First quarter closed with a bang as 21 companies raised a total of nearly a half-billion of new funding ($458 million), all equity as far as we know.

First quarter closed with a bang as 21 companies raised a total of nearly a half-billion of new funding ($458 million), all equity as far as we know.

The total number of deals in first quarter was 334, double last year’s 171. Total dollars raised in Q1 stands at $6.7 billion, also double the $3.3 billion raised in Q1 2015.

Three Finovate or FinDEVr alums, two of which presented at FinDEVr NYC last week (Betterment, Stratumn), brought in new investments:

Here are the fintech deals by size from 26 March to 1 April 2016:

Ceridian

Human resources, payroll and health insurance platform

Latest round: $150 million Private Equity

Total raised: Unknown

HQ: Minneapolis, Minnesota

Tags: SMB, healthcare, insurance, payroll, benefits, HR, employees

Source: Crunchbase

Betterment

Consumer online investment platform

Latest round: $100 million Series E ($700 million valuation)

Total raised: $205 million

HQ: New York City

Tags: Consumer, investing, robo-adviser, ETFs, retirement, Finovate alum

Source: Finovate

Real Matters

Real estate transaction management technology

Latest round: $76.7 million ($500 million valuation)

Total raised: $136.7 million

HQ: California

Tags: SMB, real estate brokers, home buying, mortgages, insurance, title insurance

Source: FT Partners

Figtree Financing

Financing solutions for energy saving improvements at commercial properties

Latest round: $30 million Series A

Total raised: $30 million

HQ: California City, California

Tags: SMB, commerical real estate, energy conservation, lending, underwriting

Source: Crunchbase

Splitit

PayItSimple consumer credit service

Latest round: $22.5 million ($56 million valuation)

Total raised: Unknown

HQ: New York City

Tags: Consumer, payments, credit, lending, POS, merchants, in-store financing, underwriting

Source: FT Partners

Blispay

In-store financing service

Latest round: $12.75 million

Total raised: $12.75 million

HQ: California

Tags: SMB, consumer lending, loans, POS, merchants, in-store financing, P2P, peer-to-peer, underwriting, personal finance

Source: FT Partners

LoanLogics

Mortgage loan quality and performance-maagement software

Latest round: $10.03 million

Total raised: $22.46 million

HQ: Fort Washington, Pennsylvania

Tags: Financial institutions, mortgage brokers, consumer lending, analytics, underwriting, compliance, regulations

Source: Crunchbase

Swanest

Consumer investing service

Latest round: $10 million Seed

Total raised: $10 million

HQ: London, England, United Kingdom

Tags: Consumer lending, investing, portfolio management, trading, wealth management, robo-adviser, Andreessen Horowitz (investor)

Source: FT Partners

Branch

Smartphone based alt-credit and underwriting for underbanked

Latest round: $9.2 million

Total raised: $9.2 million

HQ: San Francisco, California

Tags: Consumers, SMB, lending, loans, underbanked, unbanked, emerging markets, credit, credit score, underwriting

Source: Crunchbase

Bluefin Payment Systems

PayConex payment platform

Latest round: $6 million

Total raised: $6 million

HQ: Atlanta, Georgia

Tags: SMB, payments, security, merchants, acquiring, FinDEVr alum

Source: FinDEVr

Wave

Suite of small business tools for payroll, accounting, invoicing, payments

Latest round: $5.07 million

Total raised: $44.77 million

HQ: Toronto, Ontario, Canada

Tags: SMB, accounting, bookkeeping, accounts receivables, payables, payments, billing, billpay, invoicing

Source: Crunchbase

Veritas Finance

Banking services for the under- and non-banked

Latest round: $4.5 million Series A

Total raised: $4.5 million

HQ: Guindy, India

Tags: Consumer, lending, deposits, loans, payments, banking, underbanked, non-banked

Source: Crunchbase

Bitt

Bitcoin exchange and remittance platform

Latest round: $4 million Series A

Total raised: $5.5 million

HQ: Hastings, Barbados

Tags: Consumer, payments, bitcoin, cryptocurrency, Overstock (investor), mobile wallet, debit card, funds transfers, remittances

