With Coinbase and Motif Investing both winning a place on Fast Company’s list of Most Innovative Companies of 2016, it looks like bitcoin and innovations in investing remain two of fintech’s hottest trends.

With Coinbase and Motif Investing both winning a place on Fast Company’s list of Most Innovative Companies of 2016, it looks like bitcoin and innovations in investing remain two of fintech’s hottest trends.

Fast Company Editor Robert Safian said, “This year’s package – which includes top ten lists in 27 sectors – emphasizes the breadth of companies with progressive, agile business models, cultures of creativity, and ability to adapt in today’s fast-paced world.” Fast Company added that 2016 also marked the first year the magazine used machine intelligence – in this case, technology from a San Francisco company called Quid – to “help inform the list.” The list will be published in the March 2016 issue of the magazine.

Fast Company’s “Most Innovative” roster for 2016 headlines with familiar brands and businesses like BuzzFeed, Facebook, and CVS Health (“for becoming a one-stop health stop”). Coinbase and Motif Investing are among ten companies earning recognition in Fast Company’s Finance category: Coinbase “for making bitcoin user-friendly” and Motif Investing “for expanding its theme-based trading.”

![]() The news comes as Coinbase CEO and co-founder Brian Armstrong made headlines in the debate over how to scale bitcoin. Armstrong favors an approach that would immediately double capacity, as opposed to other proposals that would increase capacity by as much as 4x over a longer period of time.

The news comes as Coinbase CEO and co-founder Brian Armstrong made headlines in the debate over how to scale bitcoin. Armstrong favors an approach that would immediately double capacity, as opposed to other proposals that would increase capacity by as much as 4x over a longer period of time.

Last month, Coinbase announced that the 30Shift Card, a bitcoin Visa debit card launched in partnership with Shift Payments in November, had processed more than $1 million in bitcoin and had signed up more than 10,000 cardholders. Founded in 2012 and headquartered in San Francisco, Coinbase demonstrated its Instant Exchange technology at FinovateSpring 2014.

A two-time Best of Show award-winner, Motif Investing demonstrated its Advisor Platform at FinovateSpring 2014. Last month, Motif debuted its recurring transfers feature, and in October, the company partnered with JP Morgan to give investors on the Motif platform access to shares in JP Morgan-managed initial public offerings.

A two-time Best of Show award-winner, Motif Investing demonstrated its Advisor Platform at FinovateSpring 2014. Last month, Motif debuted its recurring transfers feature, and in October, the company partnered with JP Morgan to give investors on the Motif platform access to shares in JP Morgan-managed initial public offerings.

Founded in 2010 and headquartered in San Mateo, California, Motif Investing CEO is Hardeep Walia, who is also a co-founder.

Prepaid card and digital commerce company

Prepaid card and digital commerce company

United Capital CEO Joe Duran

United Capital CEO Joe Duran

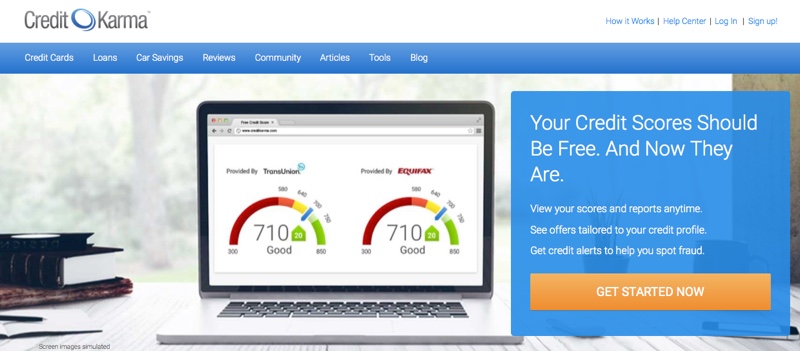

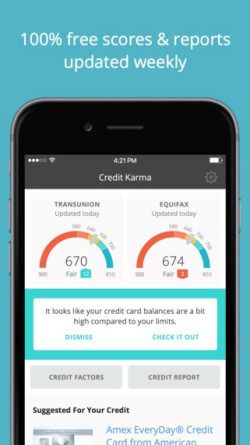

Calling the redesign a “major reimagining,” Jonathan Chao, mobile product manager for Credit Karma, noted that user behavior strongly influenced the new look and feel of the app. “It has some of our most direct, specific and proactive product features to date, and we’re excited that we can finally show it off to our members,” Chao said.

Calling the redesign a “major reimagining,” Jonathan Chao, mobile product manager for Credit Karma, noted that user behavior strongly influenced the new look and feel of the app. “It has some of our most direct, specific and proactive product features to date, and we’re excited that we can finally show it off to our members,” Chao said. Credit Karma’s new app redesign isn’t the only news the company is making in 2016. In January, Credit Karma announced the

Credit Karma’s new app redesign isn’t the only news the company is making in 2016. In January, Credit Karma announced the