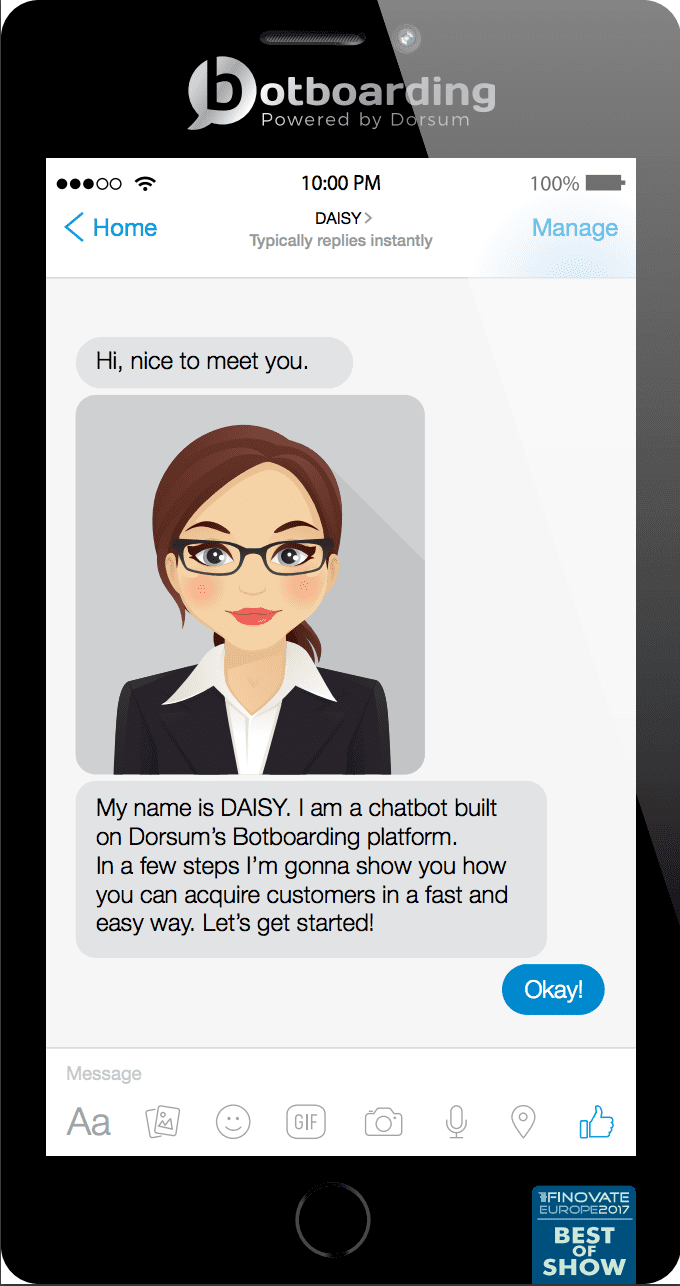

You can’t spell the name Daisy without AI, which is good because it’s the premise behind Dorsum’s new banking chatbot, the Dorsum Artificial Intelligence SYstem.

You can’t spell the name Daisy without AI, which is good because it’s the premise behind Dorsum’s new banking chatbot, the Dorsum Artificial Intelligence SYstem.

The Hungary-based company debuted its bank Botboarding platform at FinovateEuorpe earlier this year and took home a Best of Show win. The bot uses AI to interact with users in a friendly, human-like way. The bot’s personalized and targeted questions help with client onboarding. The system also offers a backend dashboard that offers real-time analytics about usage and allows banks to alter how the chatbot presents products and services.

Company facts

- 20+ years of experience in financial software development

- 250+ employees

- 70+ financial institutions use its solutions

- Serves more than 8000+ individual users

- Has clients in 8+ countries

- Has 4 offices in CEE

Above: Imre Rokob (Business Development Director), Reanta Stein (Business Development Director), and Peter Sallai (Head of Mobile Development) on stage at FinovateEurope 2017 in London

We interviewed Róbert Kő (pictured), Dorsum CEO, for a bit more insight into Dorsum and Daisy, it’s Botboarding chatbot.

We interviewed Róbert Kő (pictured), Dorsum CEO, for a bit more insight into Dorsum and Daisy, it’s Botboarding chatbot.

Finovate: What problem does Dorsum solve?

