evosnap.com | evosnap.com/blog | @canyousnap

As the integrated payments division for EVO Payments International, EVO Snap* simplifies in-store, online, and mobile payment, making payments a Snap* for software companies and merchants. EVO Snap* is a one-stop shop for application integration, merchant underwriting, and payment processing. EVO Snap* offers single-integration access to omnichannel payment processing through one API and can instantly decision, board, and activate merchants.

As the integrated payments division for EVO Payments International, EVO Snap* simplifies in-store, online, and mobile payment, making payments a Snap* for software companies and merchants. EVO Snap* is a one-stop shop for application integration, merchant underwriting, and payment processing. EVO Snap* offers single-integration access to omnichannel payment processing through one API and can instantly decision, board, and activate merchants.

Making the shift to EMV quickly and securely

The cost and complexity of managing EMV certification can quickly become overwhelming. There is a better way. Create EMV approved iOS, Windows, and Android-based point-of-sale (POS) applications in a snap with the Commerce Driver from EVO Snap. As with a printer-driver, the precertified Commerce Driver SDK installs alongside your software application, adding PCI-compliant transaction processing to iOS, Windows, and Android-based POS systems. The Commerce Driver facilitates all transactional communication with EVO’s global processing platforms and approved hardware devices and meets all EMV level 3 compliance requirements for payment processing in the U.S. and Europe.

Key takeaways:

- How retailers can prepare for the EMV liability shift

- How EMV impacts mobile POS (mPOS)

- Increasing addressable global markets with standardized EMV solutions

Presenters:

Peter Osberg, SVP U.S. Product and Worldwide Integrated Payments, eCommerce and Gateway Solutions

LinkedIn | [email protected]

Osberg, as SVP U.S. product, worldwide, is responsible for globally defining and executing EVO’s integrated software strategy.

Darren Adelgren, VP Product, Customer Care

LinkedIn | [email protected]

As VP of product and customer care, Adelgren is responsible for defining and leading the product and integration strategy for EVO’s integrated payments group, EVO Snap.*

Deluxe Corporation

Deluxe Corporation

Linqto

Linqto

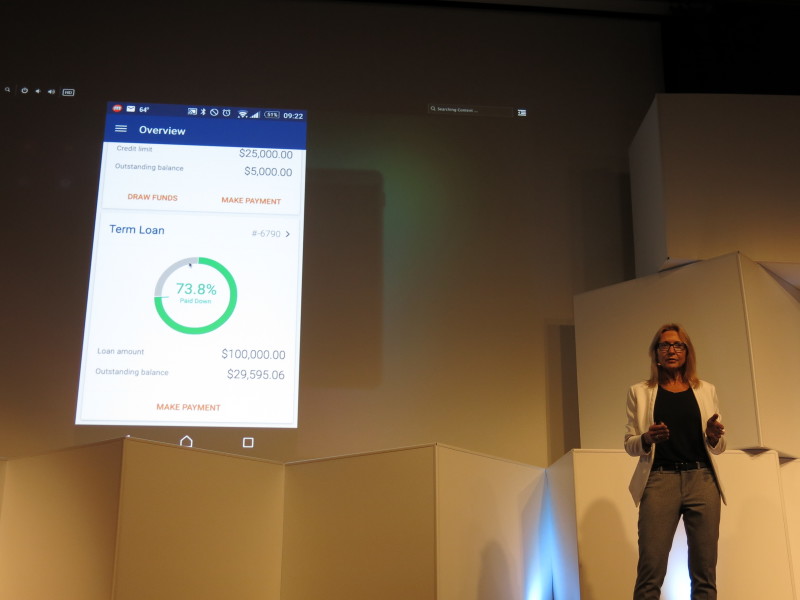

OnDeck

OnDeck