When it comes to saving for big purchase goals, most of us can use all the help we can get. With The Internet of Savings™ platform from InSpirAVE, consumers can not only accrue the benefit of savings from retail and financial institutions all in one place, but equally leverage the wisdom (and discretionary cash) of friends and family to make smart spending goals, design a personalized savings plan to help raise the money to meet those goals faster, and then track progress as the savings grow and those longed-for big-ticket purchases draw near – with InSpirAVE’s program relentlessly at work until the purchase arrives right at their doorstep.

“Much beyond ‘layaway on steroids’, InSpirAVE helps you multiply your savings so that those big purchase goals that you thought were out of reach are now all of a sudden in reach without getting into the debt trap,” InSpirAVE founder and CEO Om Kundu explained from the Finovate stage during his company’s demo last fall. “Much beyond financial health, InSpirAVE helps you achieve whatever big goal you set your mind to,” he said.

Pictured: InSpirAVE founder and CEO Om Kundu demonstrating the Internet of Savings™ at FinovateFall 2016.

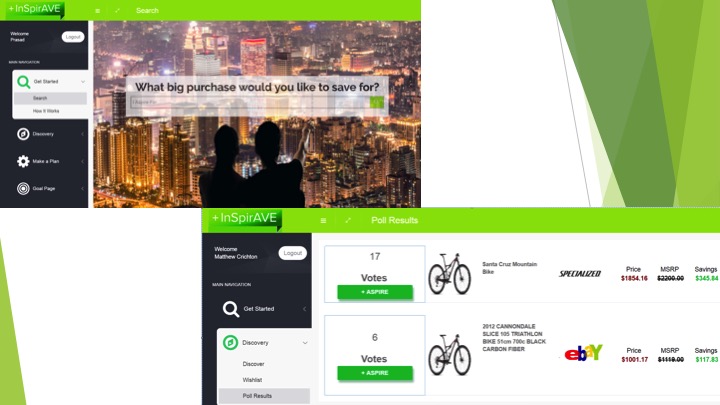

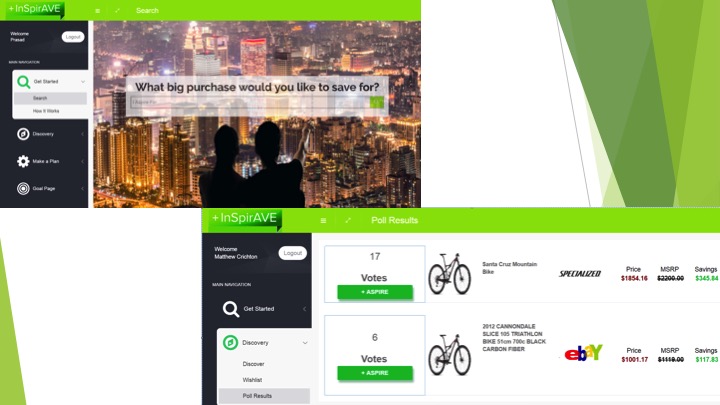

At FinovateFall, Om Kundu and InSpirAVE CTO Mark Krofchik demonstrated how the Internet of Savings™ works. Consumers starting on the platform search for items (“aspirations”) they are interested in purchasing from bicycles to consumer electronics, jewelry, and more courtesy of InSpirAVE’s API-integration with leading retailers such as Best Buy, Amazon, and eBay. The consumer finds items of interest, adds them to their wishlist and then solicits advice on the potential purchase from friends or family using email, text, or social networks directly from the InSpirAVE platform. “So rather than an impulsive purchase, we are creating a shared experience where friends and family can get engaged to create a thoughtful purchase decision,” Kundu said. “And with friends and family more engaged they are more likely to support the user further downstream.”

