London-based digital payments innovator SumUp announced the relaunch of its online store and the appointment of a new CEO for Europe: Michael Schrezenmaier.

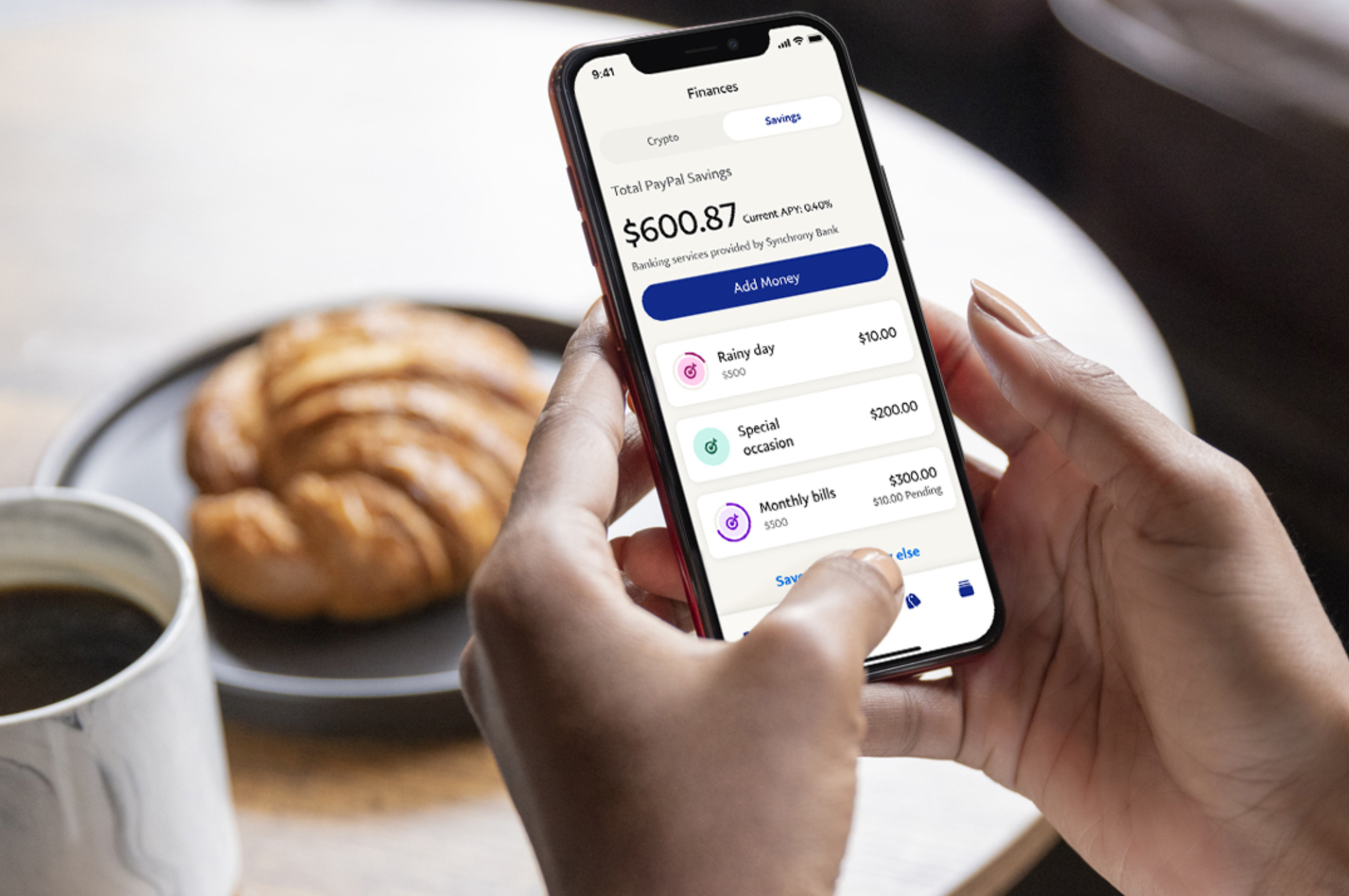

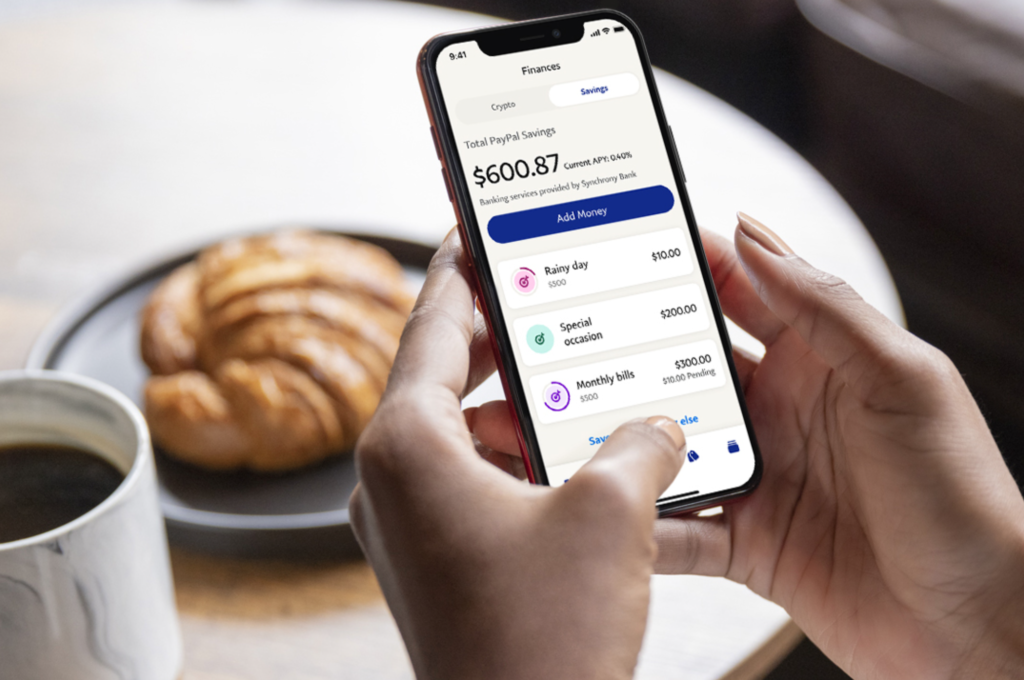

The decision to enhance the SumUp Online Store is part of a strategic pivot toward online retail, an industry that grew significantly during the pandemic. “E-commerce has completely changed since we first launched the Online Store,” SumUp Vice President of Growth, Mark Wang said. “This shift has meant that an exponentially growing number of people now prefer to shop online.” The SumUp Online Store was initially launched in May 2020.

Among the new features offered are tools to enable business owners to set up a store in minutes due to a simplified signup process, a theme editor to customize storefronts, and a learning hub to support both new and veteran business owners. The upgraded platform also will no longer charge subscription fees, making it that much accessible to more small businesses.

“At SumUp our mission with the new Online Store is to provide a better platform for small businesses to reach customers anywhere in the world,” Wang added. “We are constantly working to build innovations that empower anyone to become an entrepreneur.”

Moving from platforms to people, SumUp also announced today that it has appointed Michael Schrezenmaier as its new CEO of Europe. Schrezenmaier comes to SumUp after serving as Chief Operating Officer and interim co-CEO for CRM platform Pipedrive and nearly seven years as COO at international dating company Spark Networks.

“SumUp is a company known for its entrepreneurial spirit and willingness to embrace change which, combined with its growth journey and continued upward trajectory, makes this an exciting time to join,” Schrezenmaier said, adding praise for the company’s innovation, “dedication to merchants,” and its leadership in the payment space overall.

Marc-Alexander Christ, co-founder of SumUp underscored the “quirks” and regional differences in Europe – and the unique aspects of the average European’s relationship with money – in explaining why Schrezenmaier was the right pick for the CEO spot. Christ called Schrezenmaier “a prime example of the type of person who will drive the company forward as we look to uphold our strong position in Europe – and deliver for our merchants.”

Founded in 2012 and making its Finovate debut a year later at FinovateEurope, SumUp has grown into a global digital commerce enabler and payments company. SumUp supports more than three million merchants around the world and boasts a workforce of 2,600+. The company has raised $1.4 billion in funding, most recently securing $893 million in debt financing in March of this year.

Photo by Nataliya Vaitkevich from Pexels