A look at the companies demoing live to 1,500+ fintech professionals on September 8 & 9, 2016. Register today.

A look at the companies demoing live to 1,500+ fintech professionals on September 8 & 9, 2016. Register today.

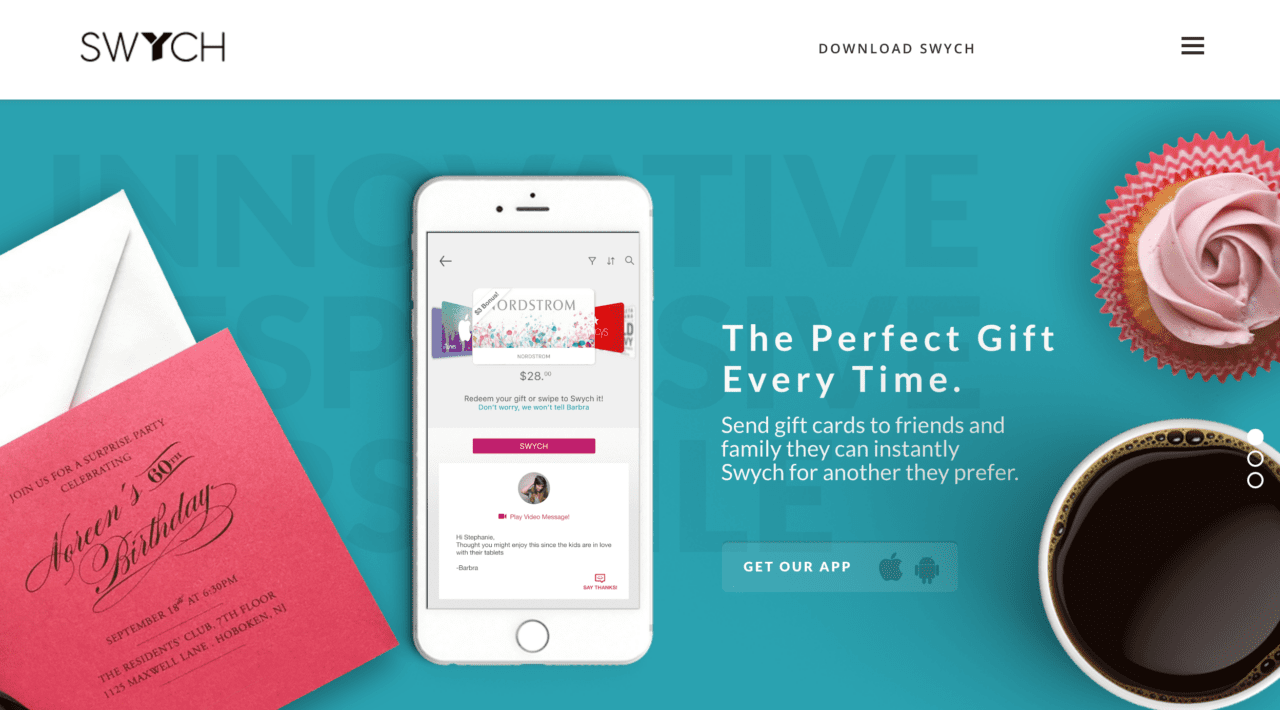

Swych’s patent-pending mobile gifting platform enables users to send “Swychable” gifts from their mobile device or social chat bot that can be instantly redeemed for electronic gift cards.

Features:

- Integrated gifting chat bots

- Easily buy, send, manage, and exchange gift cards from your mobile device

- Conversational commerce platform with easy-t0-implement APIs

Why it’s great

The innovative Swych mobile gifting digital platform elegantly modernizes, digitizes, and simplifies gifting on the mobile device and within a user’s social networks.

Presenters

Deepak Jain, CEO, Co-founder

Jain is a strategic leader with over a decade of experience launching and transforming early-stage startups. He specializes in bringing innovative technologies to market and holds more than 55 patents.

LinkedIn

Robert Sabella, CRO, Co-founder

Sabella is a serial entrepreneur, investor, inventor, and author. He has started and invested in many companies and invented a few patents-pending products along the way.

LinkedIn

Ross Jardine, Adviser and Investor

Ross Jardine, Adviser and Investor

Emily Reijnierse, Community Strategist

Emily Reijnierse, Community Strategist