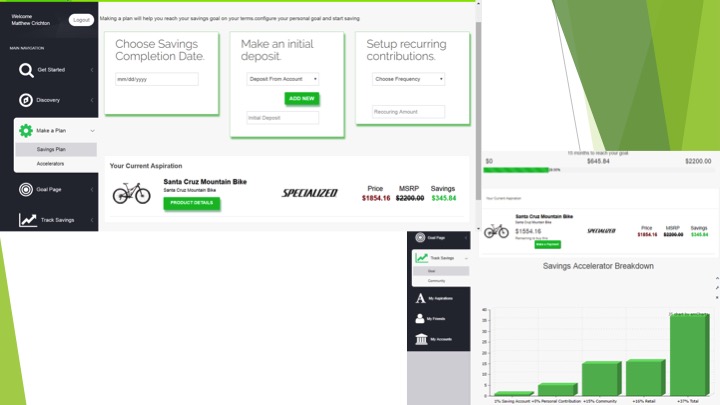

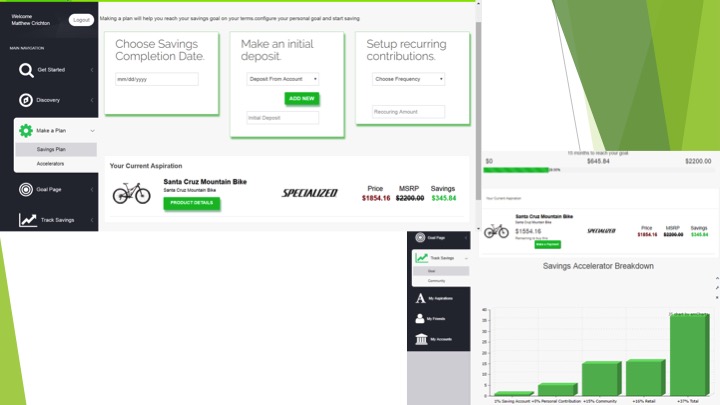

And “downstream” is where much of the innovation in InSpirAVE lies. After choosing the item, the consumer picks a savings completion date, decides an initial deposit amount, sets up recurring contributions aided by InSpirAve’s AI capabilities, and the personalized payment plan is complete. And through merchant offers, the use of a savings account during the fundraising process, and successful completion of “personal savings challenges”, consumers are able to save a lot more faster on the price of their purchases. Consumers can use secure email and messaging to then invite friends and family – especially those who participated in the decision-making process – to help support the actual purchase of the item they recommended.

Kundu notes that InSpirAVE’s technology has been particularly cited for knocking down siloes that get in the way of saving and responsible purchases, and for engineering a simple way for people to “save for what matters.” InSpirAVE was selected as one of the top eight emerging technology ventures at SXSW in 2016, during inaugural year the festival accelerator established Fintech & Payments as a distinct category. The company was separately recognized by American Banker and BAI as among the world’s Top FinTech Forward companies.

Company facts

- Founded in 2014

- Headquartered in Pittsburgh, Pennsylvania and New York City

- Developed proprietary technology backed with published patents in several markets globally

We caught up with InSpirAVE founder and CEO Om Kundu at Finovate last fall, and followed up with a few questions by email. His responses are below.

We caught up with InSpirAVE founder and CEO Om Kundu at Finovate last fall, and followed up with a few questions by email. His responses are below.

Finovate: What problem does InSpirAVE solve?

Om Kundu: In contrast to the impulse to “buy, buy, buy” as our InSpirAVE focus-group users have told us they’re bombarded with (the average household with credit card debt has balances totaling $16K according to the Fed), there isn’t enough impetus to save for what matters with 69% of Americans having less than $1,000 in savings: In fact there isn’t a vehicle to save for anything specific with the exception of retirement or schooling: Persistently low interest rates has also left financial institutions with diminished incentives for consumers to save.

InSpirAVE empowers fulfillment of big purchase goals without debt by helping Users make thoughtful purchase decisions and create a personalized savings plan to fulfill them: The magic of our Internet-of-Savings™ platform helps you save faster through the support of friends and family, as well as partnering merchants and financial institutions: InSpirAVE does so by creating a new underlying set of economic incentives that have proven to be materially significant for partnering banks and merchants to encourage their customers to save.

Finovate: Who are your primary customers?

Kundu: That nearly half of the country is living paycheck–to-paycheck and yet a third of purchases are regretted speaks to the initial consumer segments InSpirAVE is serving: Digital buyers who want to make their next big purchases responsibly, without debt.

We are also tapping into findings from our own proprietary InSpirAVE research that we have candidly been astonished by ourselves. Digitally-savvy consumers whose demonstrated behaviors on the InSpirAVE platform have borne out time and again how much of a premium they assign to advice from trusted friends/family to make their next big purchase equally affordable and memorable (rather than just another transaction).

Our Internet-of-Savings™ platform provides intelligent tools empowering such users with the discipline to make responsible financial decisions — it starts with thoughtfully selecting what matters, and does not stop until that purchase-goal is saved-for and fulfilled. Merchants and financial institutions partnering with InSpirAVE are equally benefiting from our socially responsible model and realizing materially enhanced revenues through greater engagement and expansion of their customer base.

Finovate: How does InSpirAVE solve the problem better?

Kundu: The magic of the InSpirAVE platform is empowering users with advice from their network of friends and family — big purchase decisions are more well-informed by those who care about you the most.

By harnessing behavioral finance principles and goals that matter, rather than saving for saving’s sake, InSpirAVE’s design, AI, and content-creation tools have made it extraordinarily simple to foster a well-wishing community who egg the user on to ensure the goal is fulfilled, even if it may have been out-of-reach otherwise.

Users are saving faster through The Internet-of-Savings™ platform by drawing from multiple sources — savings from merchants and banks, as well as contribution of friends and family — whose benefits have turned out to be an order-of-magnitude higher than what solely relying on savings from just one source would…for users as well as partnering merchants and banks.

