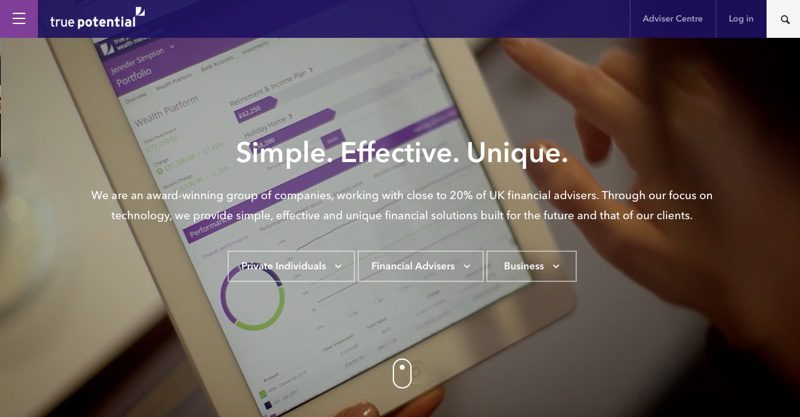

True Potential, a U.K.-based financial services group, has picked up a “significant investment” from FTV Capital. The amount paid for the minority stake in the company was not disclosed, but the investment puts True Potential’s valuation at more than £150 million (more than $213 million USD).

“Our aim at True Potential is to revolutionize the way wealth management is delivered,” said David Harrison, True Potential’s managing partner. “We believe by using technology to deliver financial services, we empower financial advisers and their clients to take control of their financial futures.”

From left: True Potential Head of Mobile Applications Paul Outterside and Senior Partner Daniel Harrison demonstrated impulseSave at FinovateFall 2014 in New York.

FTV Capital partner, Brad Bernstein, echoed this last point, adding that “as the wealth management landscape in the U.K. continues to transform, digital tools will become table stakes for advisers who want to retain existing clients and continue to grow their client bases.” Bernstein, along with fellow FTV partner, Kyle Griswold, will join True Potential’s board of directors as part of the investment.

True Potential builds and markets integrated wealth-management technology to financial advisers and retail clients. A leading U.K. platform provider, True Potential provides solutions for nearly 20% of financial advisers in the United Kingdom and serves the wealth-management needs of more than 2.1 million private clients. True Potential’s platform gives wealth managers everything from client onboarding to fee and commission reconciliation and client servicing support. Private clients enjoy a variety of features including investment options such as impulseSave, which allows clients to make micro-payments as low as a single euro to their investments.

The investment news comes at the same time that True Potential announced gross sales of more than £1 billion in 2015—the second year in a row in which revenues topped the £1 billion mark. Other recent headlines for True Potential include the launch of the company’s Managed Portfolio Series (MPS) and, on the technical side of things, the release of the company’s Apple Watch app last May. True Potential unveiled True Potential One last March to help investors consolidate and simplify their finances.

Founded in March 2007 and headquartered in Newcastle upon Tyne, United Kingdom, True Potential demonstrated its impulseSave technology at FinovateFall 2014.

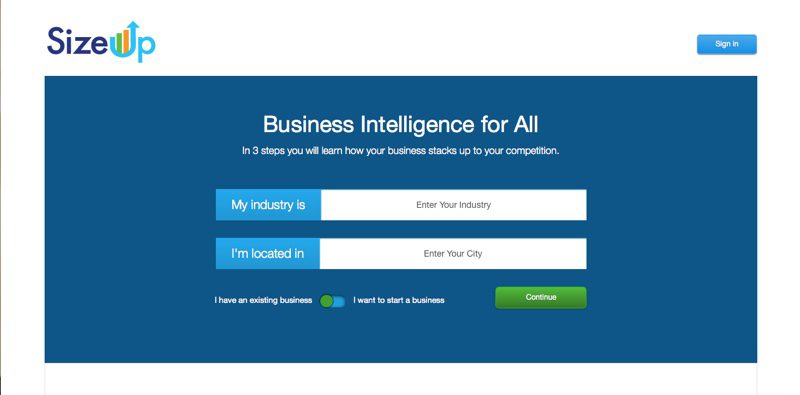

Antalio Ubalde, CEO, Founder

Antalio Ubalde, CEO, Founder Brandon Harrell, Product Manager

Brandon Harrell, Product Manager

Matt Mills, Commercial Director

Matt Mills, Commercial Director Dave Excell, CTO, Co-founder

Dave Excell, CTO, Co-founder

Pedro Almeida, Member, Board of Directors

Pedro Almeida, Member, Board of Directors Maria Domingues, Market Manager

Maria Domingues, Market Manager

Nikita Blinov, CEO

Nikita Blinov, CEO Alexander Fonarev, Chief Data Scientist

Alexander Fonarev, Chief Data Scientist Anna Laskovaya, Project Manager

Anna Laskovaya, Project Manager

David Sosna, CEO, Co-founder

David Sosna, CEO, Co-founder

In a release today, the company notes highlights from 2105:

In a release today, the company notes highlights from 2105: