There may be a bubble in tech investing. But if there’s one in the fintech sector, the dozens of investors in these 23 companies didn’t get the memo.

There may be a bubble in tech investing. But if there’s one in the fintech sector, the dozens of investors in these 23 companies didn’t get the memo.

In the last full non-holiday week of the year, $685 million poured into fintech companies worldwide. The vast majority went into alt-lending, including NYC-based Pave, $300 million; Australian P2P platform MoneyPlace, $60 million from Auswide Bank; and Chinese lenders Fengjr.com, $80 million, and Dashu Finance, $77 million.

Three Finovate alums banked a total of $65 million:

With just two holiday-shortened weeks remaining in the year, the total invested in private fintech companies YTD now stands at $18.8 billion.

Here are the deals by size from 12 Dec to 18 Dec 2015:

Pave

Person-to-person lender

Latest round: $300 million Private Equity

Total raised: $300 million

HQ: New York City, New York

Tags: Consumer, lending, youth market, alt-credit, underwriting, sub-prime, loans, P2P, investing

Source: Crunchbase, WSJ

Fengjr.com (aka Phoenix Finance)

Alt-lender to consumers

Latest round: $80 million

Total raised: $80 million

HQ: Beijing, China

Tags: Consumer, lending, underwriting, loans, credit

Source: FT Partners

Dashu Finance

Consumer alt-lender

Latest round: $77 million Series B

Total raised: $93 million

HQ: Shenzen, China

Tags: Consumer, lending, P2P, underwriting, loans

Source: Crunchbase

MoneyPlace

P2P lender

Latest round: $60 million; $300 million valuation

Total raised: Unknown

HQ: Australia

Tags: Consumer, lending, credit, loans, person-to-person, peer-to-peer, Auswide Bank (investor)

Source: Lets Talk Payments

Gusto (fka ZenPayroll)

Payroll services

Latest round: $50 million Series C

Total raised: $136.1 million

HQ: London, England, United Kingdom

Tags: SMB, payroll, payments, HR, Finovate alum

Source: Finovate

CloverHealth

Health insurance

Latest round: $35 million Series B

Total raised: $135 million

HQ: San Francisco, California

Tags: Consumer, insurance, healthcare, payments

Source: Crunchbase

NextCapital

Investing and portfolio management

Latest round: $16 million Series B

Total raised: $22.3 million

HQ: Chicago, Illinois

Tags: Consumer, investing, wealth management, 401(k), aggregation, portfolio management

Source: Crunchbase

Trulioo

Online identify verification

Latest round: $15 million

Total raised: $23.3 million

HQ: London, England, United Kingdom

Tags: Enterprise, security, authentication, security, Finovate alum

Source: Finovate

Oration

Tools for self-insured businesses

Latest round: $11.2 million Series A

Total raised: $12.2 million

HQ: Foster City, California

Tags: Enterprise, SMB, insurance, healthcare, payments

Source: Crunchbase

FinTech Group

Diversified financial technology provider

Latest round: $11 million Post-IPO equity

Total raised: Unknown

HQ: Frankfurt, Germany

Tags: Enterprise, payments, IT solutions, trading, investing management

Source: FT Partners

Bench

High-tech and high-touch bookkeeping services

Latest round: $6.1 million

Total raised: $16.1 million

HQ: Vancouver, British Columbia, Canada

Tags: Accounting, SMB, bookkeeping, Techstars, Vancouver, Canada

Source: Crunchbase

CardLab

Residential and commercial property search

Latest round: $6.0 million Series A

Total raised: $6.0 million

HQ: Herlev, Denmark

Tags: Enterprise, credit/debit cards, hardware, card manufacturing

Source: Crunchbase

DealCloud

Workflow tool for investment bankers

Latest round: $5.3 million Series A

Total raised: $5.57 million

HQ: Charlotte, North Carolina

Tags: Enterprise, investing, trading, deals, investment banking

Source: Crunchbase

Gastrofix

Point-of-sale system for restaurants and hotels

Latest round: $4 million Series A

Total raised: $4 million

HQ: Berlin, Germany

Tags: SMB, payments, POS, ePOS, mPOS, credit/debit card acquiring, merchants

Source: Crunchbase

TransferGo

Remittance service

Latest round: $2.5 million Seed

Total raised: $2.5 million

HQ: London, England, United Kingdom

Tags: Consumer, payments, remittances, fx, mobile

Source: Crunchbase

Factom

Blockchain technology for businesses

Latest round: $1.5 million

Total raised: $3.04 million

HQ: Austin, Texas

Tags: B2B, SMB, blockchain, bitcoin, cryptocurrency

Source: Crunchbase

Indexa Capital

Low-cost investment portfolio management

Latest round: $1.2 million

Total raised: $1.2 million

HQ: Madrid, Spain

Tags: Consumer, investing, mutual funds, wealth management

Source: FT Partners

Bewa7er

Secondary market for private company shares

Latest round: $1 million Seed

Total raised: $1.24 million

HQ: Bilbao, Spain

Tags: SMB, consumer, trading, equity, investing

Source: Crunchbase

PayJoy

Consumer point-of-sale financing

Latest round: $1 million Debt

Total raised: $2.3 million

HQ: Palo Alto, California

Tags: Consumer, lending, point-of-sale financing, payments, loans, lending, underwriting

