![]() This post is part of our live coverage of FinovateFall 2015.

This post is part of our live coverage of FinovateFall 2015.

The co-CEOs of Crowdability are next.

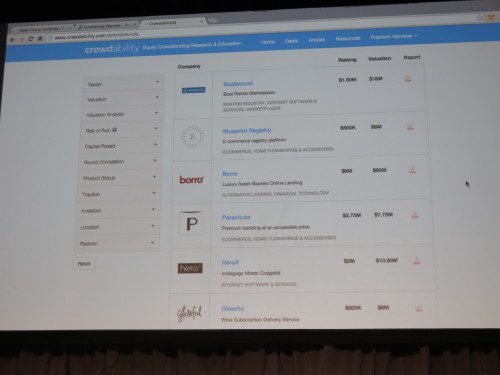

CrowdabilityIQ is the world’s first independent “stock screener” for early stage private companies. It provides subscribers with a way to quickly identify the most promising private market investments.

Each day, the CrowdabilityIQ software automatically gathers and analyzes data about new startups that are raising capital on various funding platforms. After collecting data from the platforms and other online sources, CrowdabilityIQ prepares an easy-to-understand, 10- to 15-page research report on each investment opportunity, including a number of proprietary metrics and data points. Investors can use the CrowdabilityIQ interface to rapidly filter and surface reports and opportunities that are most suitable for their investment objectives.

Presenters: Crowdability’s Co-CEOs Matthew Milner and Wayne Mulligan

Product Launch: September 2015

Metrics: $1 million raised; 50,000+ subscribers

Product distribution strategy: Direct to Consumer (B2C)

HQ: New York City, New York

Founded: March 2014

Website: crowdability.com

Twitter: @crowdability