California

Latest round: $5 million

Total raised: $6.8 million

Tags: Investing, sales, business development

Source: Crunchbase

Procurify

Corporate-purchasing management

HQ: Richmond, British Columbia, Canada

Latest round: $4 million

Total raised: $5.2 million

Tags: Purchasing, expense management, expense reports, accounts payable, accounting

Source: Crunchbase

Bitx

Bitcoin wallet and payments

HQ: Singapore

Latest round: $4 million

Total raised: $4.8 million

Tags: Digital wallet, bitcoin, blockchain, mobile, payments, South Africa (market)

Source: FT Partners

Limelight Health

Sales tools for insurance agents

HQ: California City, California

Latest round: $3 million Series A

Total raised: $3 million

Tags: Healthcare, insurance, brokers, sales, quotes

Source: Crunchbase

Mint Payments

Mobile point-of-sale system

HQ: Sydney, Australia

Latest round: $2.9 million

Total raised: Unknown

Tags: mPOS, SMB, payments, cards, acquiring, merchants

Source: FT Partners

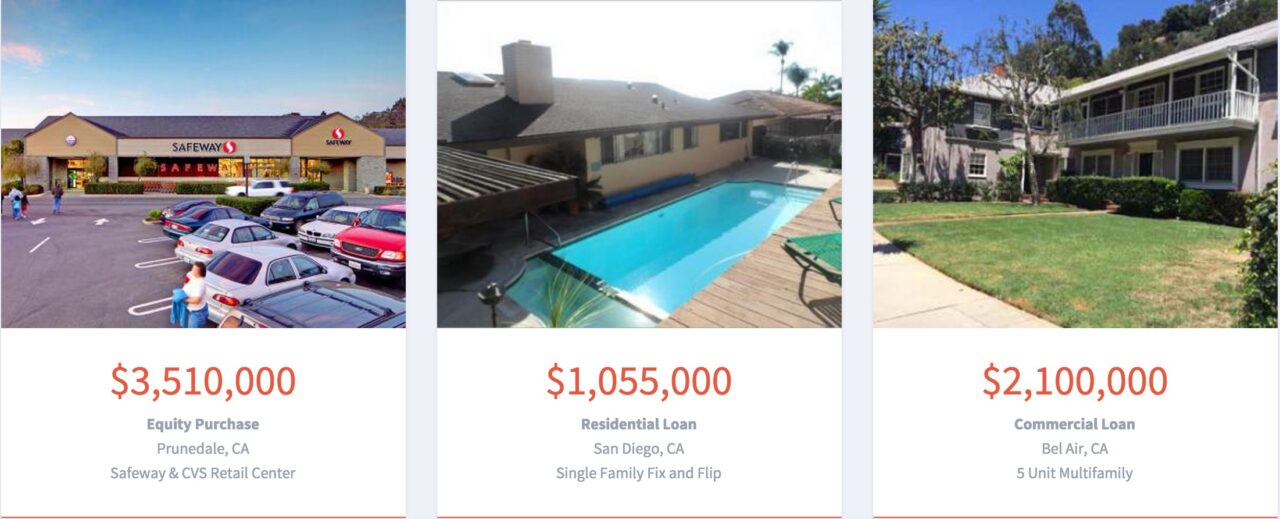

Investorist

Investing and selling platform for raw land property

HQ: Melbourne, Australia

Latest round: $2.5 million Seed

Total raised: $2.5 million

Tags: Real estate, investing, off-the-plan property, B2B, SMB, enterprise

Source: Crunchbase

Revolut

P2P mobile payments and remittances

HQ: London, England, United Kingdom

Latest round: $2.3 million Seed

Total raised: $2.8 million

Tags: Payments, fx, remittance, mobile, prepaid debit card, Finovate alum

Source: Finovate

MoneyMover

Remittance provider

HQ: Cambridge, England, United Kingdom

Latest round: $1.6 million

Total raised: Unknown

Tags: Payments, fx, SMB, funds transfer

Source: FT Partners

Fortress Risk Management

Enterprise risk-management services for financial institutions

HQ: South Glastonbury, Connecticut

Latest round: $1 million

Total raised: $5.1 million

Tags: Security, enterprise, business intelligence, compliance, ERM, fraud protection

Source: Crunchbase

Factom

Using the blockchain for managing records

HQ: Austin, Texas

Latest round: $1 million Series A

Total raised: $1.1 million

Tags: Bitcoin, blockchain, cryptocurrency

Source: Crunchbase

Self Lender

Credit-building service

HQ: Austin, Texas

Latest round: $500,000 Seed

Total raised: $2.6 million

Tags: Lending, loans, consumer, credit score, underwriting

Source: Crunchbase

Bankers Toolbox

Risk and compliance management for financial institutions

HQ: North Hollywood, California

Latest round: Undisclosed

Total raised: Unknown

Tags: Compliance

Source: FT Partners

Cermati

Indonesian consumer financial services hub

HQ: Jakarta, Indonesia

Latest round: Undisclosed

Total raised: Unknown

Tags: Consumer, lead generation, advertising, deposits, credit

Source: Crunchbase

——-

Debt only

LiftForward

Alt-lender to small- and mid-sized businesses

HQ: New York City, New York

Latest round: $250 million Debt

Total raised: $261.3 million ($2.3 million equity, $259 million debt)

Tags: Lending, credit, SMB

Source: Crunchbase

Argos Risk

Credit risk management tools for small businesses

HQ: Minneapolis, Minnesota

Latest round: $200,000 Debt

Total raised: $2 million

Tags: SMB, accounts receivables, trade finance, underwriting

Source: Crunchbase

———

Photos licensed from 123RF.com

pany

pany