Source: Crunchbase

Capcito

Receivables financing

Latest round: $600,000

Total raised: $600,000

HQ: Stockholm, Sweden

Tags: SMB, factoring, financing, commercial lending, underwriting

Source: Crunchbase

Nous Global Markets

Crowdsourcing financial market predictions

Latest round: $290,000

Total raised: $1.9 million

HQ: London, England, United Kingdom

Tags: Consumer, trading, investing, gamification Finovate alum

Source: Finovate

DotDashPay

Payments for the internet of things

Latest round: $250,000 Award

Total raised: $250,000

HQ: Oakland, California

Tags: B2B, SMB, IoT, payments, API, developers

Source: Crunchbase

VentureCrowd

Platform for investing in startups

Latest round: Undisclosed

Total raised: Unknown

HQ: Sydney, Australia

Tags: SMB, investing, crowdfunding, equity, P2P

Source: Crunchbase

While I have

While I have

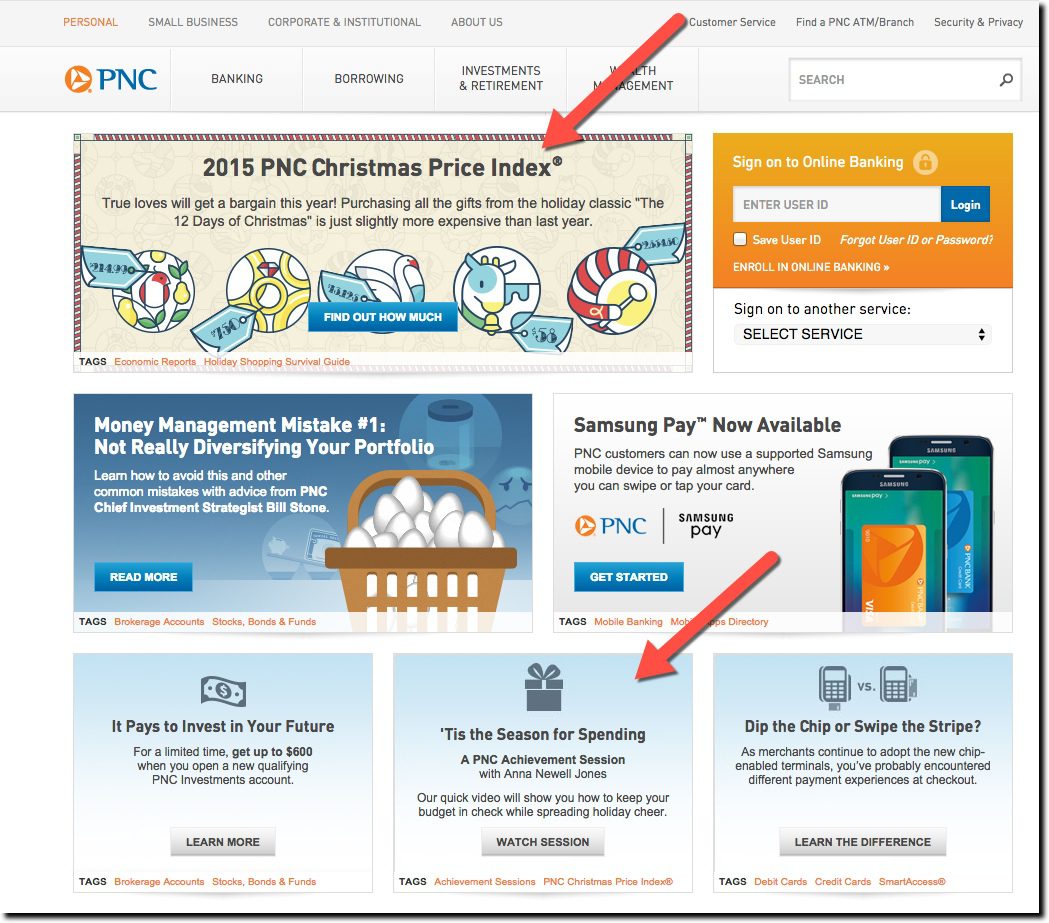

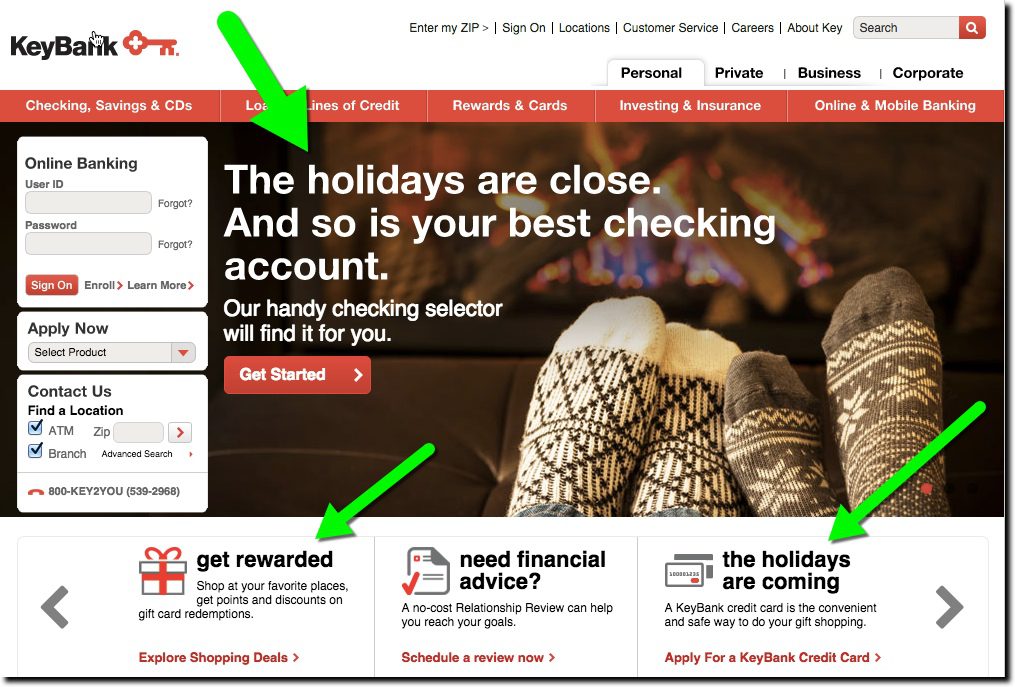

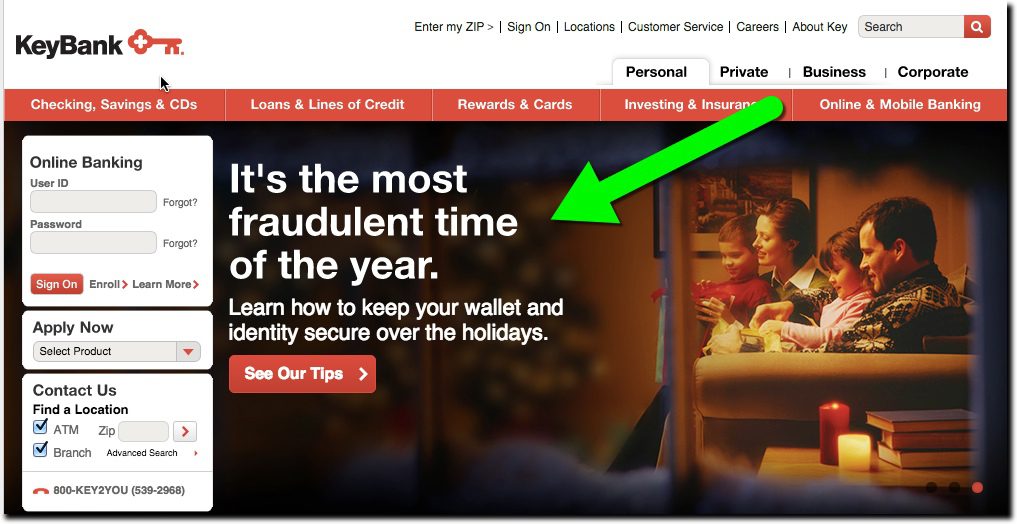

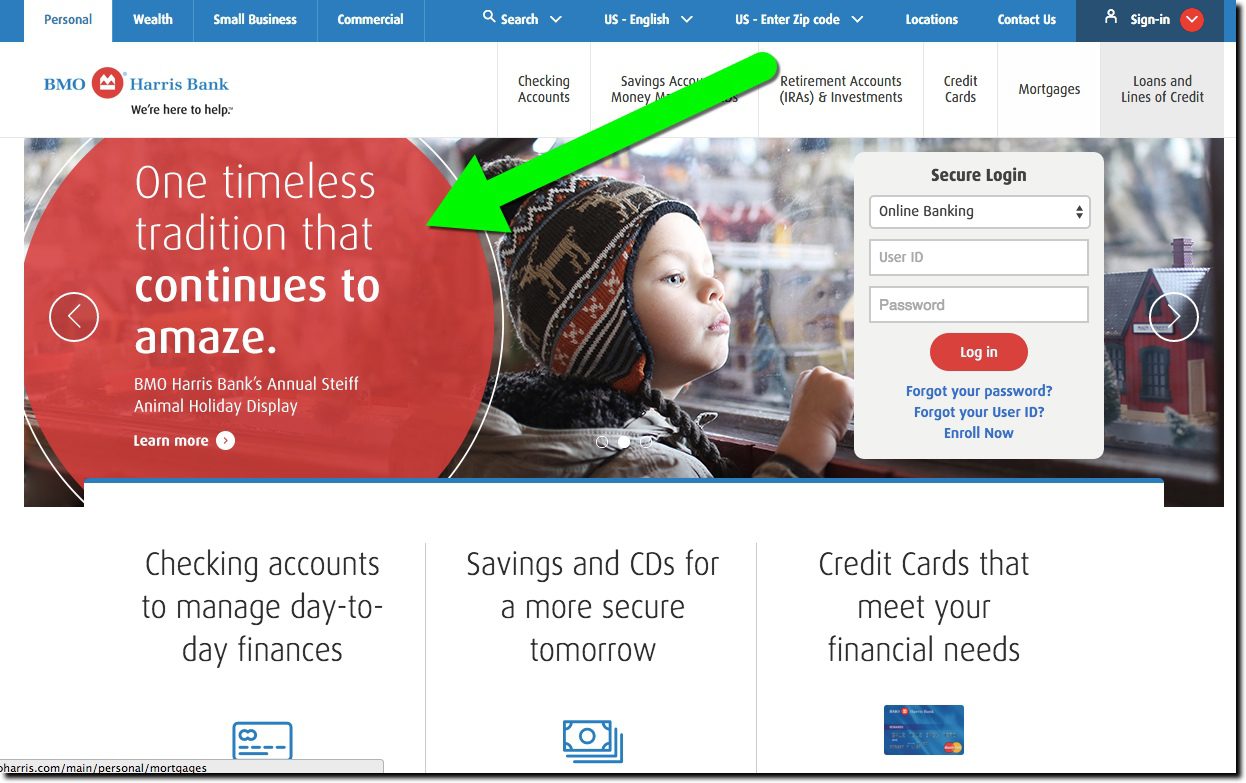

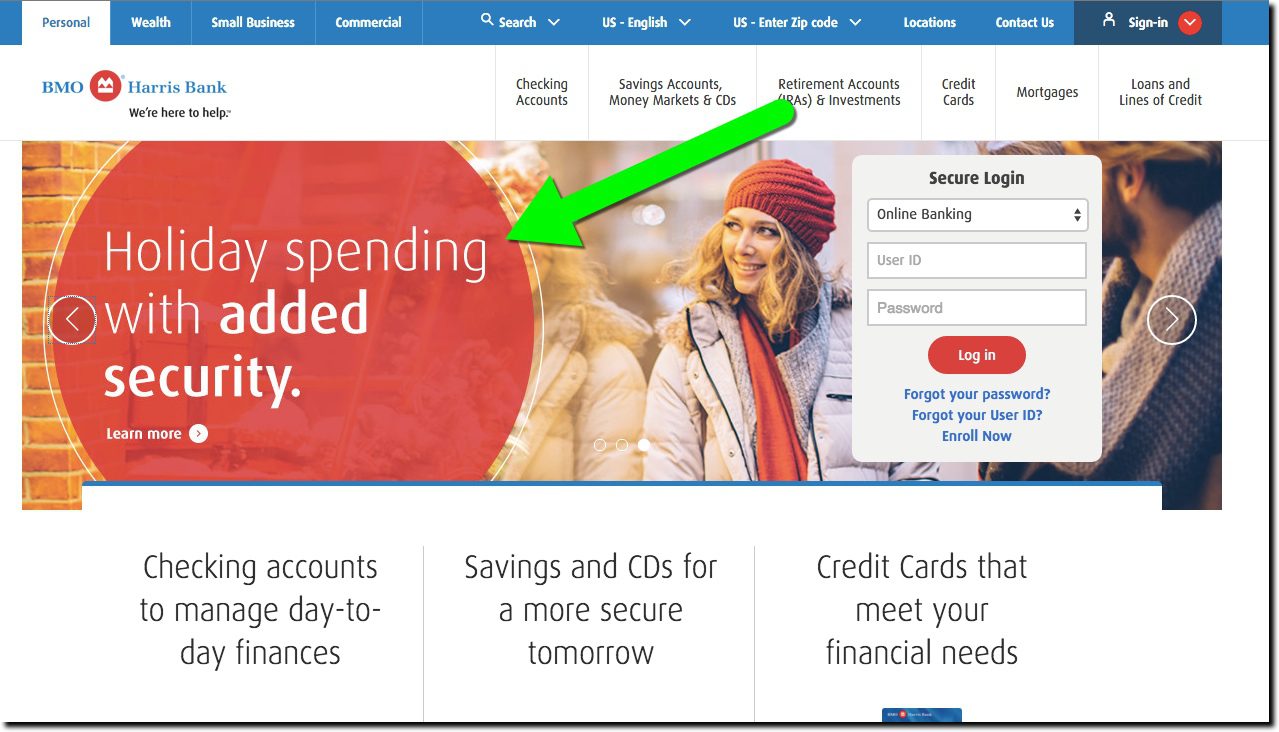

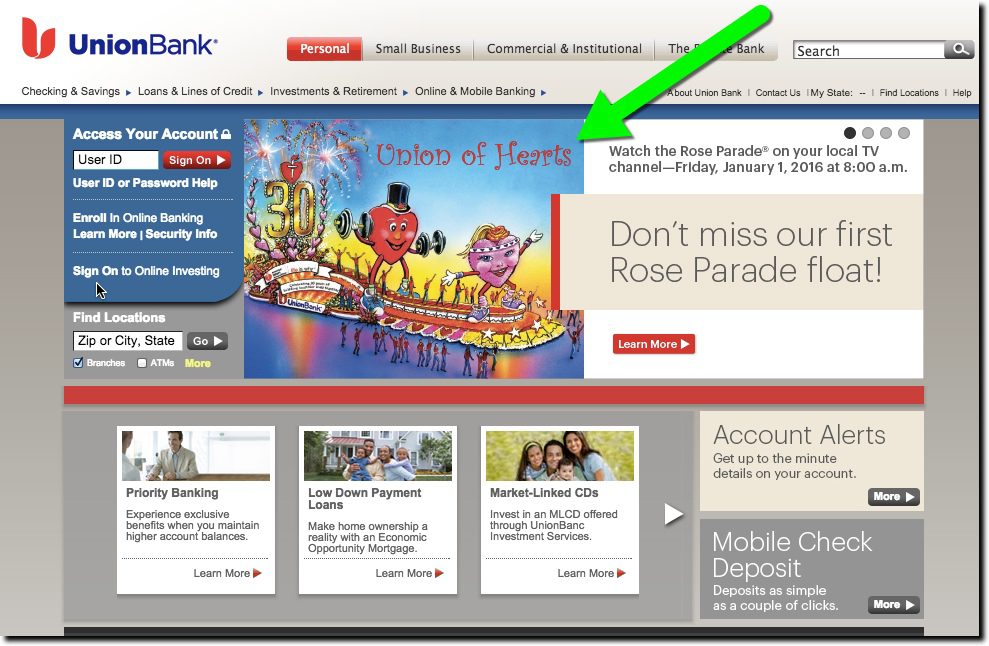

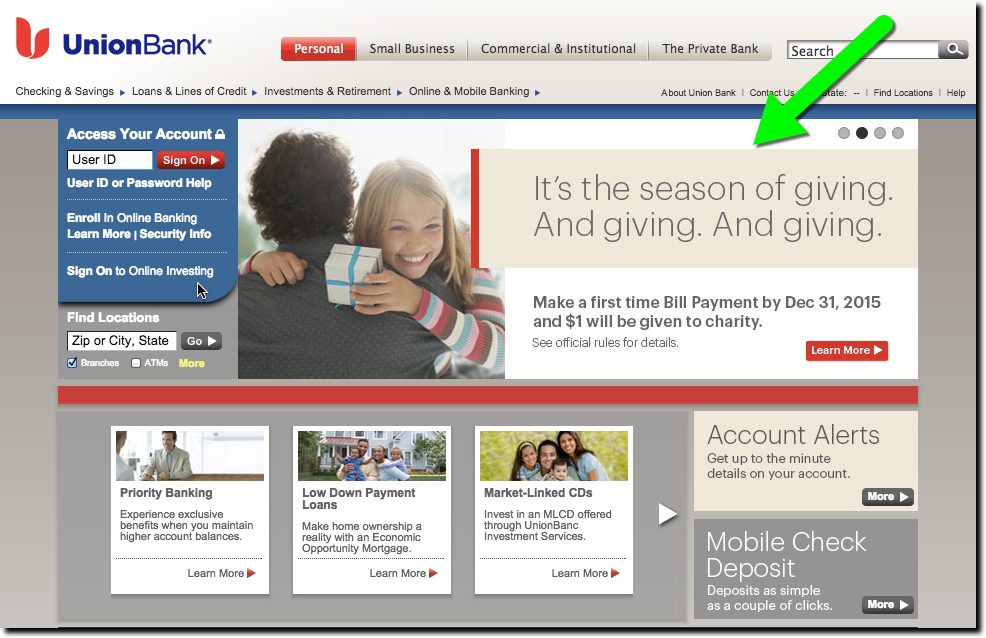

