A look at the companies demoing live at FinovateAsia on October 29 and 30, 2018 in Hong Kong. Register today and save your spot.

Think Analytics is a five-year old leading analytics startup in India, with the core team having a combined experience of 50+ years. The company works with several non-banking financial companies, leading fintechs, banks, and others.

Features

Algo360 helps digitize and automate processes like underwriting, identity assessment, and seamless digital onboarding. Think Analytics is able to leverage alternative data through digital footprints for the same.

Why it’s great

The solution is already live with several non-banking financial companies and fintechs. It has already processed 10 million applications with turnaround time of less than one minute.

Presenters

Presenters

Monish Salot, Co-founder and CTO

Salot leads the business development and technology efforts at Think Analytics. Prior to this, he lead teams at 3iInfotech and other organizations.

LinkedIn

Abhishek Joshi, Senior Associate

Abhishek Joshi, Senior Associate

Joshi loves solving technology problems and building solutions for scale. He has already won multiple fintech awards in India for building scalable tech solutions.

LinkedIn

Presenters

Presenters Bodo Grauer, Head of Digital Strategy and Transformation

Bodo Grauer, Head of Digital Strategy and Transformation

Presenters

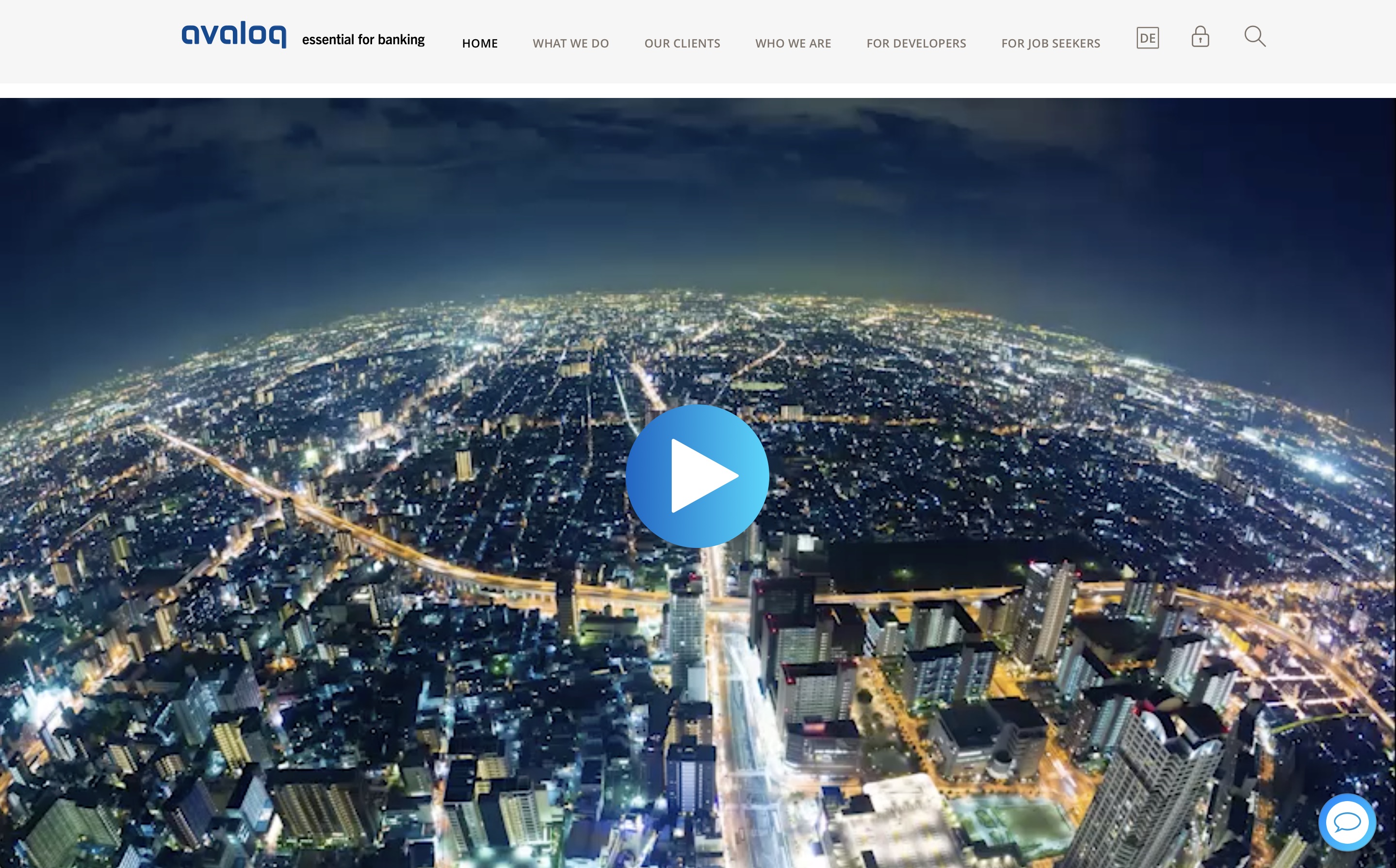

Presenters Igor Pesin, Co-Founder and CFO

Igor Pesin, Co-Founder and CFO

Presenters

Presenters Ozan Vakar, CTO

Ozan Vakar, CTO

Presenters

Presenters Justin Lai, Sales and Marketing Director

Justin Lai, Sales and Marketing Director

Presenters

Presenters Piyachat Kunthachaem, Business Platform Officer

Piyachat Kunthachaem, Business Platform Officer Sukanya Bowornsettanan, Project Manager, Transformation

Sukanya Bowornsettanan, Project Manager, Transformation

Michel Brinkhuis, Solution Architect

Michel Brinkhuis, Solution Architect

Yury Panov, CMO

Yury Panov, CMO

Presenter

Presenter

Presenter

Presenter

Presenters

Presenters

Lincoln Yin, CEO

Lincoln Yin, CEO