Source: FT Partners

Slice Labs

On-demand insurance

Latest round: $3.9 million Seed

Total raised: $3.9 million

HQ: New York City

Tags: SMB, consumer, insurance, mobile, underwriting

Source: Crunchbase

Homie

Peer-to-peer real estate marketplace

Latest round: $3.76 million

Total raised: $3.76 million

HQ: Salt Lake City, Utah

Tags: Consumer, home buying, residentail real estate, P2P, mortgage

Source: Crunchbase

LandBay

P2P real esate loan marketplace

Latest round: $3.57 million

Total raised: $6.72 million

HQ: London, England

Tags: Consumer, lending, loans, mortgage, investing, peer-to-peer, crowdfunding

Source: Crunchbase

HealthJoy

Consumer healthcare and payments platform

Latest round: $3 million Seed

Total raised: $3 million

HQ: Chicago, Illinois

Tags: Consumer, healthcare, insurance, personal financial management, benefits, spending management, billing, payments

Source: Crunchbase

EDJ Analytics

Analytics platform for financial services and other verticals

Latest round: $2.4 million Series A

Total raised: $2.4 million

HQ: Louisville, Kentucky

Tags: SMB, enterprise, analytics, gamification, trading, investing, big data

Source: FT Partners

Stratumn

Blockchain appliction platform

Latest round: $670,000 Seed

Total raised: $670,000

HQ: Paris, France

Tags: SMB, enterprise, blockchain, bitcoin, infrastructure, developers, FinDEVr alum

Source: Crunchbase

iQapla

platform

Latest round: Not disclosed

Total raised: Unknown

HQ: Madrid, Spain

Tags: Consumer, investing, trading, robo-adviser, porfolio management

Source: Crunchbase

SwitchME

Loan price comparison portal

Latest round: Not disclosed

Total raised: Unkown

HQ: Mumbai, India

Tags: Consumer, lending, loans, mortgage, personal finance, price comparison, lead gen, discovery,

Source: Crunchbase

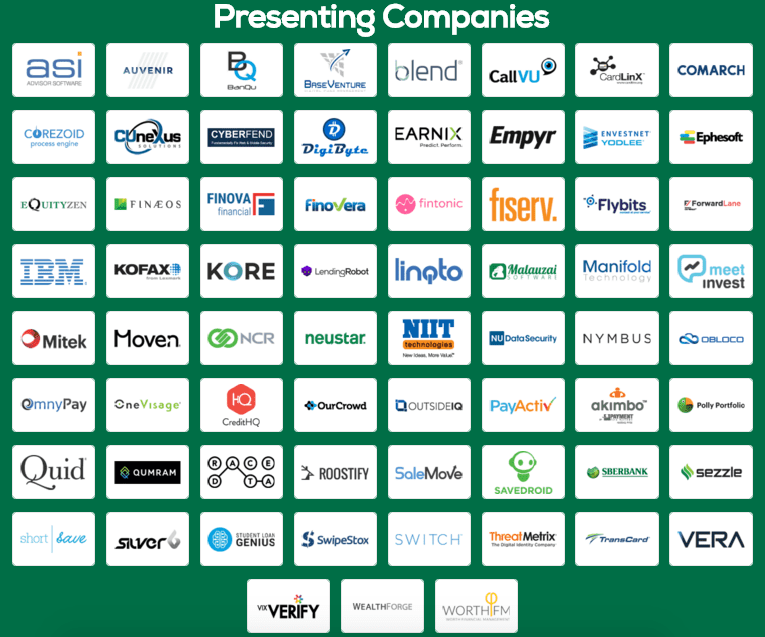

A look at the companies demoing live to 1,500+ fintech professionals on May 10 & 11. Register today.

Presenter: Safwan Shah, Founder and CEO

Presenter: Safwan Shah, Founder and CEO

Presenters

Presenters Grant Shirk, Senior Director of Product Marketing

Grant Shirk, Senior Director of Product Marketing