Total raised: $8 million

Total raised: $6 million

Finovate is part of the Informa Connect Division of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC's registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

P2Binvestor marks milestones in new credit lines, purchased invoices.

P2Binvestor marks milestones in new credit lines, purchased invoices.We have only been tracking fintech investments across all companies since Aug 1. But I’m pretty sure that even if we’d been doing it for 20 years, there would never have been a month as frenzied as October.

P2Binvestor, the Denver-based crowdfunding platform, announced today that it reached two major milestones this week. The receivables-secured SME lender has originated more than $10.5 million in lines of credit to 19 clients, and purchased more than $24 million in invoices since May.

At this pace, P2Binvestor believes it will reach $35 million in credit lines extended by the middle of next year. “Crowdlending is perfect for younger, fast-growing companies that need a good chunk of working capital to get to the next growth stage,” said P2Binvestor President Krista Morgan.

Smartphone checkbook app MagicMony powered by VerifyValid. Read our CEO interview with VerifyValid CEO Paul Doyle here.

Smartphone checkbook app MagicMony powered by VerifyValid. Read our CEO interview with VerifyValid CEO Paul Doyle here.Gremln, the company dedicated to making it easier for banks and other financial institutions to benefit from social media, has secured a new investment of half a million dollars from Cultivation Capital.

The new funding takes Gremln’s total capital to nearly $2 million.

We’re in Vegas this week, catching up with several Finovate and FinDEVr alums. Before the week even started, however, we took a gamble and spent the weekend at the Money20/20 Hackathon.

Many Finovate and FinDEVr alums have powerful APIs to enable the creation of solutions to solve all types of problems. At the hackathon, the crowd of 450 developers, engineers, and entrepreneurs developed a myriad of solutions over the course of 25 hours.

Here are the winners for each company:

Bionym winners:

MasterCard winner:

store, liking the company on Facebook, and making purchases in the store. The points are added to the consumer’s Modo Payments app.

CEO Paul Hoeper confirmed the WhoGotFunded.com report yesterday that InvoiceASAP had raised $696,000 in new funding.

The company’s SEC Form D filing is available here. The investment takes InvoiceASAP’s total capital to more than $1 million.

Braintree announces new service that makes it easier for merchants to sign up for the platform.

Braintree announces new service that makes it easier for merchants to sign up for the platform.

Trustly, the Swedish payments company that began 2014 with a deal to make Groupon easier to use for customers at seven Swedish banks, is closing out the year with a €23 million ($30 million USD) investment courtesy of Bridgepoint Development Capital.

Carl Wilsson, Trustly CEO, said that the investment from Bridgepoint will help fuel the company’s European expansion. Trustly is live in eight European countries, and covers 57 banks representing 67 million consumers. The company currently processes more than seven million payments a year.

Oberthur and SecureKey announce collaboration to enable secure cloud transactions.

Oberthur and SecureKey announce collaboration to enable secure cloud transactions.

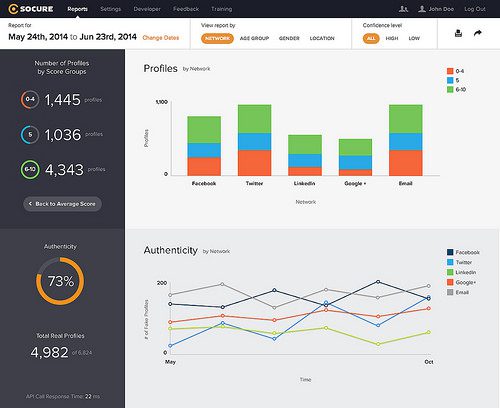

Online security companies are always working to stay one step ahead of fraudsters. Socure, a New York-based company is out to fight these malevolent deeds with an approach it calls Social Biometrics.

As it turns out, it pays to be good. The company just closed a $2.5 million round of funding this week. Investors include:

This, added to Socure’s $2.2 million Seed round it generated in March, brings the company’s total funding to $4.7 million.

Socure’s fraud detection solution uses people’s social behavior across networks to determine the authenticity of their identity. See their debut of Social Biometrics at FinovateFall 2013.