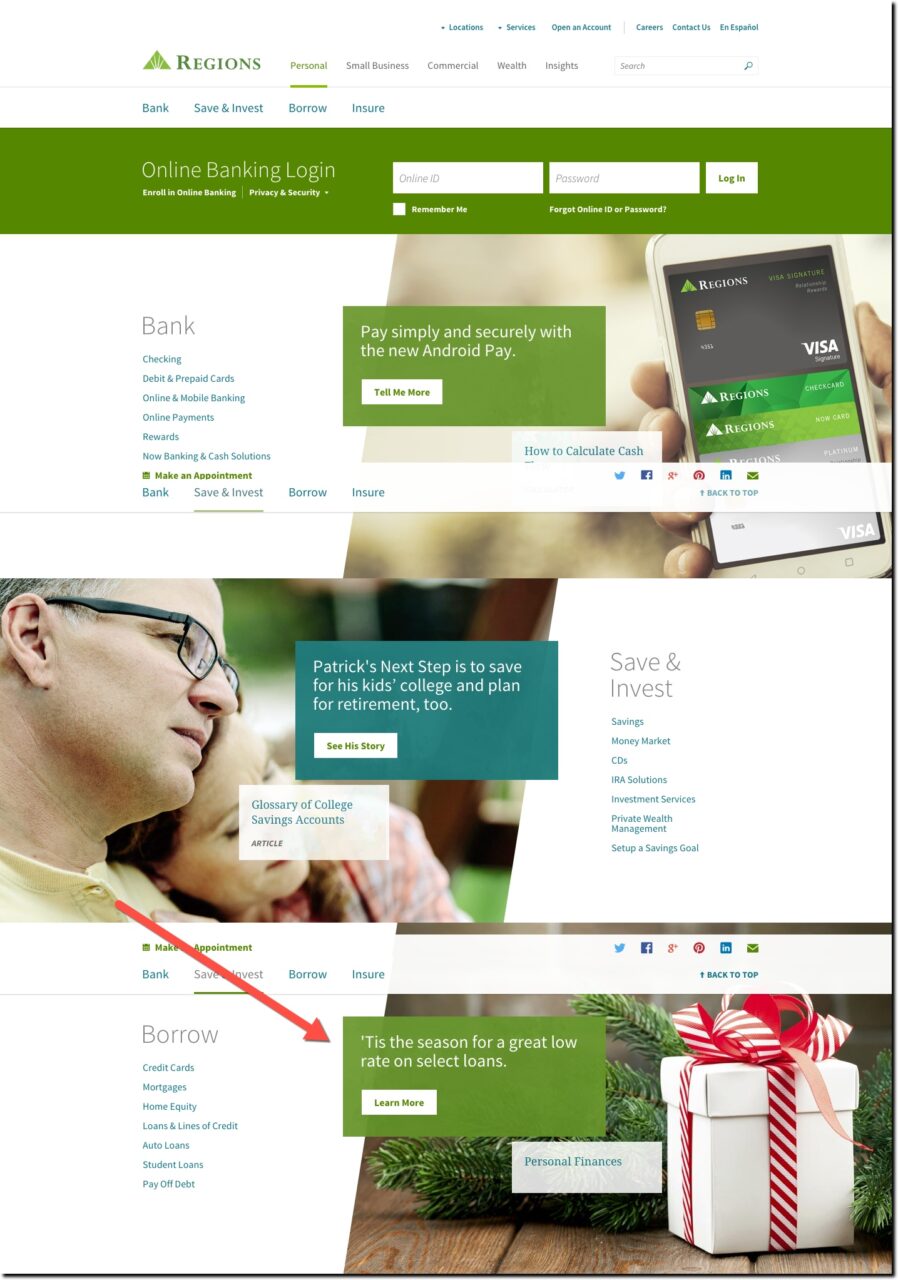

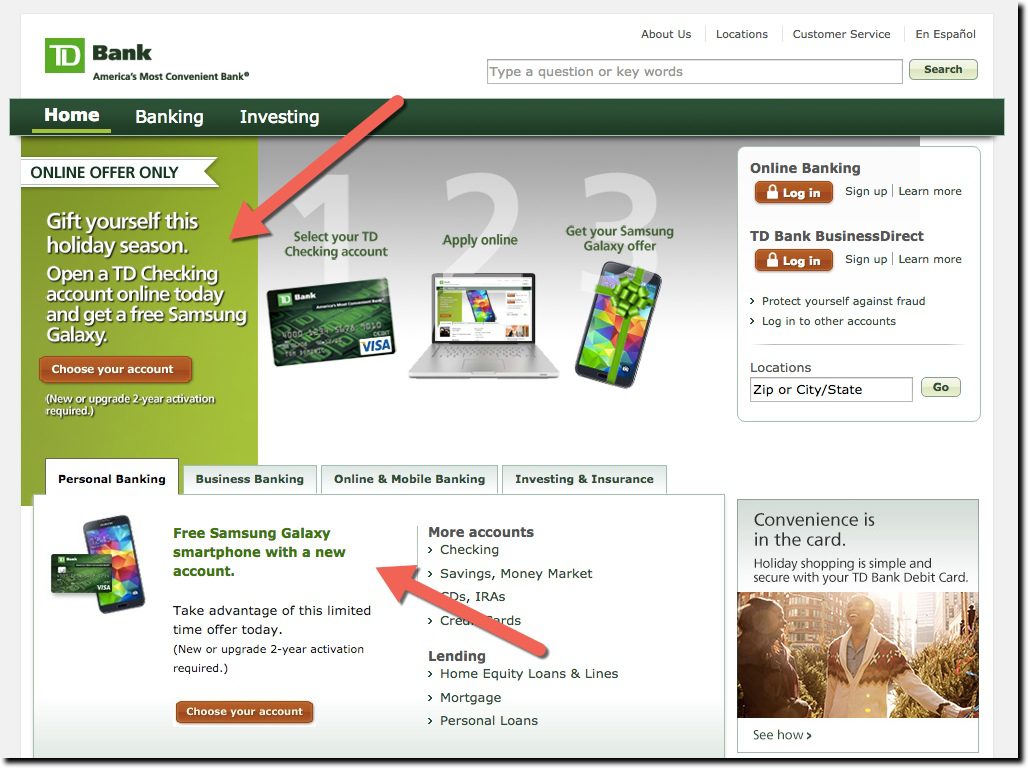

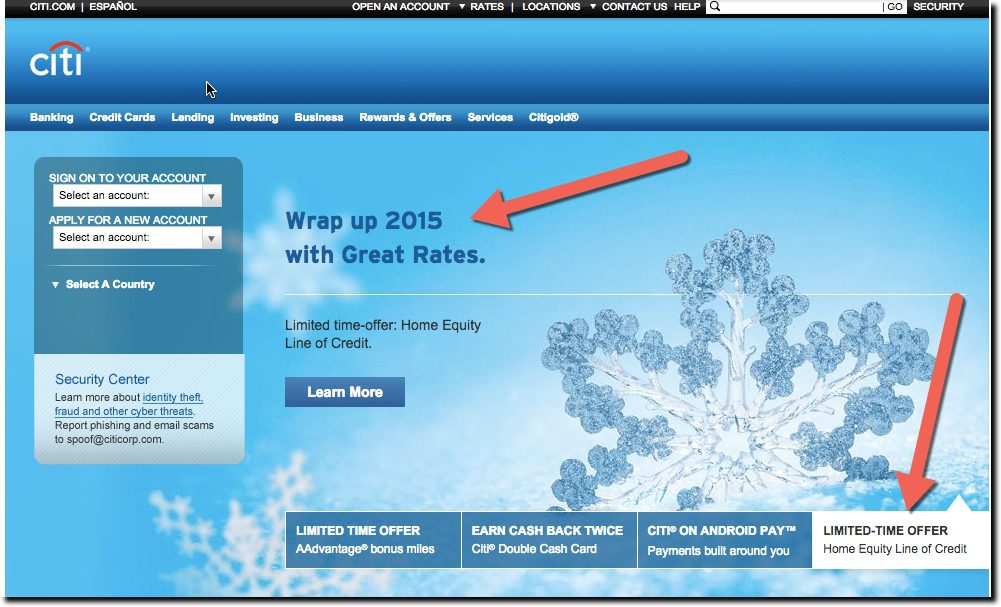

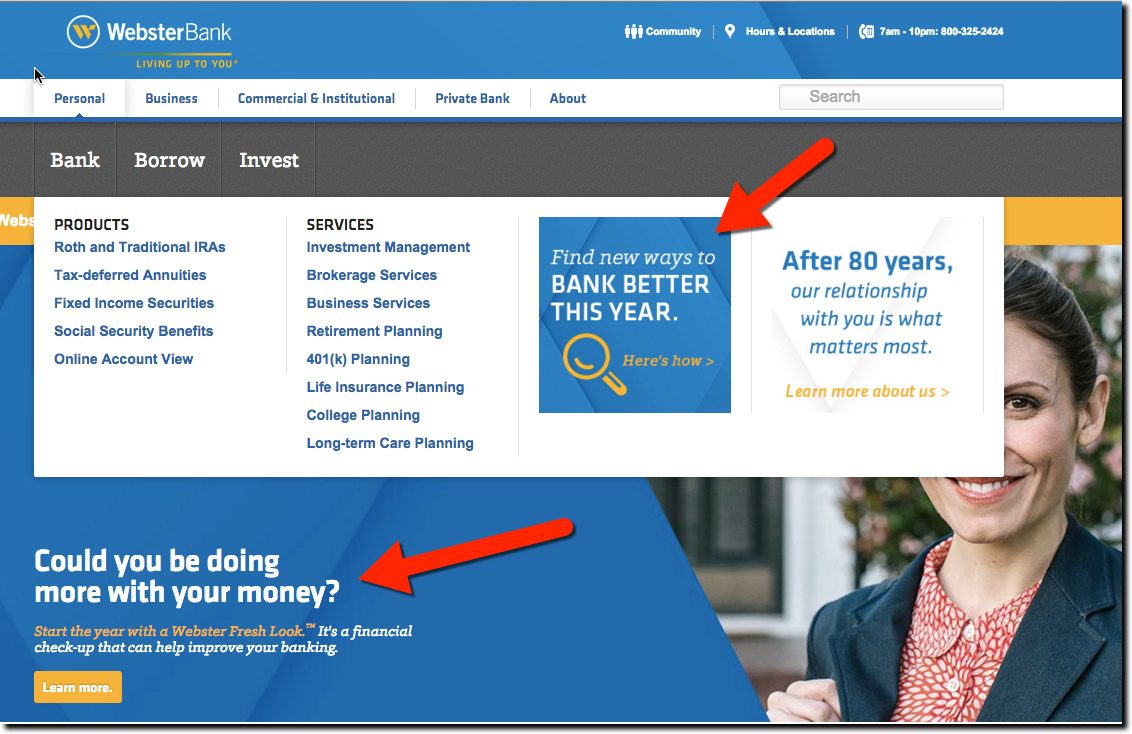

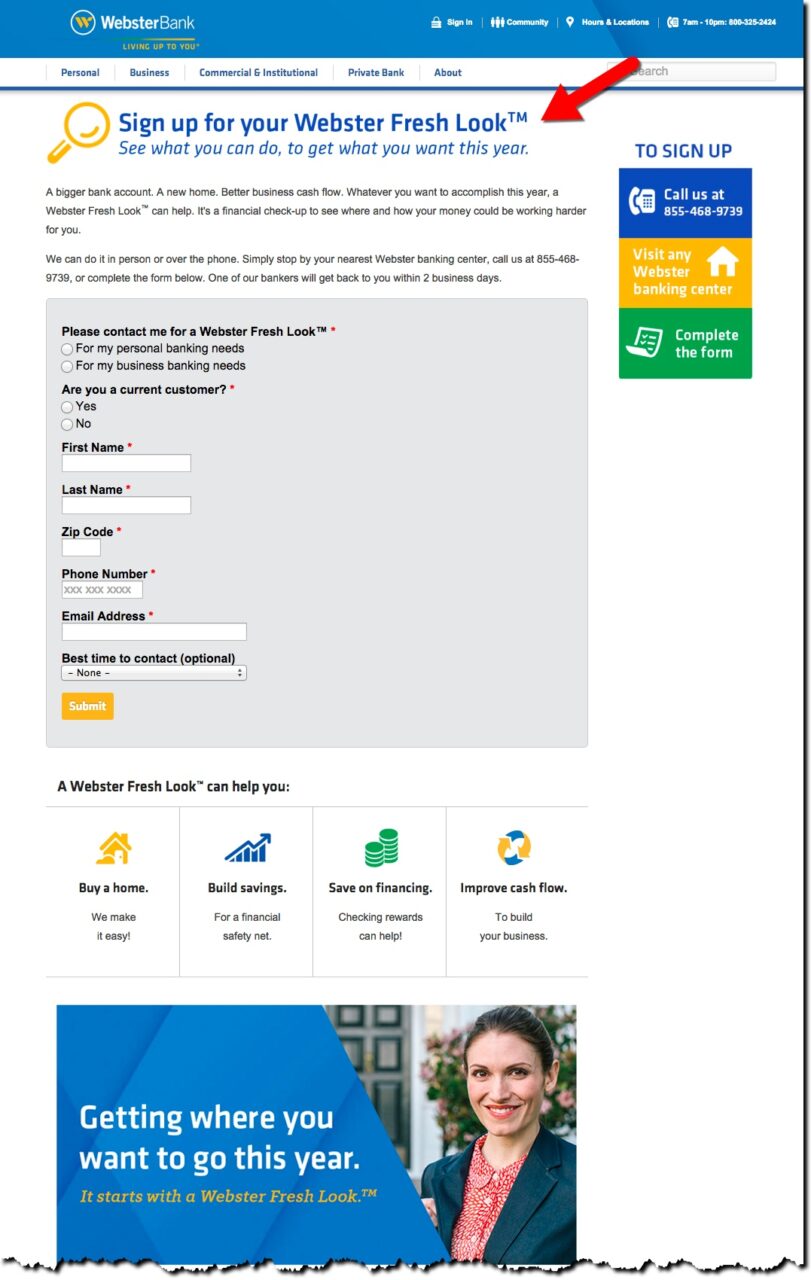

The end of the year provides a unique challenge to banks. Customers are busy buying gifts, finishing year-end projects at work, and preparing for holiday travel, meal prep and/or extended family time. There isn’t an abundance of deep thought about long-term financial plans, other than how to pay down inflated December credit card bills.

The end of the year provides a unique challenge to banks. Customers are busy buying gifts, finishing year-end projects at work, and preparing for holiday travel, meal prep and/or extended family time. There isn’t an abundance of deep thought about long-term financial plans, other than how to pay down inflated December credit card bills.