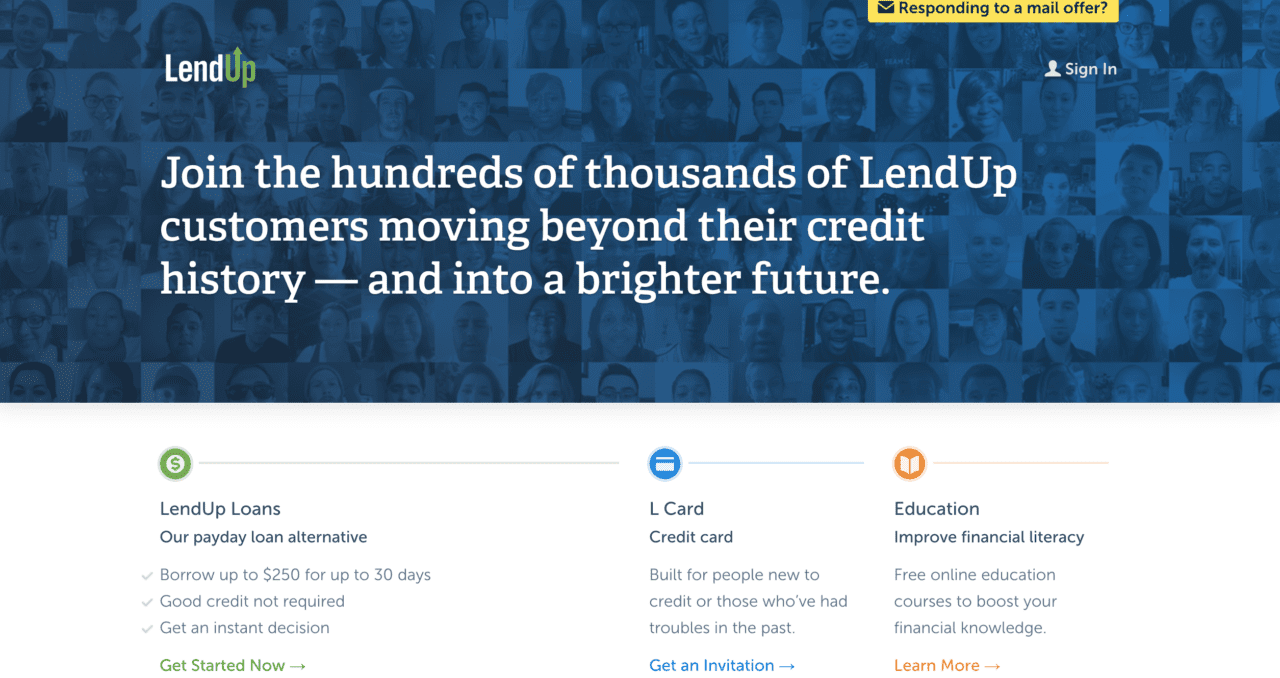

Payday lender-alternative LendUp landed $47 million in series C funding this week. Y Combinator’s growth fund, Y Combinator Continuity, led the round. Google Ventures, Thomvest Ventures, QED Investors, Data Collective, Susa Ventures, Radicle Impact, Bronze Investments, SV Angel and other¬†angels also contributed.

The $47 million¬†brings the company’s total funding to just over $110 million.¬†LendUp will use the funds¬†to build LCard, a credit card with a companion mobile app designed to help users build credit.

Founded in 2011, LendUp aims to help consumers rejected by banks find a safe alternative to payday lenders. The San Francisco-based company offers three main products:

- LendUp Loans, a payday loan alternative that lets users borrow up to $250 for 30 days

- LCard, a credit card made for those who have historically struggled with credit

- Educational materials, free online courses to give cardholders the information they need to make decisions about their financial future

The company’s CEO Sasha Orloff told TechCrunch that the new round brings LendUp’s valuation “substantially higher than the last time.”

Cofounders CEO Sasha Orloff and¬†CTO Jacob Rosenberg debuted the company’s¬†API at FinovateSpring 2014. The API exposes LendUp’s core to allow partners to leverage its platform. The company won Best of Show at FinovateSpring 2013 for debuting its product that helps the underbanked build credit.

Elizabeth Santorelly, Innovation Manager

Elizabeth Santorelly, Innovation Manager