We just completed our latest Online Banking Report. It will be mailed to subscribers this week.

We just completed our latest Online Banking Report. It will be mailed to subscribers this week.

It’s also available online here. There’s no charge for current subscribers; others may access it immediately

for US$495.

———————————————————

Improving Online Account Opening ROI

Ten strategies to increase online application conversion rates

102 pages (published 21 June 2009)

In this report (abstract PDF), we focus on ways to increase conversions and improve your results when opening financial accounts online or over a mobile phone.

The online application is the new branch new-accounts desk. And, just as you provide ongoing support, training and incentives to branch-based sales staff, you must continually fine-tune your online sales process.

The online application is the new branch new-accounts desk. And, just as you provide ongoing support, training and incentives to branch-based sales staff, you must continually fine-tune your online sales process.

In our experience, this is an area that needs attention at most financial institutions. Things have greatly improved during the 10+ years we’ve been tracking online applications. However, during the research for this report, we reached dead-ends at three of the 10 applications tested (note 1). That just can’t happen.

The report outlines a 10-step approach to improving the process:

- Direct users to the application

- Set expectations

- First things first

- Guide customers

- Bundle mobile access & alerts

- Upsell

- Fund

- Ask for referrals

- Stay in touch

- Humanize the process

We reviewed the online applications of the following companies:

- Bank of America

- BECU (powered by uMonitor)

- Capital One

- Chase Bank

- First Arkansas Bank & Trust (powered by FirstROI)

- Flagstar Bank (powered by uMonitor)

- HSBC Direct

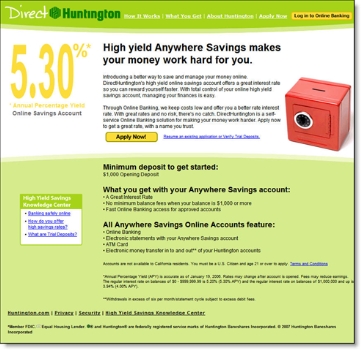

- Huntington Direct (powered by CashEdge)

- M&I Bank

- National City

- Verity Credit Union (powered by Andera)

- Wells Fargo

- Zions Bank

Finally, a 10-year forecast for online account-opening volumes in the United States is presented.

M&I Bank has an attractive and informative application start page (9 June 2009)

Note: The online banking guarantee at the bottom is a good way to improve user trust.

Note:

1. Granted, user error was the problem in two of the three failed apps; however, we weren’t purposely trying to make mistakes. The online application should have provided assistance in correcting them, rather than leaving us hanging.