- ACI Worldwide introduced its new, centralized payment hub, ACI Connetic.

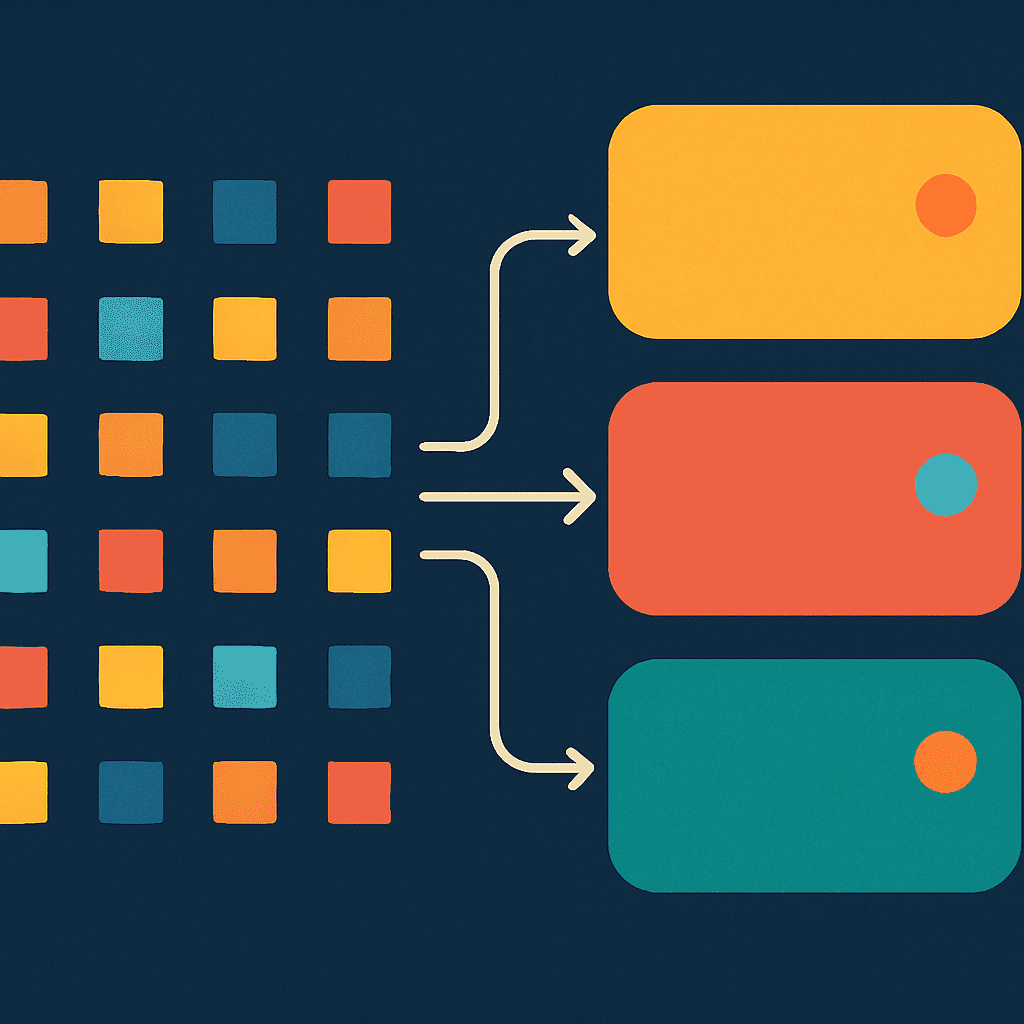

- The new offering integrates the capabilities of major global payment networks including Swift cross-border and RTGS payments into a single, cloud-based platform.

- Headquartered in Florida, ACI Worldwide has been a Finovate alum since 2011.

ACI Connetic, ACI Worldwide’s new centralized payment hub, was unveiled this week. The solution integrates major global networks’ payment capabilities—including Swift cross-border payments, RTGS payments including Target2, SEPA Instant RT1, and TIPS payments, with more capabilities to be integrated later. This brings account-to-account (A2A) payments, card payments, and AI-powered fraud prevention into a unified, cloud-native platform that gives banks an easier, faster, and more cost-effective way to modernize their payment infrastructures.

“ACI Connetic is not just a new product, it is a new standard for how banks must operate in the digital economy and approach payments transformation,” ACI Worldwide CEO and President Thomas Warsop said. “Against the backdrop of increasing payments complexity, the rise of new technologies and a shifting regulatory environment, ACI Connetic empowers financial institutions to unlock new revenue opportunities and navigate compliance in order to drive growth and financial inclusion.”

Already gaining traction with financial institutions in both the US and Europe, ACI Connetic enables these businesses to consolidate siloed systems and benefit from a centralized approach to processing all payment types. The offering comes as Datos Insights recently championed the benefits of centralized payment processing. In its report, Datos contended that centralized payment processing streamlines operations, enhances efficiency, and helps support growth. ACI noted that it is already working with the world’s leading clearing and settlement systems including the Bank of England, Pay.UK, ECB, EBA Clearing, and Stet, as well as Swift, the US Federal Reserve, and The Clearing House to integrate their payment functionalities into ACI Connetic.

“We built ACI Connetic to give banks a future-proof foundation to meet the ever-increasing demand for faster, smarter, and secure payments,” ACI Worldwide head of product for banking and intermediaries, Scotty Perkins, said. “Built for scalability, intelligence, and resilience, ACI Connetic empowers banks to reduce complexity, accelerate product innovation, and deliver new solutions to their customers in an unprecedented way and at unprecedented speed.”

ACI Worldwide has been a Finovate alum since 2011, when the company joined MShift on stage at FinovateFall in New York. ACI Worldwide is also an alum of our developers conference, participating in FinDEVr Silicon Valley in 2016. Today, the company serves the top 10 banks in the world, enables 80,000+ merchants directly and through PSPs, and provides services such as billpay and payments intelligence. ACI Worldwide has more than 6,000 customers around the world, and annually processes 25 billion cloud transactions and 225+ billion consumer transactions.

ACI Worldwide’s new product news comes just days after the company announced that CIMB Bank had selected its technology to combine all its account-to-account transactions—real-time, ACH, RTGS, and cross-border—in a single payments platform. CIMB Bank is the second largest financial services provider in Malaysia and one of the leading banking groups in the ASEAN region.