Partnering merchants are realizing the benefits of enhanced purchasing power, highly predictive and signals of spending intent, and material reduction in volume of merchandise returns, as are financial institutions from enhanced savings-levels and “on us” transaction volume. Enduring loyalty is being forged in ways that is translating tertiary customers into lasting primary relationships, including those with consumers that would have otherwise fallen outside a retail and financial institution’s traditional definition of addressable market.

Finovate: Tell us about your favorite implementation of your solution.

Kundu: Users on InSpirAVE.com — either directly or through partnering institutions — are discovering their next big purchase goal through access to one of the largest merchandise selections, through our integration with some of the most well-recognized merchants. Case-in-point of how the InSpirAVE platform is also empowering users to make intelligent purchase decisions. Beyond comments left by random strangers on a website, InSpirAVE is helping them get the informed opinion of friends, family, and experts they know and trust.

InSpirAVE is giving users the benefits of interest income for the funds they already have as well as the merchant’s best offer. The AI embedded within our platform is generating a personalized plan to get the user from where they are to where they need to be, by setting aside funds on an ongoing basis. Taken together, users are ending up saving a lot more, faster with InSpirAVE. Fulfillment of the goal is also being significantly accelerated with friends and family taking advantage of the capability InSpirAVE provides to make p2p monetary contributions. Once the goal is reached, users are choosing to have the merchandise show-up right at their doorstep or at their preferred retail location.

Finovate: What in your background gave you the confidence to tackle this challenge?

Kundu: The InSpirAVE vision has crystallized from decades in operating track-record its team has had connecting the dots across retail, financial services and technology sectors, both in scaling new ventures from scratch (in fintech and ‘big data’, predating the entry of such buzzwords into the lexicon of shiny objects) and in direct accountability for P&L of consumer portfolios for over 10+ million users and $40+ billion in balances.

Our team has demonstrated ability in forging new ways to deliver superior returns for both investors and clients over and over again, even as they have remained unrelenting in delighting end-users.

On a personal note, I humor myself into thinking that my life experiences as an immigrant and an entrepreneur has taught me some lessons that have become impossible to forget on the importance of setting goals for the long haul, and ensuring the promise of a vibrant future is democratized for access by all. Perhaps even more sobering is the sheer amount of necessary grit, grace, and support I have seen being pitched in for such goals to be collectively shared in ways that ultimately improve lives for all involved.

Finovate: What are some upcoming initiatives from InSpirAVE that we can look forward to over the next few months?

Kundu: We are currently in private beta gearing up for full release. As excited as everyone has been with InSpirAVE being named Top FinTech Company To Watch by American Banker and BAI, and our recognition as a presenting company at South by Southwest, and EFMA among others, personally it’s been even more fulfilling to see how surprisingly popular InSpirAVE has proven to be with thousands who have signed-up in anticipation: If you haven’t already, now would be a good time to sign-up in our current waiting list. Our advice to those wishing to get-in on the action sooner with priority access is to share that you’ve signed-up through social media channels: it’s likely that quite a few of your friends and family are already there.

Many in our current private beta have also told us how much they like realizing their savings all in one place via our platform. Expect to see more, with a wider range of users realizing the magic of our platform, both stateside and in select markets globally.

Finovate: Where do you see your company a year or two from now?

Kundu: Our InSpirAVE roadmap is on-track harnessing the full potential of our P2P savings marketplace with AI facilitating increasingly greater capabilities for users in discovering their aspired goals as well as in creating content to engage their well-wishing community. Value tangibly unlocked from social equity is opening up new vistas to realize goals well beyond the traditional confines of cash or credit users may, or, may not have had access to.

Looking ahead we see the assignment of purpose — by saving for a goal — unlocking massive efficiencies in transforming idle cash into powerful signals of spending intent: Further avenues are opening up in how both retail consumers as well as enterprises — particularly across travel, education, automotive, and residential real estate sectors — are realizing the magic of InSpirAVE.

InSpirAVE’s Om Kundu (CEO, Founder, Chairman) and Mark Krofchik (Chief Technology Officer) demonstrating the Internet of Savings at FinovateFall 2016.

We caught up with InSpirAVE founder and CEO Om Kundu at Finovate last fall, and followed up with a few questions by email. His responses are below.

We caught up with InSpirAVE founder and CEO Om Kundu at Finovate last fall, and followed up with a few questions by email. His responses are below.

Presenters

Presenters Lui Smyth, Director of Blockchain Research and Ecosystem Engagement

Lui Smyth, Director of Blockchain Research and Ecosystem Engagement

Presenters

Presenters Angeline Gavino, Business Development and Key Accounts Manager

Angeline Gavino, Business Development and Key Accounts Manager

Presenters

Presenters Felix Grevy, Global Head of Product Management, PaaS

Felix Grevy, Global Head of Product Management, PaaS

René Konrad, Head of Products, Member of Executive Board

René Konrad, Head of Products, Member of Executive Board

Presenters

Presenters Nebo Djurdjevic, EVP Business Development

Nebo Djurdjevic, EVP Business Development

Presenter

Presenter