Róbert Kő: Based on Dorsum’s latest research and many discussions with existing and future clients, currently the greatest challenge is customer acquisition. The Botboarding platform is our answer to this challenge; allowing financial companies to build onboarding chatbots which incorporate a human-like way of communication with traditional customer data gathering and user profiling to help banks acquire new customers in a fast and frictionless way.

Finovate: Who are your primary customers?

Kő: Dorsum would like to help financial organizations which serve clients from mass affluent and high net worth individuals. Therefore, our primary customers are wealth management companies and banks that offer premium or private banking services. Naturally we can help many other financial organizations map their individual needs and provide exclusive contracts with customized offers.

Finovate: How does Dorsum solve the problem better?

Kő: People are fed up with filling endless and boring forms– besides, they like chatting. Facebook Messenger, which has 1.2 billion daily active users, opened up its platform for developers in April 2016 to build outstanding solutions – chatbots – in order to serve people who wish to communicate with businesses. Dorsum’s solution enables financial services providers to utilize the inherent potential in customer acquisition by using a chatbot instead of a form or other customer profiling solutions. With Dorsum’s Botboarding, financial services providers can reach higher conversion rates and can reduce churn ratios.

Finovate: Tell us about your favorite implementation of your solution.

Kő: Our chatbot is currently in delivery phase for two retail banks. Despite the legal and IT security barriers it is currently under configuration. Both of the banks wanted the chatbot to generate leads for their best performing mortgage products. These leads are distributed for the ‘users’ every day in a detailed Excel spreadsheet which contains the essence of the communication with the chatbot. The development itself of the functions took only two weeks to cover the business process of the banks. All of the above we have started negotiations with one large Dubai-based company but this stage the details are strictly confidential.

Finovate: What in your background gave you the confidence to tackle this challenge?

Kő: Dorsum, which has recently celebrated its 20th anniversary, has a remarkable track record in offering outstanding software to capital market players. Over the last 20 years the company has grown from a few employees into an organization with a staff of 250, including an experienced project team for delivering integrated investment IT solutions. Today more than 70 financial institutions use our solutions, serving more than 8,000 individual users. We support our clients by offering them unique cooperation throughout the lifecycle of the products, managing expectations in terms of functionality, time and budget. Dorsum has two subsidiaries in order to emphasize its presence in the CEE region and to respond faster to local needs. Dorsum entered the Western European and Middle East markets recently by attending financial events (e.g. FinovateEurope 2017 – presenter; MEFTECH – exhibitor) and conducting initial negotiations with a number of financial institutions.

Finovate: What are some upcoming initiatives from Dorsum that we can look forward to over the next few months?

Kő: Our solution is now available on Facebook Messenger. In the near future we are planning to extend our developments to other platforms in order to ensure our clients reach the widest customer range.

Finovate: Where do you see Dorsum a year or two from now?

Kő: I should like to make Dorsum the best in the region in our professional field, or for instance one of the three best wealth management software solutions in Europe. It appears that the stars are aligned in our favor at the moment as two months before the Finovate victory we won a regional tender from the Raiffeisen group extending to 5 countries, for the wealth management products mentioned above. I believe that these two “BOOMS” one after the other signify a very good debut on the European Union market. An earlier dream of ours has become realized: Dorsum is capable of developing a renewable product (chatbot solution), and furthermore, another of our prize-winning solutions was given a new impetus last year. Of course, we are not standing still… In the coming years we will be there at Finovate and other fintech world events – with the standard expected from us.

Check out the FinovateEurope 2017 live demo with Imre Rokob (Business Development Director), Reanta Stein (Business Development Director), and Peter Sallai (Head of Mobile Development):

Where did you start your career and how did you gain the experience needed to run the tech side of your company?

Where did you start your career and how did you gain the experience needed to run the tech side of your company?

You can’t spell the name Daisy without AI, which is good because it’s the premise behind

You can’t spell the name Daisy without AI, which is good because it’s the premise behind

We interviewed Róbert Kő (pictured), Dorsum CEO, for a bit more insight into Dorsum and Daisy, it’s Botboarding chatbot.

We interviewed Róbert Kő (pictured), Dorsum CEO, for a bit more insight into Dorsum and Daisy, it’s Botboarding chatbot.

From a technologist’s perspective, what’s unique and game-changing about your technology?

From a technologist’s perspective, what’s unique and game-changing about your technology?

From a technologist’s perspective, what’s unique and game-changing about your technology?

From a technologist’s perspective, what’s unique and game-changing about your technology?