Is a picture really worth 1,000 words? Thanks to a new partnership between data-visualization solution-provider, Tableau software, and natural language generation (NLG) specialist, Narrative Science, we may soon find out.

With the new Narratives for Tableau, users of Tableau Server and Tableau Public will be able to generate natural language explanations of their data visualizations. Narratives for Tableau is available as a free Google Chrome extension, and the company says the extension is the “first step” toward a greater integration between the two technologies. “We are thrilled to be partnering with Tableau, a company that equally shares our passion of helping people understand their data and act on it immediately,” Narrative Science CEO Stuart Frankel said. He praised the idea of putting Advanced NLG technology at the front of the data-discovery process, which he said gives users “the best and easiest asset for understanding and sharing information narratives.”

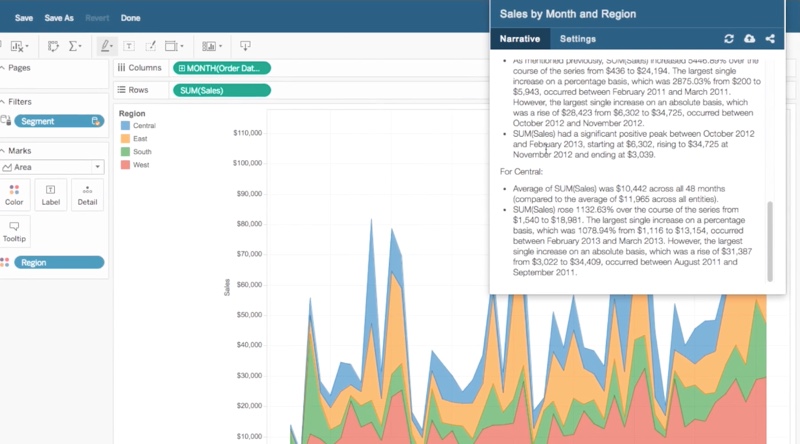

Click image to see a video of Narratives for Tableau’s features.

Francois Ajenstat, chief product officer for Tableau, said that empowering customers and providing easy-to-use technology were important to his company. Narratives for Tableau, said Ajenstat, is an example of both concepts, and provides an opportunity to “further enable Tableau users to quickly understand what is most interesting and important in their data.”

Narrative Science’s work with Tableau is the latest in a series of recent collaborations. The company partnered with Vermilion Software in May, enabling asset managers to use NLG technology to create portfolio commentary. In April, Narrative Science unveiled Narratives for Power BI, a new extension developed in partnership with Microsoft that gives managers “insightful stories” from their business intelligence data. The company began the year with the launch of Narratives for Qlik, which adds NLG narratives to Flik’s visual analytics and business intelligence functionality.

Founded in 2010 and headquartered in Chicago, Illinois, Narrative Science demonstrated its Quill Financial solution at FinovateFall 2013.

Elizabeth Santorelly, Innovation Manager

Elizabeth Santorelly, Innovation Manager