We were lucky enough to take a quick trip to Europe this summer and one of the many rituals of modern travel is convincing your card issuers not to block international transactions. The conventional wisdom is to notify issuers in advance. While not an absolute necessity, it is said to improve your odds.

We were lucky enough to take a quick trip to Europe this summer and one of the many rituals of modern travel is convincing your card issuers not to block international transactions. The conventional wisdom is to notify issuers in advance. While not an absolute necessity, it is said to improve your odds.

The process is very straightforward. All the bank needs is your travel dates and where you are visiting. However, it is tedious over the phone due to redundant authentication requirements.

Consequently, it’s an ideal service to automate with online, or even better, mobile form. I wrote about it the last time I traveled. But this time I put a clock on the process, just to see exactly how much time was wasted, for both the consumer and bank, on the phone.

Summary: It took about 1 minute per card to register online at Capital One and Chase. Over the phone, it took 6.5 minutes at Wells Fargo and 9.5 at U.S. Bank. No one has it in their mobile app yet (see details below).

I realize that online travel notifications are not a high priority these days. But, it’s such a win-win service, I wish more banks offered it. However, the real end game is to build automatic location notification into mobile-banking apps. Even if customers won’t agree to being tracked 24/7, there could be a button in the app that users press to submit their GPS location whenever they land in a new city or country.

That gives customers total control, but makes it super easy for them to communicate. And it gives you a highly secure method of knowing your customers are in the same location as their card.

__________________________________________________________________________________

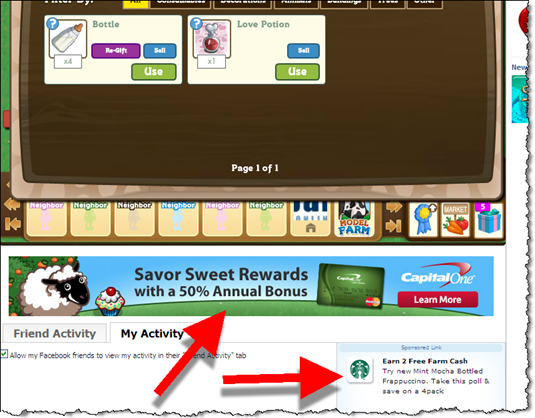

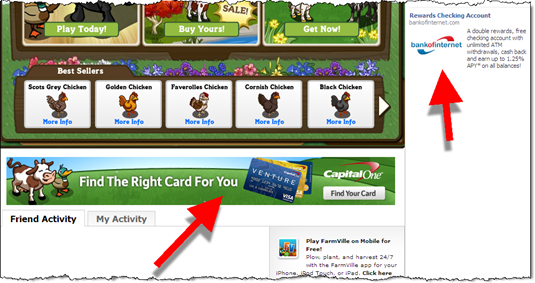

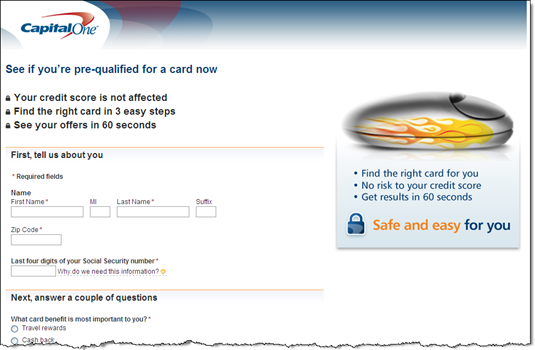

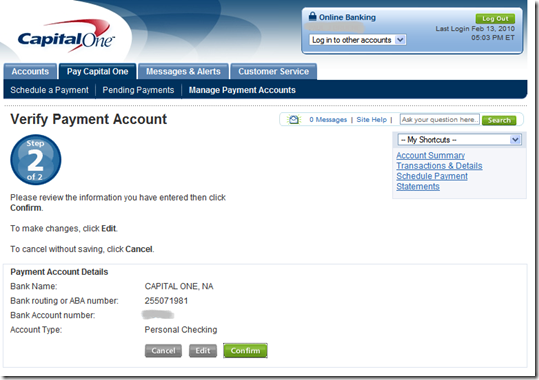

Capital One: Online — 2 minutes to register 2 cards (see screenshots in previous post)

