Array, an embedded consumer products platform, has agreed to acquire embedded debt guidance solutions provider Payitoff. Terms of the transaction were not disclosed. The deal will build on Array’s position in the intelligent debt management solutions industry, and further equip the company to help financial institutions, fintechs, and digital brands accelerate growth, create new revenue streams, and enhance the consumer experience.

“Financial institutions and other providers of financial products in digital experiences realize that helping their consumers better understand and manage their debt is a powerful way to increase deposits, revenue, and brand loyalty,” Array Founder and CEO Martin Toha said. “We acquired Payitoff because our companies have a shared vision to provide seamless, embeddable products that fuel financial progress. This provides our clients with the best of all worlds: bringing valuable products to market faster without additional resources and overhead.”

Founded in 2020, Array offers a range of embeddable private label products that enable businesses to serve as “one-stop shops” for financial services. The company’s solutions help financial institutions serve a wider range of customers’ financial needs, increasing engagement, and opening up new potential sources of growth. Array’s solutions can be implemented through embedded or private label sites, as well as via its API, and turn 18-month builds into 6-12 week deployments.

Array won Best of Show in its Finovate debut at FinovateFall 2021. The company returned to the Finovate stage the following year at FinovateSpring 2022, taking home its second Best of Show award in as many appearances. Most recently demoing its technology at FinovateSpring 2023, Array introduced its HelloPrivacy and Subscription Manager solutions. HelloPrivacy monitors and removes personally identifiable information (PII) from the web to help defend against identity theft, robocalls, and other privacy risks. Subscription Manager allows subscribers to manage their subscriptions from a single location, as well as cancel unwanted subscriptions and negotiate lower rates on select subscriptions.

Array began 2024 with the appointment of Kew Kelly-Yuoh as Chief Financial Officer, a partnership with digital banking solutions provider Narmi, and a spot on the Fintech Innovation 50 list for 2024. This spring, Array reported that its online privacy solution, Privacy Protect, had surpassed four million in protected users and removed more than 200 million online records on their behalf. Earlier this month, the company announced that Lumin Digital, a provider of cloud-native, digital banking solutions, will offer a suite of Array products including My Credit Manager with Offers Engine, and Identity Protect — along with Privacy Protect and Subscription Manager — as part of its Financial Wellness Monitoring Suite for financial institutions.

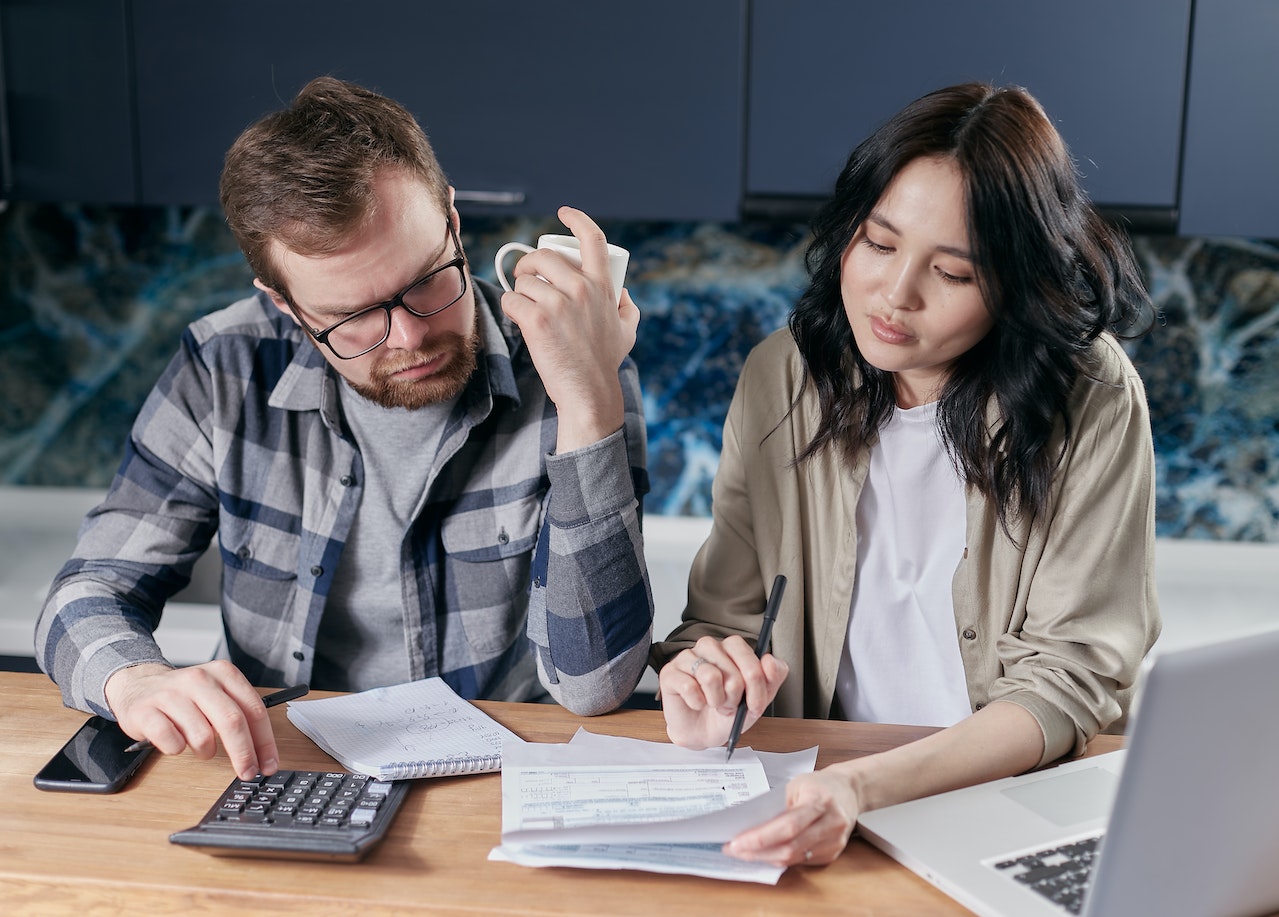

Founded in 2018, Payitoff was born out of CEO Bobby Matson’s personal struggle to pay off “six-figure student loans and debt.” After initially launching a student loan management solution, Matson and his team expanded their offerings to include a more comprehensive set of debt management tools. Enabling companies to seamlessly integrate broad debt management functionality into their digital platforms, Payitoff has managed 200,000+ loans valued at more than $1.5 billion.

“The opportunity for impact between Array and Payitoff is massive,” Matson said. “Student loan payments resumed a year ago, and with delinquencies starting to impact borrowers’ credit this month, the timing of this acquisition couldn’t be more critical. Array’s reach, combined with our debt management tools, will empower financial institutions and fintechs to help their consumers manage debt and save thousands — all with a seamless integration.”

Payitoff made its Finovate debut at FinovateFall 2023. At the conference, the consumer debt management tool provider demonstrated its white label, no code solution that empowers financial institutions to help their customers save money on student loan repayments. Earlier this year, Payitoff was selected to participate in Mastercard’s Start Path Open Banking Program.