Fintech pioneer PayPal is rolling out a new mobile app today.

The company is adding a handful of features that bring it into “super app” territory, competing with the likes of WeChat, Alipay, and Paytm. PayPal’s app already offers a peer-to-peer payment tool, a mobile wallet, and a charity donation feature.

The new release, however, will offer more features and new banking capabilities. Here’s a rundown of what to expect:

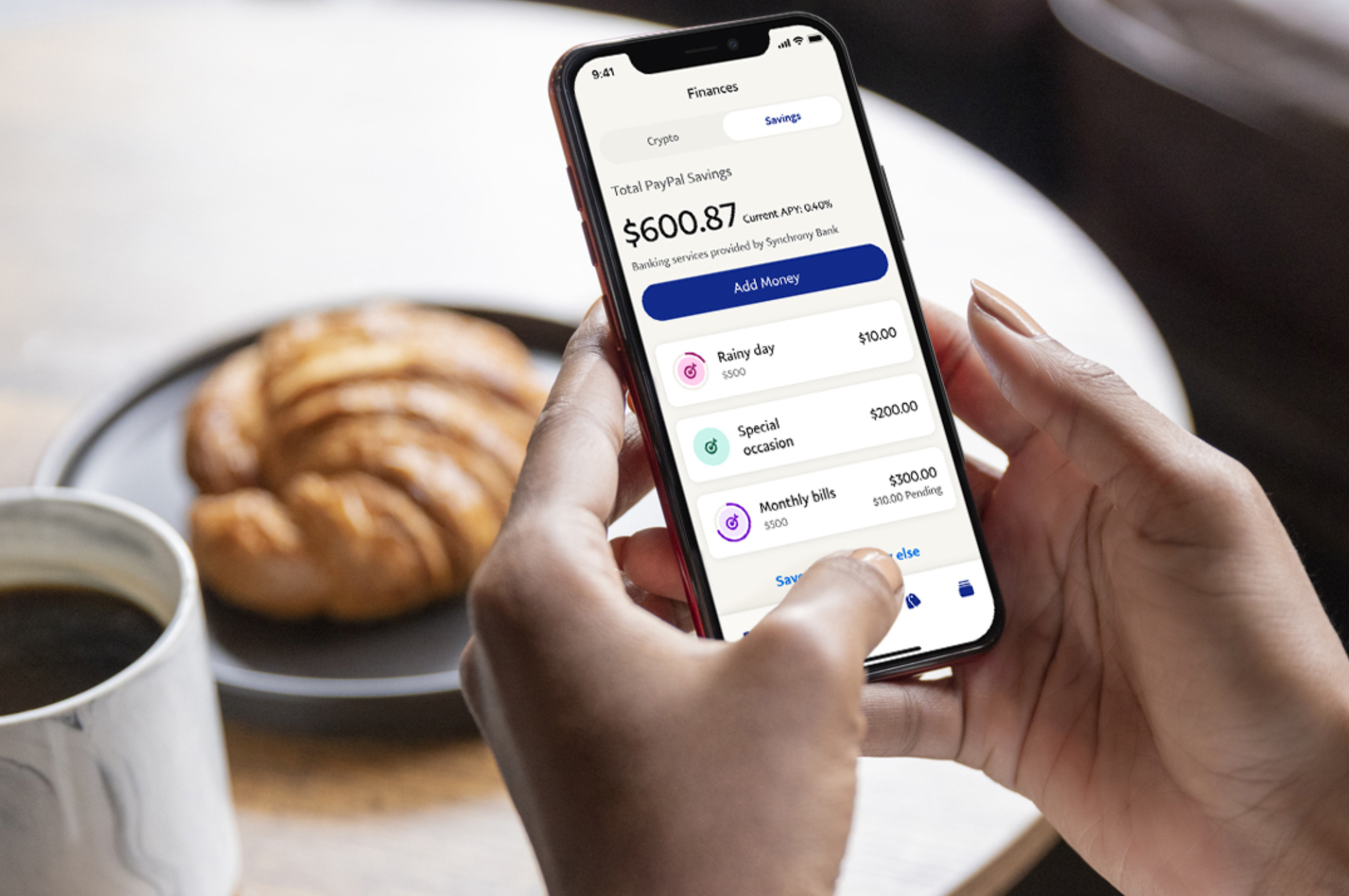

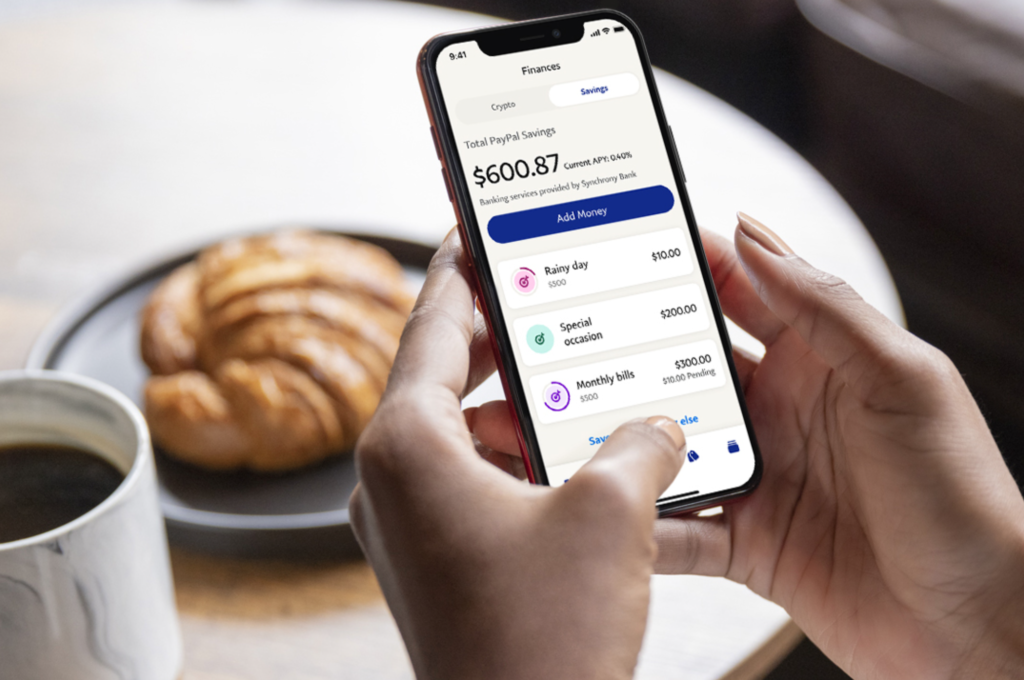

- PayPal Savings, a new, high-yield savings account provided in partnership with Synchrony Bank that pays 0.40% APY

- In-app shopping tools that allow customers to discover and earn loyalty rewards

- Billpay management tools that help users track, view, and pay their bills

- A new Direct Deposit feature that fronts users their paycheck up to two days early

- Rewards capabilities

- Gift card management

- Credit access

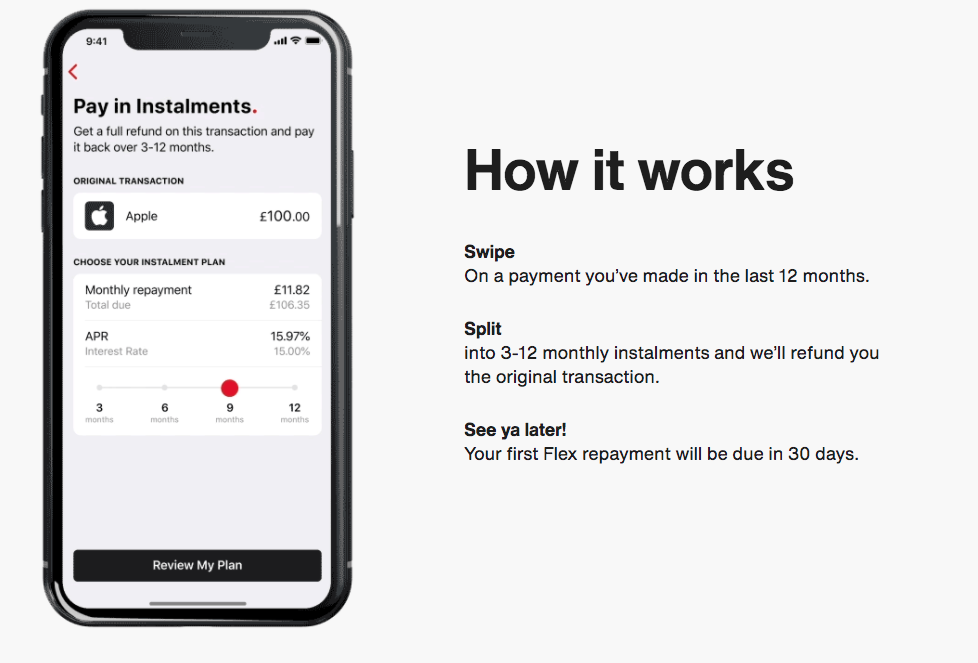

- Buy Now, Pay Later services

- Crypto purchasing, holding, and selling abilities

The app will show users a personalized dashboard of their account; a wallet tab to manage payments and direct deposits; a finance tab to access savings and crypto accounts; a payments tab that enables users to send and receive money, make a donation, and manage billpay; and a messaging feature built around peer-to-peer payments.

“We’re excited to introduce the first version of the new PayPal app, a one-stop destination for our customers to take charge of their everyday financial lives, with new features like access to high yield savings, in-app shopping tools for customers to find deals and earn cash back rewards, early access Direct Deposit, and bill pay,” said PayPal CEO Dan Schulman. “Our new app offers customers a simplified, secure and personalized experience that builds on our platform of trust and security and removes the complexity of having to manage multiple financial or shopping apps, remember different passwords and track loyalty rewards.”

What’s next for PayPal’s Super App? The company will add investment tools, offline QR code payments, and new shopping and deals capabilities.

PayPal is currently the closest thing the U.S. has to a super app. However, the new app is still missing some key elements that Asia’s successful super apps have, including food delivery, transportation, travel, health, insurance, government, and public services.