Updated (4/18/18): Finovate alums raised more than $726 million in the second quarter of 2017. The funding total, which does not include a pair of undisclosed investments for Bitbond and Symbiont, represents one of the highest Q2 fundings for Finovate alums to date (Q2 2015 produced more than $840 million). The second quarter total is more than triple the total funding for alums in the previous quarter, reinforcing the notion that pause in fintech investment over the first few months 2017 has likely passed.

Previous Quarterly Comparisons

- Q2 2016: More than $510 million raised by 23 alums

- Q2 2015: More than $840 million raised by eight alums

- Q2 2014: More than $458 million raised by eight alums

The biggest equity deal of the second quarter by far was the $225 million equity investment Klarna received from new strategic investor, Brightfolk in June. The capital infusion made Brightfolk a qualified owner of the company (i.e., owned more than 10%) and gave Klarna an estimated valuation of more than $2.25 billion.

Also impressive was the $120 million raised by Kreditech, which represents the largest equity investment in a German fintech so far. The top 10 investments in the second quarter of 2017 totaled $610 million or more than 80% of the quarter’s total alum funding.

Top 10 Equity Investments (equity only)

- Klarna: $225 million

- Kreditech: $120 million

- Signifyd: $56 million

- Zopa: $41 million

- Blockchain: $40 million

- Scalable Capital: $33 million

- Fintonic: $28 million

- Additiv: $25.5 million

- savedroid: $22 million

- Crowdflower: $20 million

Here is our detailed alum funding report for Q2 2017.

April 2017: More than $41 million raised by four alums

- Meniga: $8 million – post

- Moneytree: $9 million – post

- Narrative Science: $11 million – post

- SwipeStox: $13 million – post

May 2017: More than $253 million raised by nine alums

- Additiv: $25.5 million – post

- Bitbond: undisclosed – post

- Kreditech: $120 million – post

- NetGuardians: $8 million – post

- Quovo: $10 million – post

- Signifyd: $56 million – post

- Symbiont: undisclosed – post

- Token: $18.5 million – post

- Vera: $15 million – post

June 2017: More than $432 million raised by 11 alums

- Blockchain: $40 million – post

- Cardlytics: $12 million – post

- Crowdflower: $20 million – post

- Fintonic: $28 million – post

- Klarna: $225 million – post

- Scalable Capital: $33 million – post

- StockViews: $640,000 – post

- Stratumn: $7.8 million – post

- Trusona: $10 million – post

- Yoyo Wallet: $15 million – post

- Zopa: $41 million – post

If you are a Finovate alum that raised money in the second quarter of 2017, and do not see your company listed, please drop us a note at [email protected]. We would love to share the good news! Funding received prior to becoming an alum not included.

Mark Rockefeller (CEO & Co-Founder), Mickey Konson (COO & Co-Founder) demo at FinovateEurope 2015

Mark Rockefeller (CEO & Co-Founder), Mickey Konson (COO & Co-Founder) demo at FinovateEurope 2015

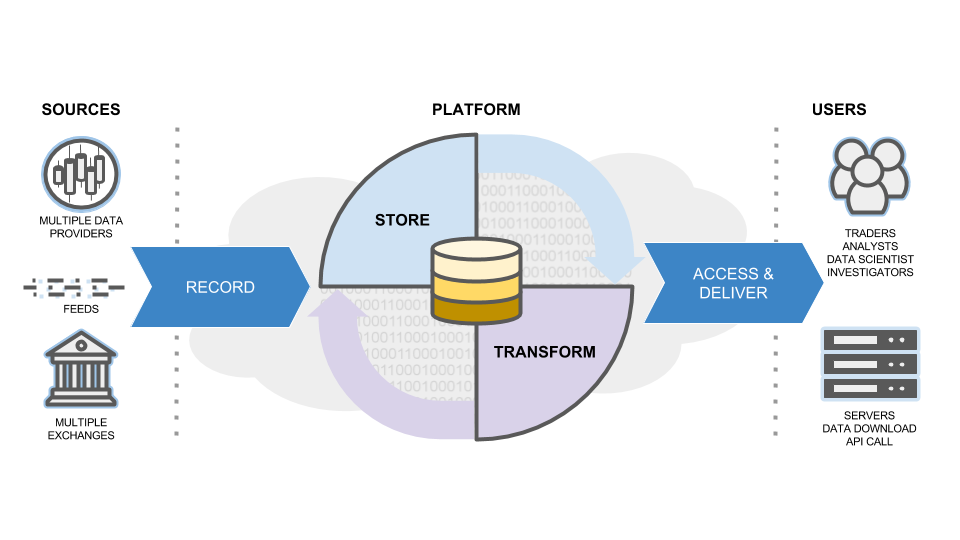

TickSmith’s TickVault data flow diagram

TickSmith’s TickVault data flow diagram

Klarna CEO and co-founder Sebastian Siemiatkowski (pictured) put the new investment in the context of its recent

Klarna CEO and co-founder Sebastian Siemiatkowski (pictured) put the new investment in the context of its recent