Credit and risk underwriting firm TransUnion announced plans today to acquire digital identity solutions company Neustar. The deal is expected to close in the fourth quarter of this year for $3.1 billion.

“The credit information and analytics that TransUnion provides make trust possible between consumers and businesses,” said TransUnion President and CEO Chris Cartwright. “As digital commerce continues to grow globally, TransUnion’s powerful digital identity assets, enhanced by Neustar’s distinctive data and digital resolution capabilities, will enable safer and more personalized online experiences for consumers and businesses.”

With the addition of Neustar’s data and analytics to enable consumers and businesses to transact online with greater confidence, TransUnion expects the purchase will expand its digital identity capabilities.

Specifically, TransUnion’s acquisition is expected to help the company break out of the traditional credit scoring space by leveraging Neustar’s OneID platform, which will help TransUnion unify its digital identity capabilities. This includes TLO data assets and fusion platform, the iovation device reputation network, and the digital marketing capabilities of Tru Optik.

As part of the purchase, TransUnion will acquire Neustar’s employees, data, and products.

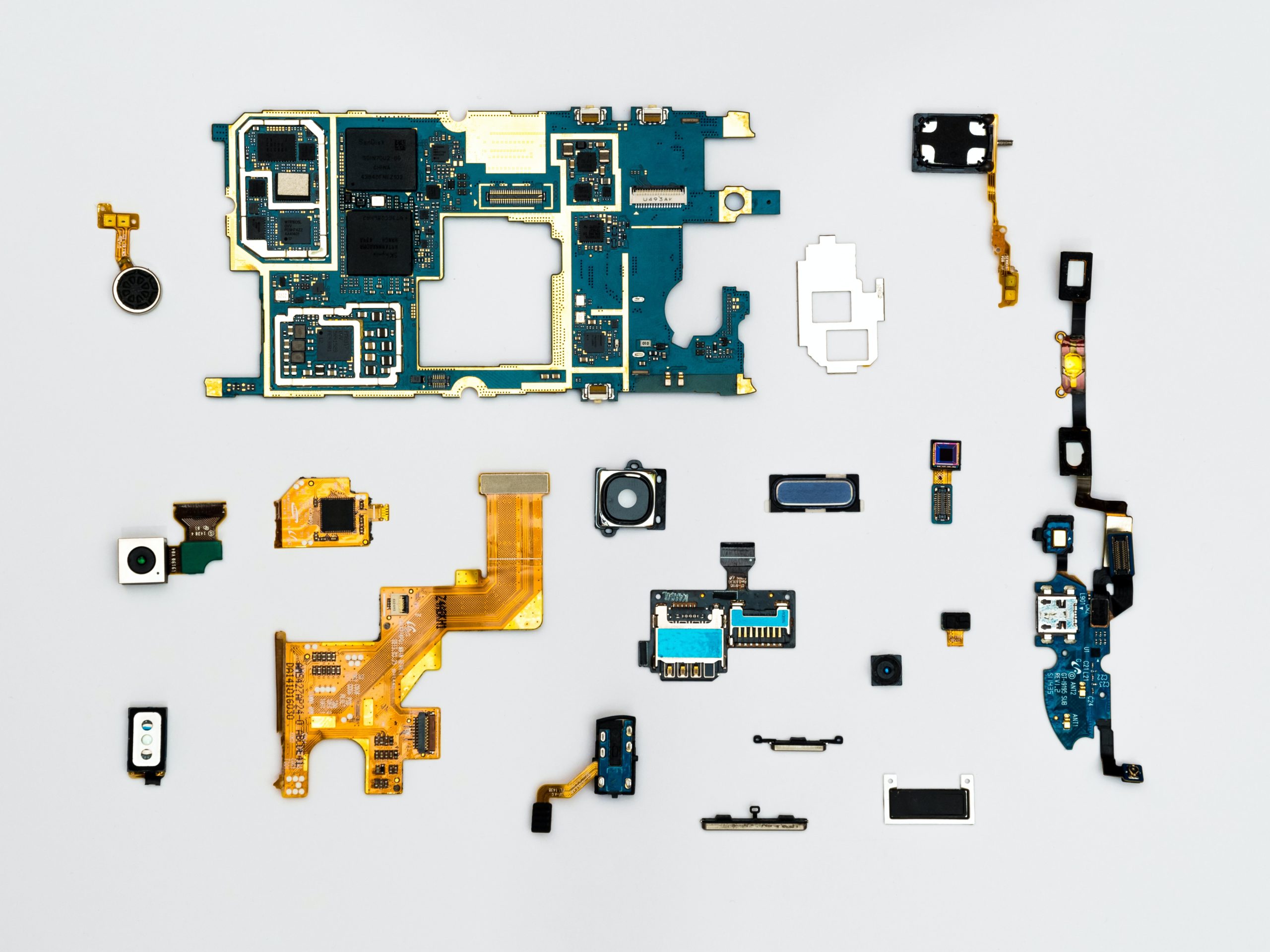

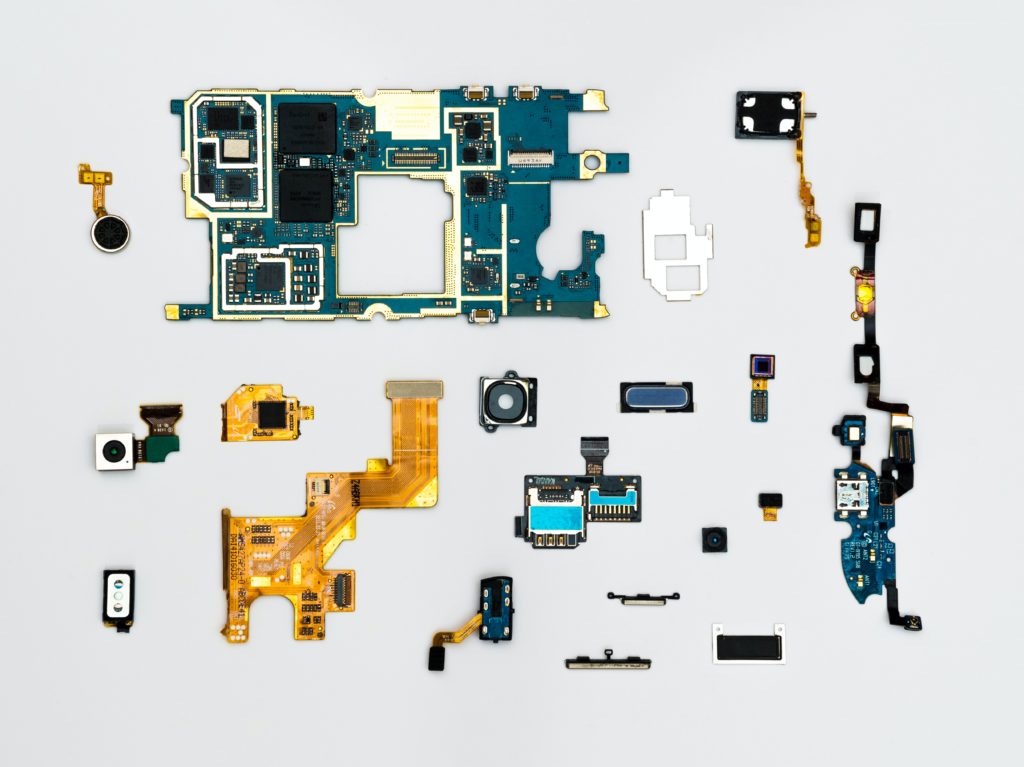

Photo by Robert Zunikoff on Unsplash