In a conference dedicated to the future of banking, it is helpful to remember that there is an inherent problem in trying to “look ahead” at a time of rapid technological advances. “Just seven years ago, there was no iPhone,” reminded Niti Badarinath, senior vice president for mobile banking and payments at U.S. Bank, during his Fireside Chat session on Day Two of Bank Innovation 2015.

Fortunately, in many ways, the future is already here. And the future is as much as about demography as it about technology.

Niti Badarinath believes that millennials, a generation expected to rival baby boomers in size, have made it clear what they want from technology and commerce. And the good news is that, in this, banks are no different from any other institution that will have to adapt to new and potentially disruptive demands from a new cohort of consumers.

What matters most to millennials? According to Badarinath, location, fees, and mobile are the three areas where banks must be most sensitive to the shift in consumer preferences. Branches are not dead, he insists. But he also cited a poll showing that over 70% of millennials responding would rather go to the dentist than talk to a banker. Moreover, “fees” is a four-letter word for most millennial consumers, and a quality mobile experience is increasingly a minimum expectation for anyone under the age of 35.

What matters most to millennials? According to Badarinath, location, fees, and mobile are the three areas where banks must be most sensitive to the shift in consumer preferences. Branches are not dead, he insists. But he also cited a poll showing that over 70% of millennials responding would rather go to the dentist than talk to a banker. Moreover, “fees” is a four-letter word for most millennial consumers, and a quality mobile experience is increasingly a minimum expectation for anyone under the age of 35.

To this end, Badarinath recommends innovating around two themes: reducing friction and real-time delivery. “Tell me what I need to know when I need to know it,” is the millennial’s push-friendly mantra when it comes to the kind of interaction consumers will want from their technology, as far as Badarinath is concerned. “Relevancy is key,” he said. “The technology must be able to tell who I am, where I am, and what I’m doing.”

Here Badarinath made two especially interesting points. The first was that innovators should be wary of the lure of “feature parity.” “What is the point of making it easy to complete a loan application on a smartphone if no one is actually going to do that?” he asked. Seamlessness and continuity are important. But a simplistic approach to multichannel can create more negative experiences than positive ones. Instead, improving the technology that allows a consumer to save in one channel and retrieve in another might be the better solution. “Knowing what not to do is as important as knowing what to do,” Badarinath said.

The second point worth highlighting was his optimism that, by embracing mobile technologies, financial institutions could position themselves to onboard young, millennial customers for life. “Get them when they are young,” Badarinath said, “and keep them through their transitions.”

“If you look ahead far enough,” he explained, “the 25-year-old with $500 in the bank is more valuable than the 60-year-old with $5,000. We have to change the way we value our customers.”

Badarinath admits it’s not yet a conversation he is “winning every time” when he talks with banks. It is true that millennials are limited in terms of providing fee revenue, and are still net spenders rather than net savers. But a little look down the road can go a long way, and mobile is what might help banks get there. “Mobile is a way of growing the bank in the direction people are moving,” Badarinath said.

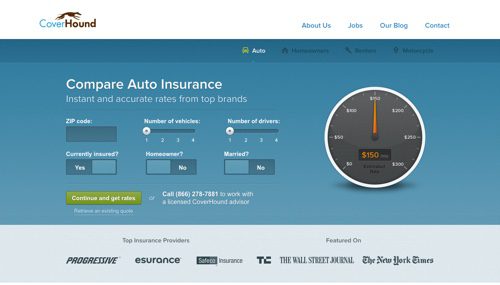

CoverHound

CoverHound