I know banks have been stung by various public floggings over the past five years. But sometimes they are too shy for their own good.

During normal times, a big chunk of retail profits come from lending. Yet, many bank websites make loans (other than mortgage and credit cards) look like a minor product line. Kind of like the AA batteries for sale at the Best Buy counter.

US Bank’s newly remodeled website is typical (note 1). Yes, you can find loans across the top navigation (good). But the bank makes users select from a dropdown list to find exactly what they are looking for. It’s not a bad approach, but it’s fairly passive (see first screenshot below).

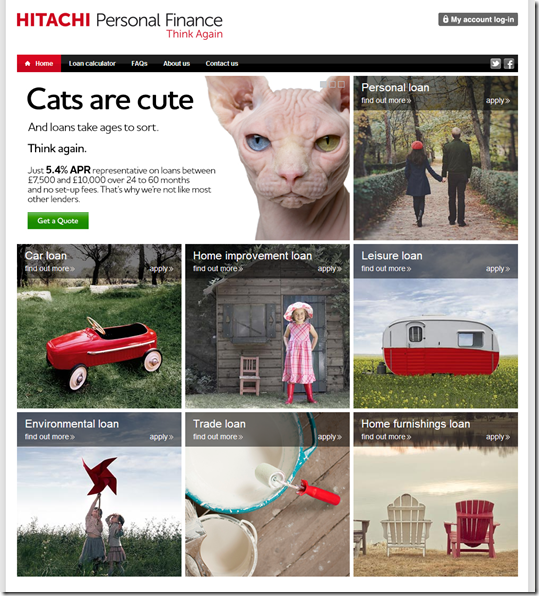

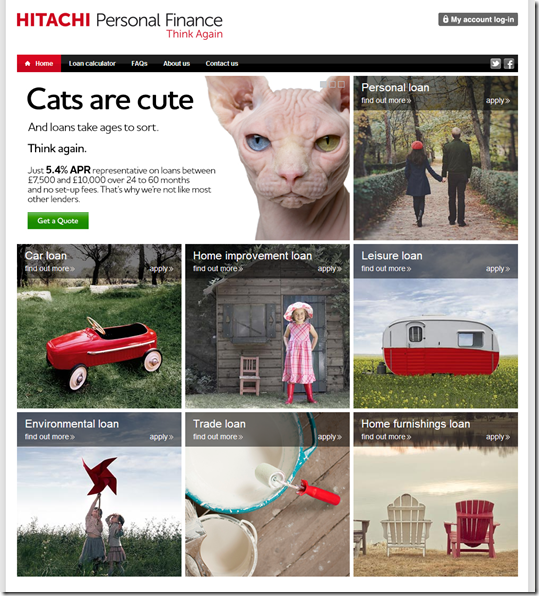

Compare that to UK’s Hitachi Personal Finance (second screenshot). The lender uses its homepage to explain its core benefits (low rates and quick turnaround) and lay out the various loan types (personal, auto, furniture, leisure, trade, environmental).

Bottom line: In the United States, we have probably reached “peak checking account fee income.” And you can’t bank on deposit values going back to 5% any time soon. Let’s face it, loans are where the money is for the foreseeable future (note 2). So its time to stop being a loan introvert and sing their praises from your online and mobile outposts.

—————————————–

US Bank requires users to select a specific loan type before drilling down for more details (3 Sep 2013)

Hitachi Personal Finance (UK) (link)

Hovering over one of the loan types brings up a short description

——————————–

Notes:

Image credit

1. I’m sorry I’m picking on US Bank, it just happened to be the first URL I typed in.

2. Also, insurance sales have a very robust future, though that a topic for another day (see our full report here, Dec 2011, subscription)

Jack Henry Banking

Jack Henry Banking