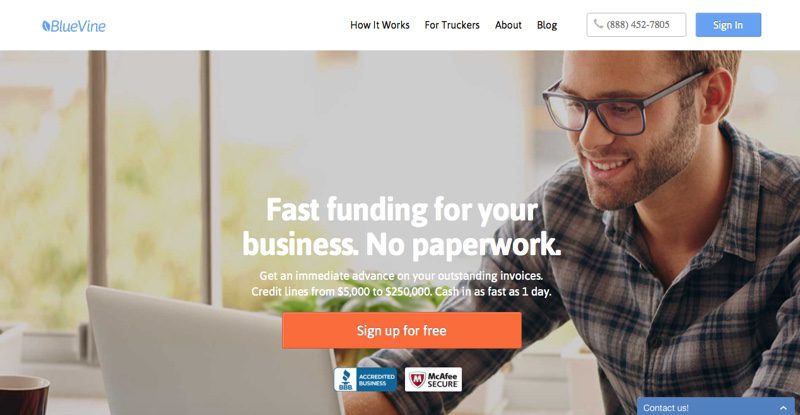

BlueVine, a startup that provides financing for small businesses, has raked in $40 million in new funding. The Series C round, led by Menlo Ventures, featured participation from new investor, Rakuten, and boosts BlueVine’s total capital to more than $64 million.

In a post at the company blog, BlueVine founder, CEO Eyal Lifshitz, said the investment would help “bolster its management ranks” as well as drive new feature development and exploration of new verticals. “With this capital infusion,” Lifshitz said, “our team is excited to work with more SMB owners to solve their cash-flow challenges on a greater scale.” BlueVine also announced an expansion of its maximum credit line from $150,000 to $250,000.

From left: BlueVine VP of Operations Edward Castano and CEO Eyal Lifshitz demonstrated their platform at FinovateFall 2014 in New York.

BlueVine specializes in cloud-based “invoice financing,” also called “factoring.” The practice helps small- and medium-sized businesses manage cash flow and payment cycles by advancing cash against outstanding invoices via a simple, online solution. BlueVine enables SMEs to get paid on “day one” for invoices due in 15-90 days with credit lines starting at $5,000. BlueVine reported a 12-fold increase in funded invoices in 2015 and expects to fund more than $200 million in working capital in 2016. Tyler Sosin of Menlo Ventures praised the company for “bringing automation and a modern web experience to factoring, a massive market that has yet to be optimized by technology.”

Founded in July 2013 and headquartered in Palo Alto, California, BlueVine demonstrated its technology at FinovateFall 2014. BlueVine’s approach to factoring was profiled by PYMNTS.com in September and, in February, the company was highlighted by Fast Company as one of “The World’s Top 10 Most Innovative Companies of 2015 in Money.”

Presenters

Presenters Bartosz Dobrowolski, Customer Success Director at Uselab

Bartosz Dobrowolski, Customer Success Director at Uselab

Dom Wolf, CMO and co-founder

Dom Wolf, CMO and co-founder

Larky’s co-founders Andrew Bank and Gregg Hammerman demoed at FinovateFall 2014 in New York.

Larky’s co-founders Andrew Bank and Gregg Hammerman demoed at FinovateFall 2014 in New York.

Presenters

Presenters Einar Thor Gustafsson, Vice President of Product Management

Einar Thor Gustafsson, Vice President of Product Management

Founded with a mission to eliminate the fees that often accompany both spending and transferring money, Revolut has been used by more than 80,000 people in 150 countries. More than $180 million has been transacted via the app, saving users an estimated $15 million. With the RevolutCard, users can make purchases worldwide in any one of 90 different currencies. And with the Revolut app, users can make instant money transfers through SMS, social media, and email, all without fees or a bank intermediary.

Founded with a mission to eliminate the fees that often accompany both spending and transferring money, Revolut has been used by more than 80,000 people in 150 countries. More than $180 million has been transacted via the app, saving users an estimated $15 million. With the RevolutCard, users can make purchases worldwide in any one of 90 different currencies. And with the Revolut app, users can make instant money transfers through SMS, social media, and email, all without fees or a bank intermediary.

Presenter

Presenter

Presenters

Presenters Luis Rodriguez, Product Evangelist

Luis Rodriguez, Product Evangelist

Presenters

Presenters

Jay Hummel, SVP, Advisory Services

Jay Hummel, SVP, Advisory Services