This post is part of our live coverage of FinovateEurope 2014.

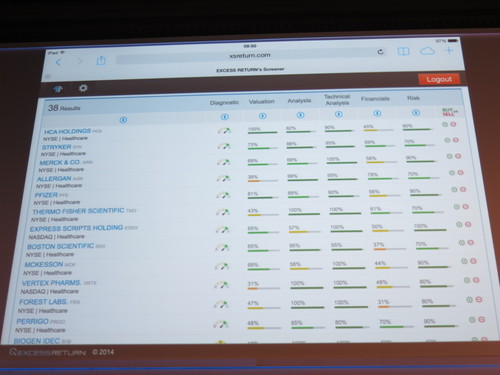

Our next innovator is EXCESS RETURN with their investment innovation SCREENER/REPORT.

“EXCESS RETURN develops next generation investment tools for the financial community. SCREENER/REPORT is an automatic tool that brings an immediate and crystal clear diagnosis of a trading opportunity.

SCREENER – Open the trading ideas box. Find the most promising stocks thanks to our SCREENER mode.

REPORT – Buy? Hold? Sell? Easy to use decision tool, our REPORT module.”

Presenting Frederic Lieferinckx (Founder) and Erik Laeremans (Web Designer & Developer)

Product Launch: February 2014

Metrics: Company Ownership: private, self-funded; Employees: 2 founders (financial analysts) and 3 IT engineers. To date, we’ve contracted large accounts (online brokers, banks, and media groups) and hundreds of thousands of users use our applications. EXCESS RETURN is targeting a total revenue of €2.5 million for 2014. The company didn’t raise any money yet and the shareholders are still the same (the 2 founders).

Product distribution strategy: Direct to Business (B2B), through financial institutions, through other fintech companies and platforms, licensed

HQ: Brussels, Belgium

Founded: October 2011