__________________________________________________________________________________

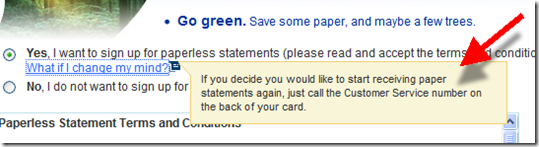

Luckily, Capital One, my go-to card abroad with no international transaction fee, has an online form to do this. It’s not easy to find, but I’d written about it before so I knew roughly where to look. The form is a little convoluted; if traveling to multiple countries, you have to keep pressing “add another destination,” but it took less than a minute to add the five countries were we passing through.

I have Capital One personal and business cards which are integrated into the same online banking platform. But unfortunately, you have to do each card separately, so total time expended, including login, was about 2 minutes.

Capital One gets extra credit for sending me an email on my scheduled departure day asking me whether I needed anything and providing their international call-center instructions. _________________________________________________________________________________

Chase Bank: Online — less than 1 minute for 2 cards (see screenshot in previous post)

__________________________________________________________________________________

I couldn’t remember whether Chase had an online option, so I logged in, didn’t see it on the right-hand column of common links. So I went to customer service and found it on the list of available tasks. The form was super-easy; I could do both of my cards at once and just free-form input the countries. Total form-completion time was under 10 seconds, but if counting login and function-search, it took just under a minute. __________________________________________________________________________________

U.S. Bank: Phone: 9.5 minutes on phone + 2 minutes searching online for 1 debit card (with 2 different account numbers)

___________________________________________________________________________________

I first checked online to see if travel notifications had been added since the last time I checked. No such luck, so about 2 minutes were wasted. Because we needed ATM access abroad, we had to have this card working, so I reluctantly called the 800 number on a Friday evening, and was told that wait times were approx 4 minutes. I think they were only half that, but it still took me a full 9.5 minutes to get my ATM cards registered. About one minute of that was spent finding my wife’s debit card, which I now know has a different number than mine.

Why the agent couldn’t handle both ATM cards from a joint account without needing the other number is beyond me, but he insisted.

Total time expended was 2 minutes online and 9.5 on the phone: 11.5 minutes total.

Extra credit goes to the U.S. Bank agent who activated my new debit card that had recently come in the mail. My old card would have expired during the trip.

___________________________________________________________________________________

Wells Fargo: Phone: 6.5 minutes on the phone + 2 minutes searching online for 1 card

___________________________________________________________________________________

My wife carries a Wells card at all times, so usually she handles travel notifications. But since I was already on a roll, I took on the task. Although I didn’t recall ever seeing it, I assumed Wells would have an online option, but after a search of the site, I found that my hunch was wrong and that I’d wasted a few minutes.

I called the 800 number and was able to complete the process in about 6.5 minutes. Much of that time was spent listening to menu choices and current balance info (which I didn’t want). Had I known how to skip through the menus, it would have taken only about 3 minutes. The agent was friendly and efficient, although she twice asked if she could also activate my debit card even though I don’t have a checking account there. But I appreciate that she was trying to be thorough. ___________________________________________________________________________________

Bank of America: Phone — 2 minutes, 0 cards

___________________________________________________________________________________

I was going to take my Bank of America card along, but after searching customer service I could not find an online form to complete, so I decided to leave it at home. Score 1 for the more online-savvy approach at its competitors.

Boosting mobile engagement has a promising ROI. Among other benefits, the potential $6+ saved per displaced call center inquiry can have a meaningful impact on the bottom line (note 1).

Boosting mobile engagement has a promising ROI. Among other benefits, the potential $6+ saved per displaced call center inquiry can have a meaningful impact on the bottom line (note 1).